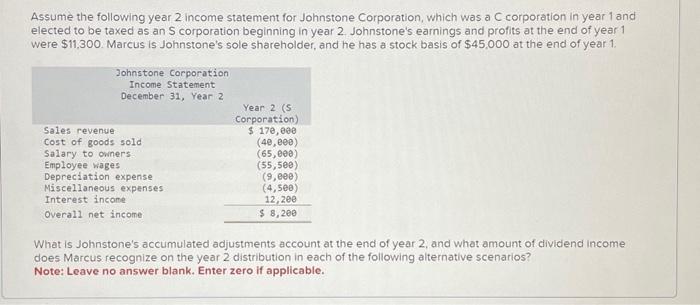

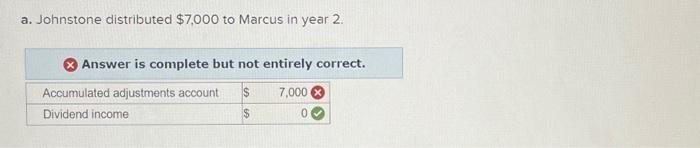

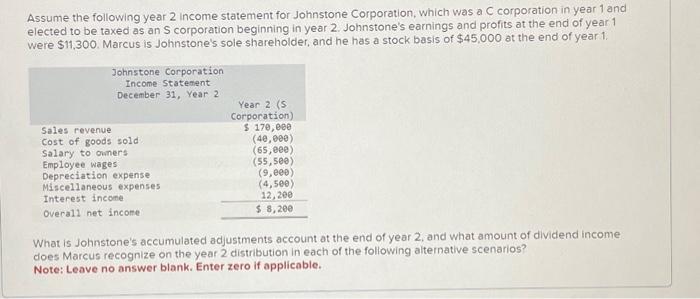

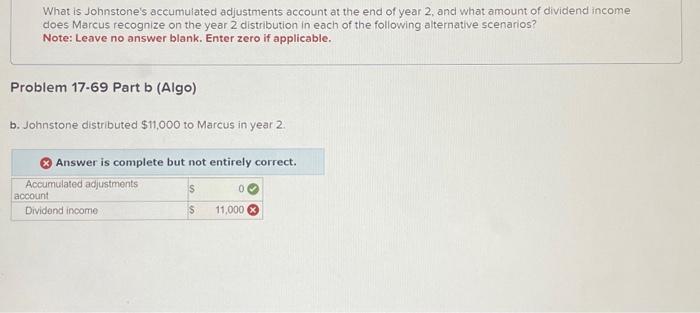

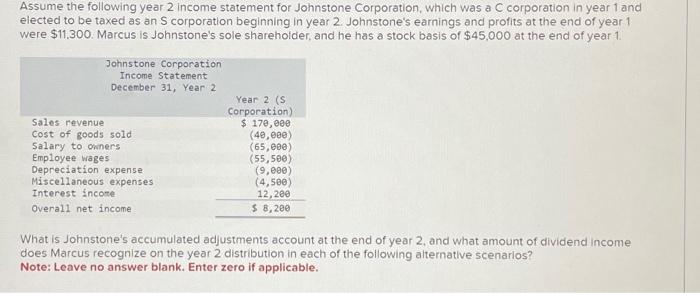

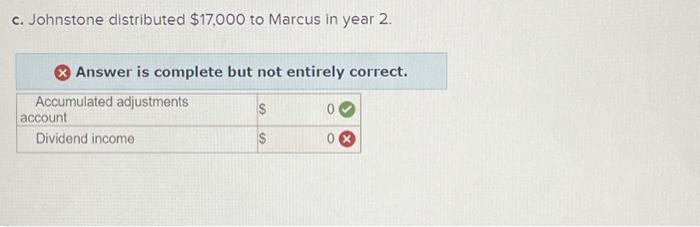

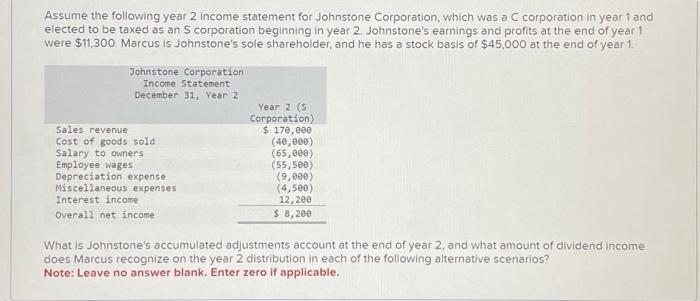

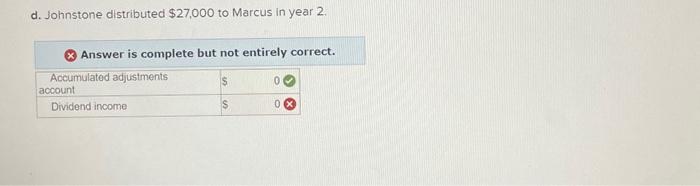

Assume the following year 2 income statement for Johnstone Corporation, which was a Corporation in year 1 and elected to be taxed as an S corporation beginning in year 2 . Johnstone's earnings and profits at the end of year 1 were $11,300. Marcus is Johnstone's sole shareholder, and he has a stock basis of $45,000 at the end of year 1 . What is Johnstone's accumulated adjustments account at the end of year 2, and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? Note: Leave no answer blank. Enter zero if applicable. a. Johnstone distributed $7,000 to Marcus in year 2 . Answer is complete but not entirely correct. Assume the following year 2 income statement for Johnstone Corporation, which was a C corporation in year 1 and elected to be taxed as an S corporation beginning in year 2 . Johnstone's earnings and profits at the end of year 1 were $11,300. Marcus is Johnstone's sole shareholder, and he has a stock basis of $45,000 at the end of year 1 . What is Johnstone's accumulated adjustments account at the end of year 2 , and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? Note: Leave no answer blank. Enter zero if applicable. What is Johnstone's accumulated adjustments account at the end of year 2 , and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? Note: Leave no answer blank. Enter zero if applicable. Problem 17.69 Part b (Algo) b. Johnstone distributed $11,000 to Marcus in year 2. Answer is complete but not entirely correct. Assume the following year 2 income statement for Johnstone Corporation, which was a C corporation in year 1 and elected to be taxed as an S corporation beginning in year 2. Johnstone's earnings and profits at the end of year 1 were $11.300. Marcus is Johnstone's sole shareholder, and he has a stock basis of $45,000 at the end of year 1 . What is Johnstone's accumulated adjustments account at the end of year 2 , and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarlos? Note: Leave no answer blank. Enter zero if applicable. c. Johnstone distributed $17,000 to Marcus in year 2 . Answer is complete but not entirely correct. Assume the following year 2 income statement for Johnstone Corporation, which was a Corporation in year 1 and elected to be taxed as an S corporation beginning in year 2 . Johnstone's earnings and profits at the end of year 1 were $11,300. Marcus is Johnstone's sole shareholder, and he has a stock basis of $45,000 at the end of year 1 . What is Johnstone's accumulated adjustments account at the end of year 2, and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? Note: Leave no answer blank. Enter zero if applicable. d. Johnstone distributed $27,000 to Marcus in year 2 . ( Answer is complete but not entirely correct