Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume the return on a market index represents the common factor and all stocks in the economy have a beta of 1. Firm-specific returns all

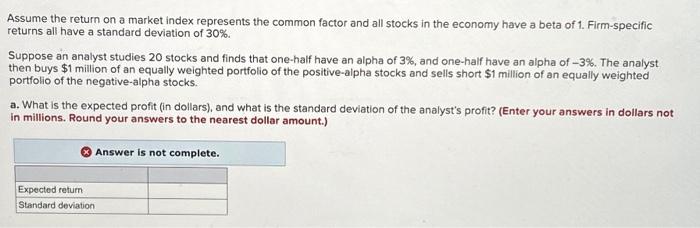

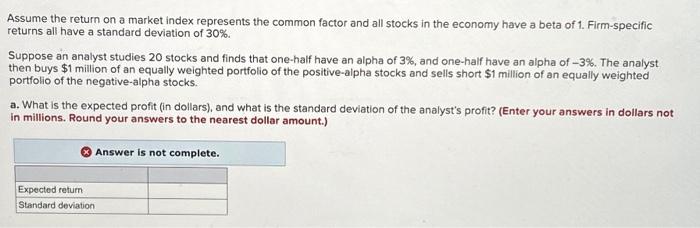

Assume the return on a market index represents the common factor and all stocks in the economy have a beta of 1. Firm-specific returns all have a standard deviation of 30%.

Suppose an analyst studies 20 stocks and finds that one half have an alpha of 3%, and one-half have an alpha of -3%. The analyst then buys $1million of an equally weighted portfolio of the positive-alpha stocks and sells short $1million of an equally weighted portfolio of the negative-alpha stocks.

A) What is the expected profit(return) (in dollars), and what is the standard deviation of the analysts profit? (Enter answers in dollars not in millions. Round andwers to nearest dollar amount)

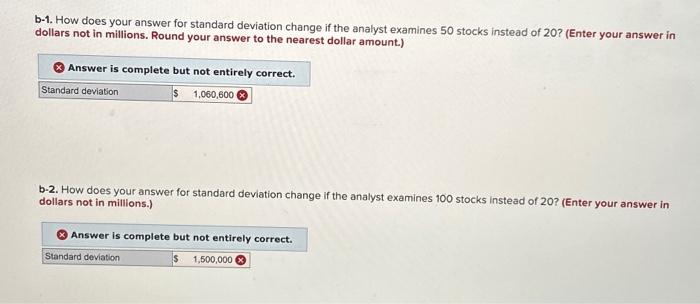

B-1. How does your answer for standard deviation change if the analyst examines 50 stocks instead of 20? (Enter answers in dollars not in millions. Round andwers to nearest dollar amount)

B-2. How does your answer for standard deviation change if the analyst examines 100 stocks instead of 20? (Enter answers in dollars not in millions)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started