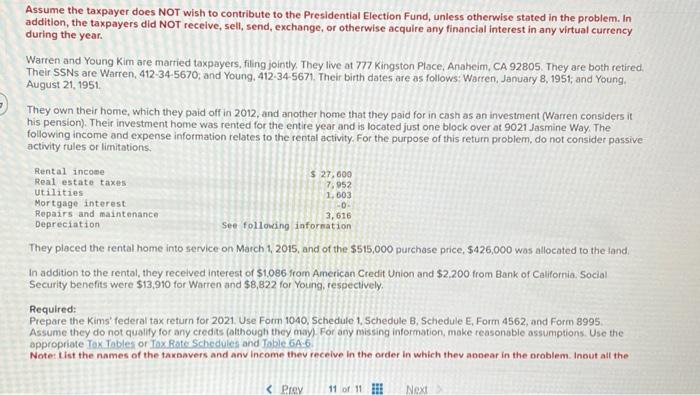

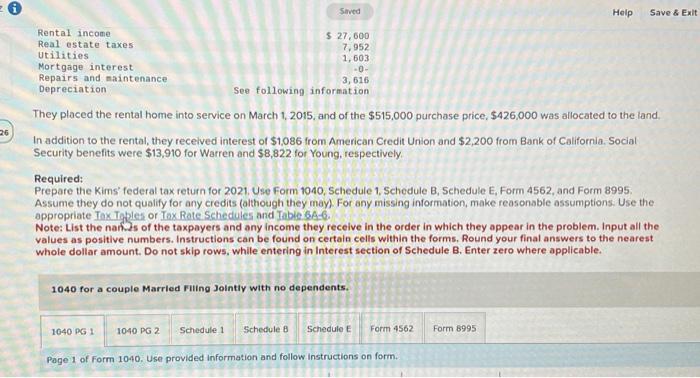

Assume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. In addition, the taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financlat interest in any virtual currency during the year. Warren and Young Kim are married taxpayers, filing jointly. They live at 777 Kingston Ploce, Anaheim, CA 92805. They are both retired. Their SSNs are Warren, 412-34-5670; and Young, 412-34-5671. Their birth dates are as follows: Warren, January 8, 1951; and Young. August 21, 1951. They own their home, which they paid off in 2012, and another home that they paid for in cash as an investment (Warren considers it his pension). Their investment home was rented for the entire year and is located just one block over at 9021 Jasmine Way. The following income and expense information relates to the rental activity. For the purpose of this return problem, do not consider passive activity rules or limitations. They placed the rental home into service on March 1,2015, and of the $515,000 purchase price, $426,000 was allocated to the iand. In addition to the rental, they recelved interest of $1,086 from American Credit Union and $2.200 from Bank of California. Socia! Security benefits were $13,910 for Warren and $8,822 for Young, respectively. Required: Prepare the Kims' federal tax return for 2021. Use Form 1040, Schedule 1, Schedule B, Schedule E, Form 4562, and Form 8995 Assume they do not qualify for any credits (although they may). For any missing information, make reasonable assumptions. Use the appropriate Tox Tables or Iox. Rate Schedules and Jable 6A=6. Note: list the names of the taxnavers and anv income thev receive in the order in which thev aboear in the oroblem. Inout all the They placed the rental home into service on March 1, 2015, and of the $515,000 purchase price, $426,000 was allocated to the land. In addition to the rental, they recelved interest of $1,086 from American Credit Union and $2,200 from Bank of California. Social Security benefits were $13,910 for Warren and $8,822 for Young, respectively. Required: Prepare the Kims' federal tax return for 2021. Use Form 1040, Schedule 1, Schedule B, Schedule E, Form 4562, and Form 8995. Assume they do not qualify for any credits (although they may). For any missing information, make reasonable assumptions. Use the appropriate Tox Tgples or Tox Rate Schedules and Tabie 6A6. Note: List the nanf.2s of the taxpayers and any income they recelve in the order in which they appear in the problem. Input all the values as positive numbers. Instructions can be found on certain cells within the forms. Round your final answers to the nearest whole dollar amount. Do not skip rows, while entering in Interest section of Schedule B. Enter zero where applicable. 1040 for a couple Married Filing Jointly with no dependents. Page 1 of Form 1040, Use provided information and follow instructions on form