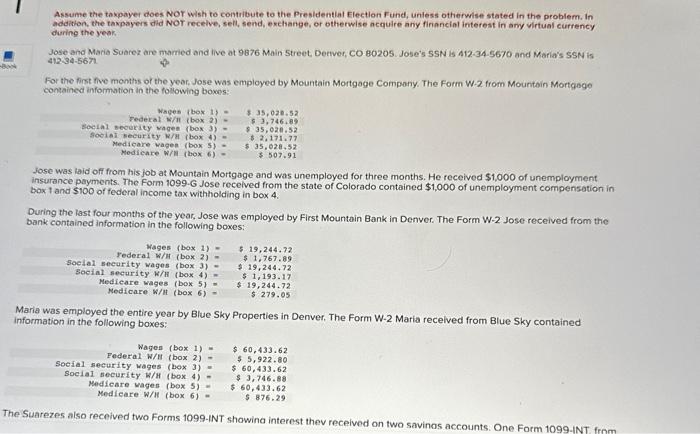

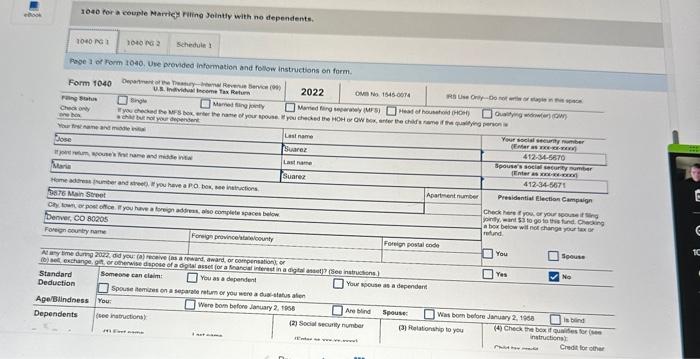

Assume the taxpayer does Nor Wish to contribute to the Presldentiat Election Fund, unless otherwise stated in the problem. In addition, the taxpayers did NOT recelve, sell, send, exchange, or otherwise acquire any firiancial interest in ary virtual currency during the yeak. Jose and Maria Subrez are married and live at 9876 Main Street, Detwer, CO B0205. Jose's SSN is A12.34.5670 and Maria's SSN is 412.34567. For the first five months of the year, Jose was employed by Mountain Mortgage Compony. The Form W-2 from Mountein Mortgage consained information in the following bowes: Wages ( box 1)=$35,028.52 rederal =/11 (box 2)=$3,746,89 social socurity vagee ( box 3)=$35,020.52 Medicare vagen (box 5)=535,028,52 Mediche w/ll ( box 6)=35,028,57507.91 Jose was laid off from his job at Mountain Mortgage and was unemployed for three months. He received $1,000 of unemployment insurance payments. The Form 1099.G Jose recelved from the state of Colorado contained $1,000 of unemployment compensation in box 1 and $100 of federal income tax withholding in box 4 . During the last fout months of the year, Jose was employed by First Mountain Bank in Denver. The Form W-2 Jose received from the bank contained information in the following boxes: Mages ( box 1)=$19,244.72 Tederal W/H(box2)=$1,767.89 soclal security wages (box 3 ) =$19,244,72 Bocial security k/h(box4)=$1,193.17 Medicare wages (box 5 ) =$19,244.72 Nedicaze W/H( box 6 ) =$279.05279.72 Aaria was employed the entire year by Blue Sky Properties in Denver. The Form W-2 Maria received from Blue Sky contained iformation in the following boxes: Wagen ( box 1)=$60,433.62 Federal W/H (box 2) = \$5,922.80 Social security wages (box 3 ) =$50,433.62 Social security W/H (box 4 ) =$60,433.62 Medicare wages (box 5 ) =$60,433.62 Medicare W/II (box 6 ) =$876.298762 Suarezes also received two Forms 1099-INT showing interest thev received on two savinos accounts. 1040 for a couple Narricy ruing Jeintly with no dependents. Asoe 1 a form toab. Une pronded information and follow instructions on form. Assume the taxpayer does Nor Wish to contribute to the Presldentiat Election Fund, unless otherwise stated in the problem. In addition, the taxpayers did NOT recelve, sell, send, exchange, or otherwise acquire any firiancial interest in ary virtual currency during the yeak. Jose and Maria Subrez are married and live at 9876 Main Street, Detwer, CO B0205. Jose's SSN is A12.34.5670 and Maria's SSN is 412.34567. For the first five months of the year, Jose was employed by Mountain Mortgage Compony. The Form W-2 from Mountein Mortgage consained information in the following bowes: Wages ( box 1)=$35,028.52 rederal =/11 (box 2)=$3,746,89 social socurity vagee ( box 3)=$35,020.52 Medicare vagen (box 5)=535,028,52 Mediche w/ll ( box 6)=35,028,57507.91 Jose was laid off from his job at Mountain Mortgage and was unemployed for three months. He received $1,000 of unemployment insurance payments. The Form 1099.G Jose recelved from the state of Colorado contained $1,000 of unemployment compensation in box 1 and $100 of federal income tax withholding in box 4 . During the last fout months of the year, Jose was employed by First Mountain Bank in Denver. The Form W-2 Jose received from the bank contained information in the following boxes: Mages ( box 1)=$19,244.72 Tederal W/H(box2)=$1,767.89 soclal security wages (box 3 ) =$19,244,72 Bocial security k/h(box4)=$1,193.17 Medicare wages (box 5 ) =$19,244.72 Nedicaze W/H( box 6 ) =$279.05279.72 Aaria was employed the entire year by Blue Sky Properties in Denver. The Form W-2 Maria received from Blue Sky contained iformation in the following boxes: Wagen ( box 1)=$60,433.62 Federal W/H (box 2) = \$5,922.80 Social security wages (box 3 ) =$50,433.62 Social security W/H (box 4 ) =$60,433.62 Medicare wages (box 5 ) =$60,433.62 Medicare W/II (box 6 ) =$876.298762 Suarezes also received two Forms 1099-INT showing interest thev received on two savinos accounts. 1040 for a couple Narricy ruing Jeintly with no dependents. Asoe 1 a form toab. Une pronded information and follow instructions on form