Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Under what circumstances is the tax result in Problem C:2-55 beneficial, and for which shareholders? Can you suggest ways to enhance the tax benefit? See

Under what circumstances is the tax result in Problem C:2-55 beneficial, and for which shareholders? Can you suggest ways to enhance the tax benefit? See photo for C:2-55 that will have the necessary facts to answer the question above.

|

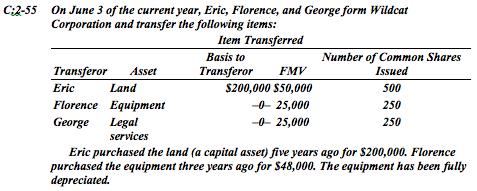

C:2-55 On June 3 of the current year, Eric, Florence, and George form Wildcat Corporation and transfer the following items: Item Transferred Basis to Number of Common Shares Transferor Asset Transferor FMV Issued $200,000 S50,000 -0- 25,000 -0- 25,000 Eric Land 500 Florence Equipment 250 George Legal services 250 Eric purchased the land (a capital asset) five years ago for $200,000. Florence purchased the equipment three years ago for $48,000. The equipment has been fully depreciated.

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Eric purchased the land a capital asset 5 years ago for 200000 Flore...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started