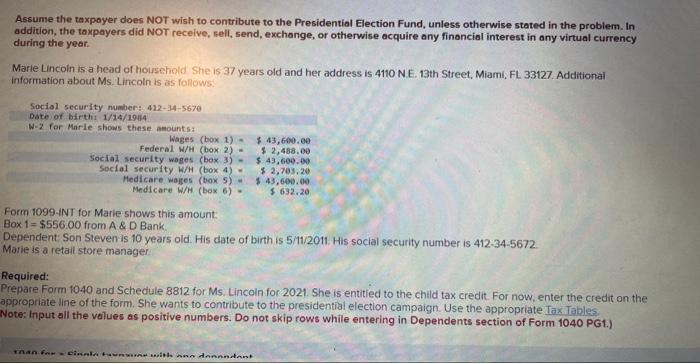

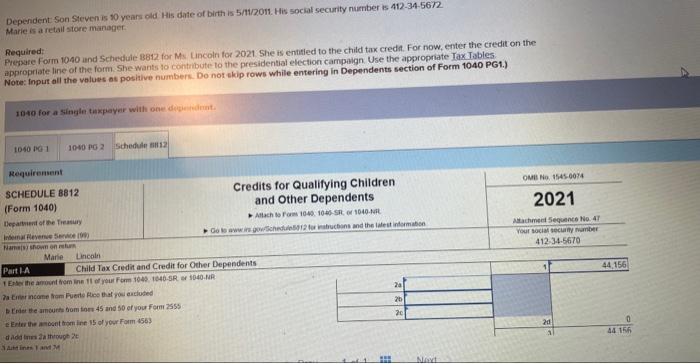

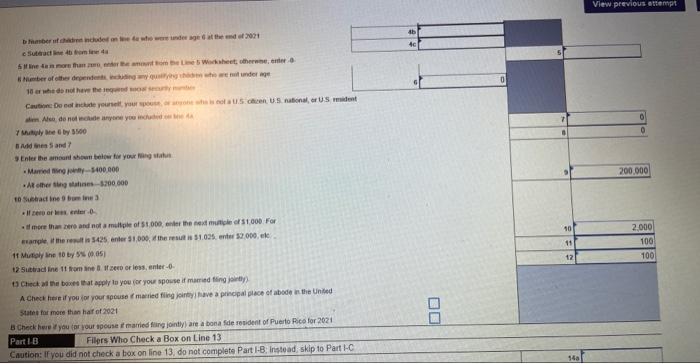

Assume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. In addition, the taxpayers did NOT receive, fell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. Marie Lincoln is a head of household She is 37 years old and her address is 4110 N. E. 13th Street, Miami, FL 33127. Additionai information about Ms. Lincoln is as follows? Form 1099-iNT for Marie shows this amount: Box 1=$556.00 from A \& D Bank. Dependent: Son Steven is 10 years old. His date of birth is 5/11/2011. His social security number is 412-34-5672. Marie is a retail store manager Required: Prepare Form 1040 and Schedule 8812 for Ms. Lincoln for 2021 . She is entitied to the child tax credit. For now, enter the credit on the ippropriate line of the form. She wants to contribute to the presidential election campaign. Use the appropriate Tax Tables. Note: Input all the values as positive numbers. Do not skip rows while entering in Dependents section of Form 1040 PG1.) Dependent Son Steven is to years old his date of birth is 5/4/2017. His social security number is 412345672 Marie is a retail store manager Required: Prepare Form 1040 and Schesdule 3812 for Mu Lincoln for 2021 . She is entitied to the child tax credit. For now, enter the credit on the appropriate line of the form. She wants 10 contribute to the presidential election campaign. Use the appropriate Iax Tables. Note: Input all the volues os positive numbers. Do not akip rows while entering in Dependents section of Form 1040 PG1.) View prewiows atternpi c suteract lise 4 th tom iare 4 a 7 thitiply the 6 by 3590 - Maried niny johey - 3400000 - he sther tiev statines - 300 600 to *uebact ine 9 buan inw 3 - If sece of kin erier a. if Mintely line 10 by 5% 00 05] 12 sittraci line it than the to If seep or less, enter 0 - 1) Chect at hin boxes that apply la you (or you spowse if mamied ting jairth) A Chect hese if you jor your spouse of maried fling jeintayi lave a principal plece at absed in the Uniked 3tates fat more than hat of 2021 Part 1.[7 Fllers Who Check a Box on Line 13 Caution: If you did not check a box on line 13 , do not complete Part I.B; instead skip to Part HC. Assume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. In addition, the taxpayers did NOT receive, fell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. Marie Lincoln is a head of household She is 37 years old and her address is 4110 N. E. 13th Street, Miami, FL 33127. Additionai information about Ms. Lincoln is as follows? Form 1099-iNT for Marie shows this amount: Box 1=$556.00 from A \& D Bank. Dependent: Son Steven is 10 years old. His date of birth is 5/11/2011. His social security number is 412-34-5672. Marie is a retail store manager Required: Prepare Form 1040 and Schedule 8812 for Ms. Lincoln for 2021 . She is entitied to the child tax credit. For now, enter the credit on the ippropriate line of the form. She wants to contribute to the presidential election campaign. Use the appropriate Tax Tables. Note: Input all the values as positive numbers. Do not skip rows while entering in Dependents section of Form 1040 PG1.) Dependent Son Steven is to years old his date of birth is 5/4/2017. His social security number is 412345672 Marie is a retail store manager Required: Prepare Form 1040 and Schesdule 3812 for Mu Lincoln for 2021 . She is entitied to the child tax credit. For now, enter the credit on the appropriate line of the form. She wants 10 contribute to the presidential election campaign. Use the appropriate Iax Tables. Note: Input all the volues os positive numbers. Do not akip rows while entering in Dependents section of Form 1040 PG1.) View prewiows atternpi c suteract lise 4 th tom iare 4 a 7 thitiply the 6 by 3590 - Maried niny johey - 3400000 - he sther tiev statines - 300 600 to *uebact ine 9 buan inw 3 - If sece of kin erier a. if Mintely line 10 by 5% 00 05] 12 sittraci line it than the to If seep or less, enter 0 - 1) Chect at hin boxes that apply la you (or you spowse if mamied ting jairth) A Chect hese if you jor your spouse of maried fling jeintayi lave a principal plece at absed in the Uniked 3tates fat more than hat of 2021 Part 1.[7 Fllers Who Check a Box on Line 13 Caution: If you did not check a box on line 13 , do not complete Part I.B; instead skip to Part HC