Answered step by step

Verified Expert Solution

Question

1 Approved Answer

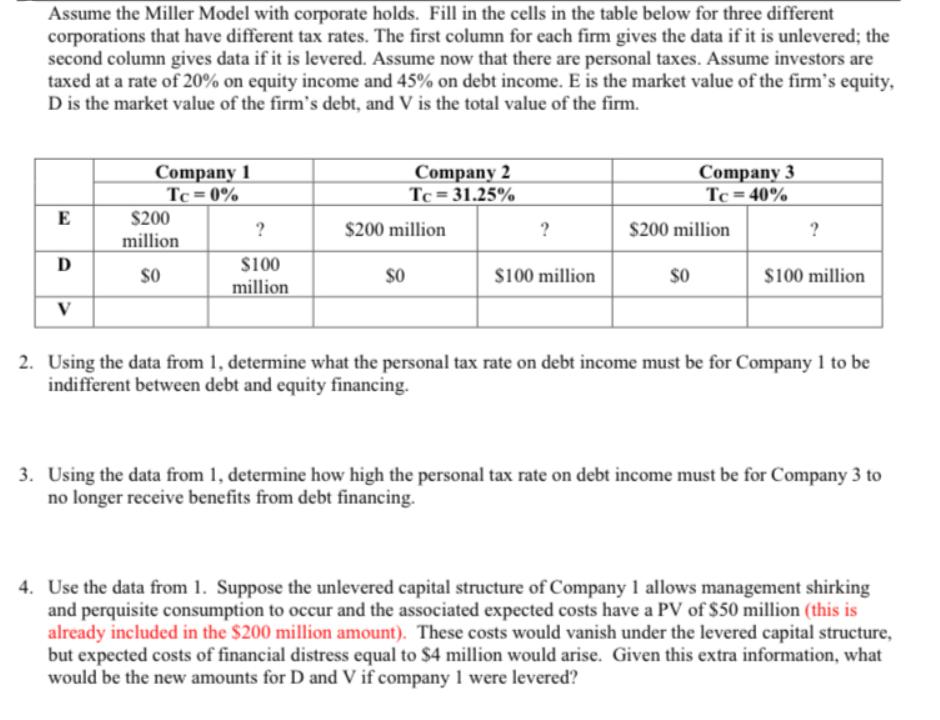

Assume the Miller Model with corporate holds. Fill in the cells in the table below for three different corporations that have different tax rates.

Assume the Miller Model with corporate holds. Fill in the cells in the table below for three different corporations that have different tax rates. The first column for each firm gives the data if it is unlevered; the second column gives data if it is levered. Assume now that there are personal taxes. Assume investors are taxed at a rate of 20% on equity income and 45% on debt income. E is the market value of the firm's equity, D is the market value of the firm's debt, and V is the total value of the firm. E D V Company 1 Tc=0% $200 million SO ? $100 million Company 2 Tc = 31.25% $200 million SO ? $100 million Company 3 Tc=40% $200 million $0 ? $100 million 2. Using the data from 1, determine what the personal tax rate on debt income must be for Company 1 to be indifferent between debt and equity financing. 3. Using the data from 1, determine how high the personal tax rate on debt income must be for Company 3 to no longer receive benefits from debt financing. 4. Use the data from 1. Suppose the unlevered capital structure of Company 1 allows management shirking and perquisite consumption to occur and the associated expected costs have a PV of $50 million (this is already included in the $200 million amount). These costs would vanish under the levered capital structure, but expected costs of financial distress equal to $4 million would arise. Given this extra information, what would be the new amounts for D and V if company I were levered?

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The image contains a table with data for three different companies Company 1 Company 2 and Company 3 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started