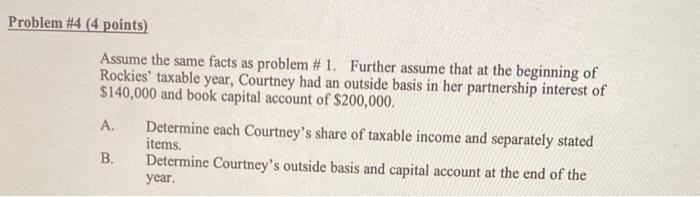

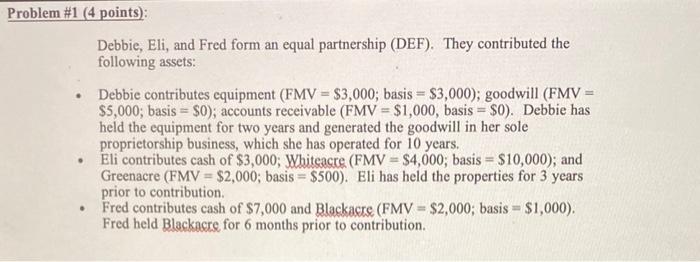

Assume the same facts as problem \# 1. Further assume that at the beginning of Rockies' taxable year, Courtney had an outside basis in her partnership interest of $140,000 and book capital account of $200,000. A. Determine each Courtney's share of taxable income and separately stated items. B. Determine Courtney's outside basis and capital account at the end of the year. Debbie, Eli, and Fred form an equal partnership (DEF). They contributed the following assets: - Debbie contributes equipment (FMV =$3,000; basis =$3,000 ); goodwill (FMV = $5,000; basis =$0 ); accounts receivable (FMV =$1,000, basis =$0 ). Debbie has held the equipment for two years and generated the goodwill in her sole proprietorship business, which she has operated for 10 years. - Eli contributes cash of $3,000; Whiteacre (FMV =$4,000; basis =$10,000 ); and Greenacre (FMV=$2,000; basis =$500). Eli has held the properties for 3 years prior to contribution. - Fred contributes cash of $7,000 and Blackacre (FMV =$2,000; basis =$1,000 ). Fred held Blackacre for 6 months prior to contribution. Assume the same facts as problem \# 1. Further assume that at the beginning of Rockies' taxable year, Courtney had an outside basis in her partnership interest of $140,000 and book capital account of $200,000. A. Determine each Courtney's share of taxable income and separately stated items. B. Determine Courtney's outside basis and capital account at the end of the year. Debbie, Eli, and Fred form an equal partnership (DEF). They contributed the following assets: - Debbie contributes equipment (FMV =$3,000; basis =$3,000 ); goodwill (FMV = $5,000; basis =$0 ); accounts receivable (FMV =$1,000, basis =$0 ). Debbie has held the equipment for two years and generated the goodwill in her sole proprietorship business, which she has operated for 10 years. - Eli contributes cash of $3,000; Whiteacre (FMV =$4,000; basis =$10,000 ); and Greenacre (FMV=$2,000; basis =$500). Eli has held the properties for 3 years prior to contribution. - Fred contributes cash of $7,000 and Blackacre (FMV =$2,000; basis =$1,000 ). Fred held Blackacre for 6 months prior to contribution