Answered step by step

Verified Expert Solution

Question

1 Approved Answer

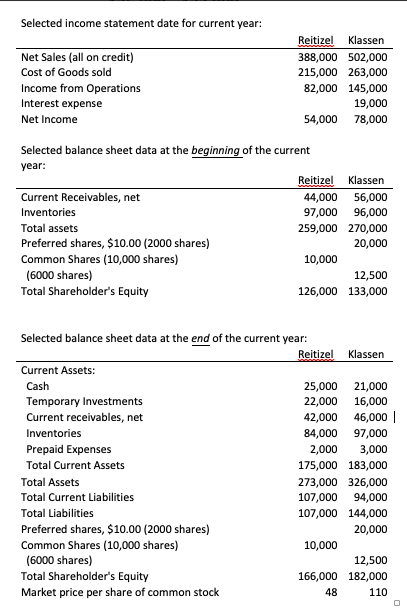

Assume the role of a banker and you have funds to lend to only one company. You have narrowed your choices to a company in

Assume the role of a banker and you have funds to lend to only one company. You have narrowed your choices to a company in the air conditioning & heating business either Reitzel Heating or Klassen. You are given the following financial data for both companies on the following page.

- Times interest earned ratio

- Return on shareholders equity

- Earnings per share of common stock

- Price Earnings Ratio

- Debt to Equity Ratio

Required:

1. Prepare an executive summary explaining which company you would loan the funds to. Justify your answer using the ratios that you calculated. (6 pts)

2. Would you consider becoming an equity holder for either company? Why or why not? (6 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started