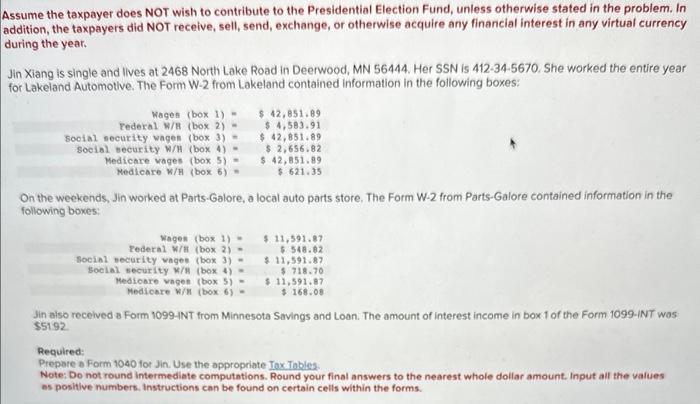

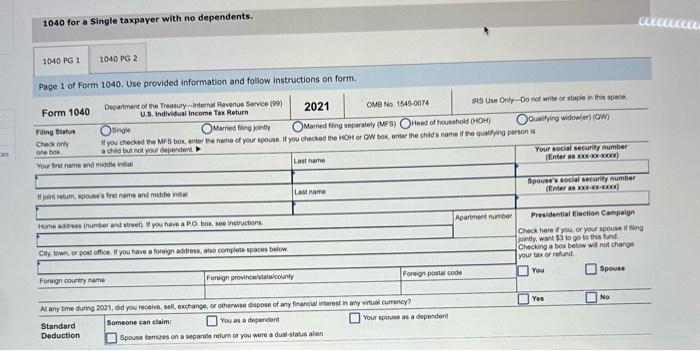

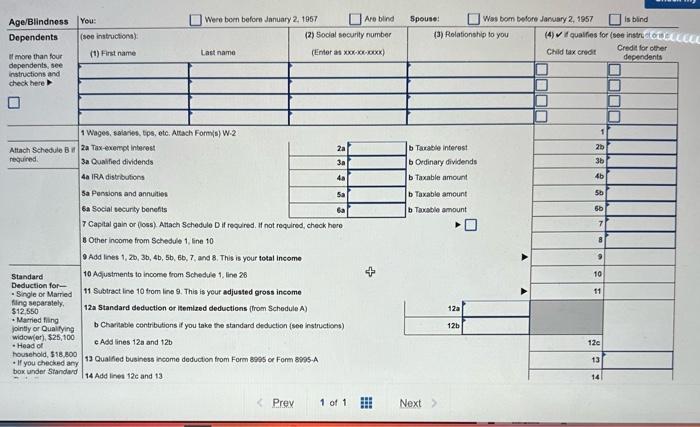

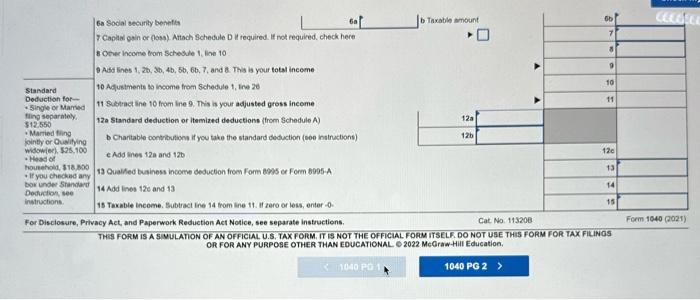

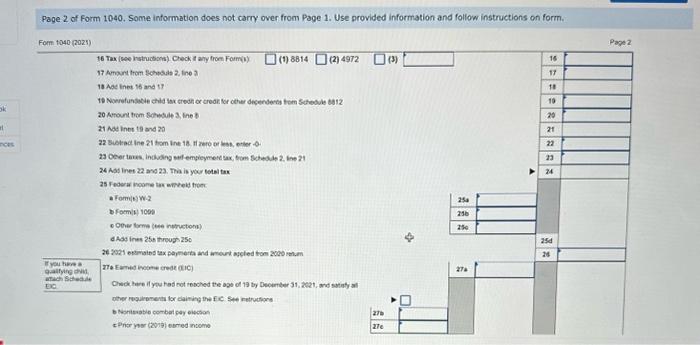

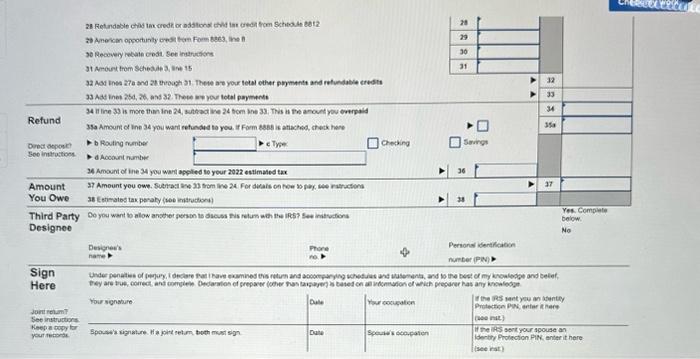

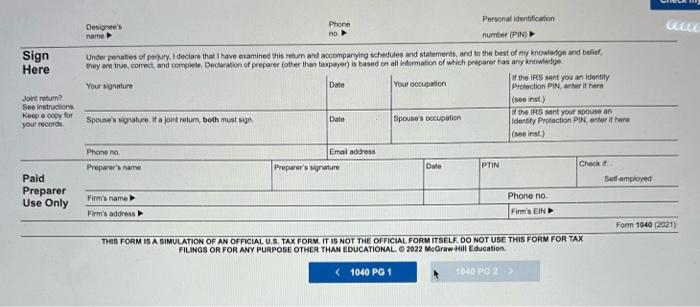

Assume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. In addition, the taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. Jin Xiang is single and lives at 2468 North Lake Road in Deerwood, MN 56444. Her SSN is 412-34-5670. She worked the entire year for Lakeland Automotive. The Form W-2 from Lakeland contained information in the following boxes: On the weekends. Jin worked at Parts.Galore, a local auto parts store. The Form W-2 from Parts-Galore contained information in the following boxes: Jin also recelved a Form 1099-1NT from Minnesota Savings and Loan. The amount of interest income in box 1 of the Form 1099 -INT was $5192 Required: Prepare o Form 1040 for Jin. Use the appropriate Iax Tobles. Note: Do not round intermediate computations. Round your final answers to the nearest whole dollar amount. Input all the values is positive numbers. Instructions can be found on certain cells within the forms. 1040 for a Single taxpayer with no dependents. 6a Social sacurity benefits 7 Capaa guin or (10sa). Attach Schedule D it required. If not required. check here 8 Cother hcome trom Schesule 1 , line 10 9 Asd lines 1,2b,3b,4b,5b,6b,7, and 8 . This is your total inceme For Disciosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. THES FOFM IS A SIUULATION OF AN DFFICIAL. U.S, TAX FORM, IT IS NOT THE OFFICIAL. FOAM ITSELF. DO NOT USE THIS FORM FOR TAX FILINOS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2022 MeOraw-Hill Education, 1040 PG 2 Page 2 of form 1040. Some information does not carry over from Page 1. Use provided information and follow instructions on form. Fom 1040(2025) 16Tax (hee hwtucions) Check i aty trom Formbi) (1) 8814 (2)4972 (3) 17 Ampurt trom terersus 2 , line 2 18 Aac inee 16 and 17 1D Nowrefundade chla isx eredi or trean tor other desendents fom Soteduls 0912 20 Avrount tram Sotwile 3, line 5 21 Mod lnos 19 and 20 22 suctad ine 21 trom ine 18 . ti zero or has, priter - . 23 Dever taus, indaing sui empieyment Eax, fom fotade 2 , ine 21 24 Ads inet 22 and 23 . Thin is your tetal tax 25 Federa woome tas evereal her. - Formites wa befomin 1005 Q Oeve forme (ese intrustione) dAds ines 25s through 250 2t 2021 entersies sax peymerta and whourt arcled tom aveb retum wher requromenta for daining the fec ste retrutfions b tionterabie combat pey eiecton c Pnis her (20i)3 noted ncomo. 30 Recovery retaln ceat Soe inatructicns 31 Amoset trom scheade a, ane 15 32 Ast inse aza and 26 troogh 21 . Thete are your tetal ethar ppymate and rofundable eredst 33 had Inet 2bd, 2 , and a2. Thete ww you total paymente 34 it line 33 is more thim ine 24 , suthact we 24 tom ine 33 . Thes in the anount you everpaid Refund Designee 39 Amourt of tine 34 you wart refunded to you. if Form 88B is atiachiod, thetk hare Dobet atpose Seo introitions. b Routing rumber a Mocount number 34 Amount of ine 34 you wart appled te yeur 2022 estimated tax You Owe 2 ferimates tax penaly (toe initruttond) Third Party Bo you wart to allow another peeson ts dacuss fis relum ath the ifcs? See intwoficu Here THES FORM HS A SIMULATION OF AN OF FICIAL. U.S. TAX FORM. IT IS NOT THE OFFICIAL FOPM ITSELF. DO NOT USE THIS FORM FOR TAX FILINOS OR FOR ANY PURPOSE OTHER THAM EDUCATIONAL. 62022 MeOraw AIII Edueation