Question

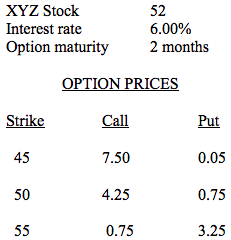

Assume the following table gives current market prices for XYZ stock and various XYZ options.? Answer the following questions: 1. Compute the intrinsic value and

Assume the following table gives current market prices for XYZ stock and various XYZ options.?

Answer the following questions:

1. Compute the intrinsic value and time value for each of these options.

2. Draw the payoff diagram for a covered call position (i.e., sell one call, buy one share of stock) using the 50 strike call.

3. What is the standstill return on this position? (The standstill return is the return if the stock price at option expiration is the same as today.)

4. Suppose the stock ends up at 51 on expiration date. What is your return as an annualized percentage rate?

XYZ Stock Interest rate Option maturity2 months 52 6.00% Strike 45 50 OPTION PRICES Call 7.50 4.25 0.75 Put 0.05 0.75 3.25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started