Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume the M&M assumptions with taxes hold. The tax rate is equal to 20%. A firm changes its capital structure: it issues an additional

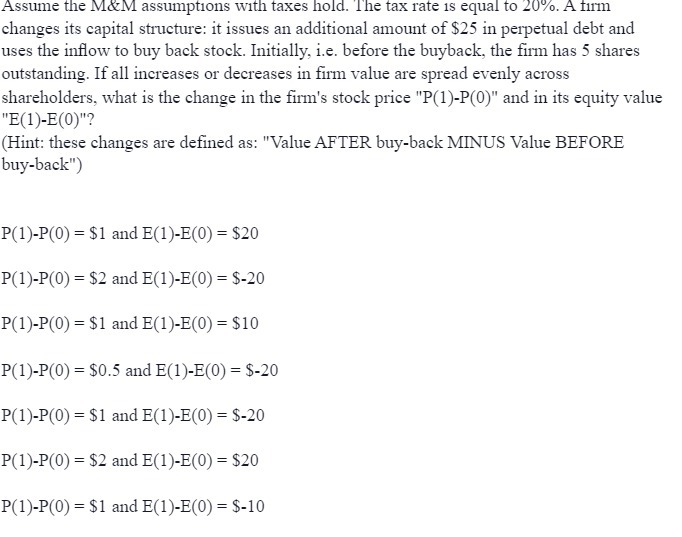

Assume the M&M assumptions with taxes hold. The tax rate is equal to 20%. A firm changes its capital structure: it issues an additional amount of $25 in perpetual debt and uses the inflow to buy back stock. Initially, i.e. before the buyback, the firm has 5 shares outstanding. If all increases or decreases in firm value are spread evenly across shareholders, what is the change in the firm's stock price "P(1)-P(0)" and in its equity value "E(1)-E(0)"? (Hint: these changes are defined as: "Value AFTER buy-back MINUS Value BEFORE buy-back") P(1)-P(0)=$1 and E(1)-E(0) = $20 P(1)-P(0)=$2 and E(1)-E(0) = $-20 P(1)-P(0)= $1 and E(1)-E(0) = $10 P(1)-P(0)= $0.5 and E(1)-E(0) = $-20 P(1)-P(0)= $1 and E(1)-E(0) = $-20 P(1)-P(0)= $2 and E(1)-E(0) = $20 P(1)-P(0)= $1 and E(1)-E(0) = $-10

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down the problem step by step Initially the firm has 5 shares outstanding It issues an ad...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started