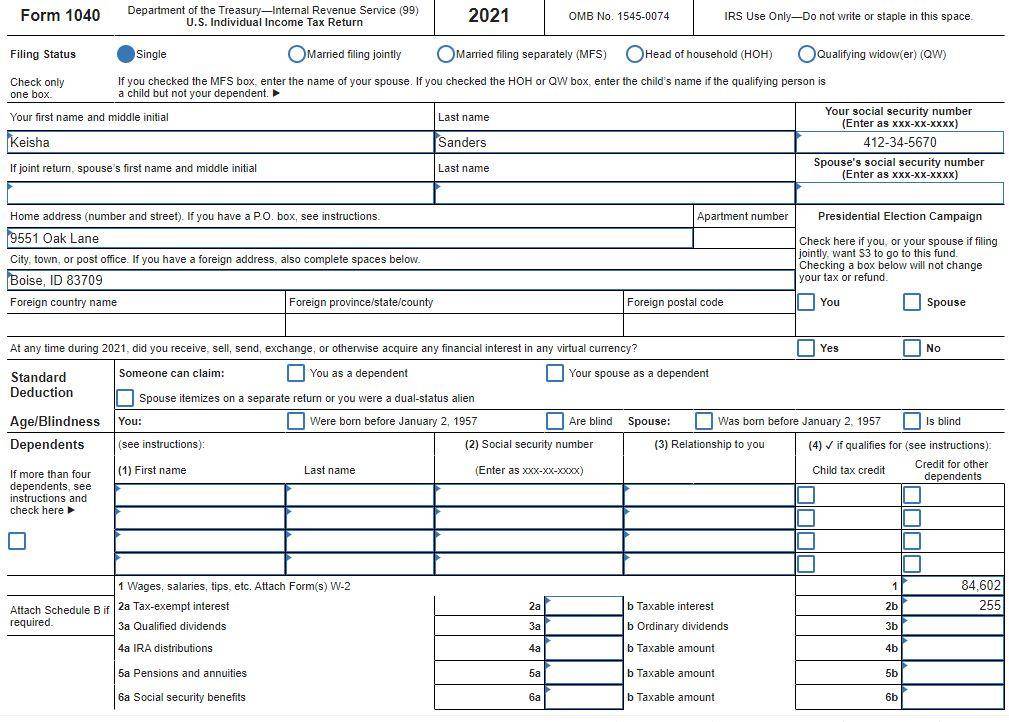

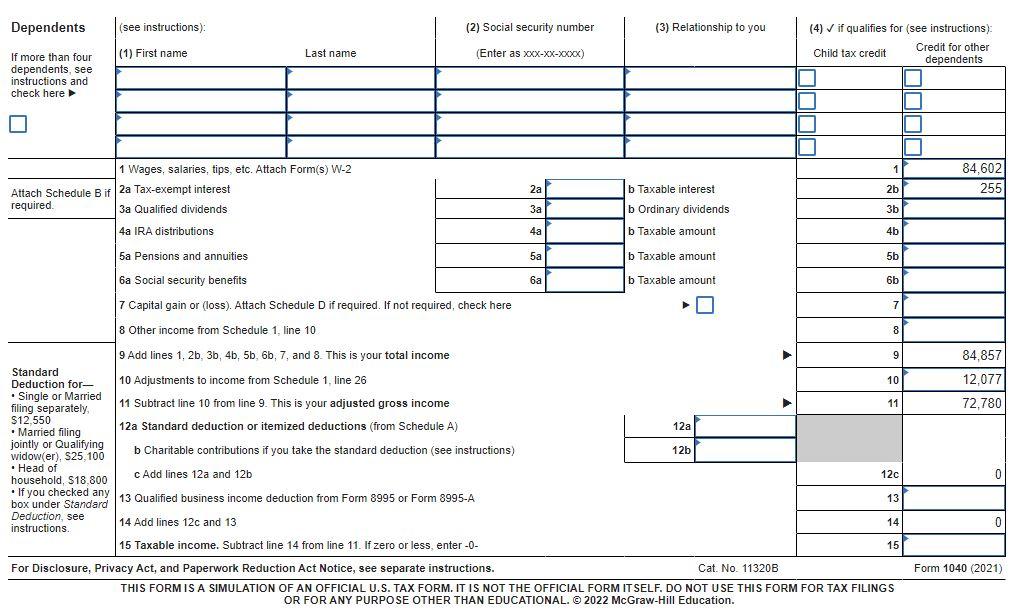

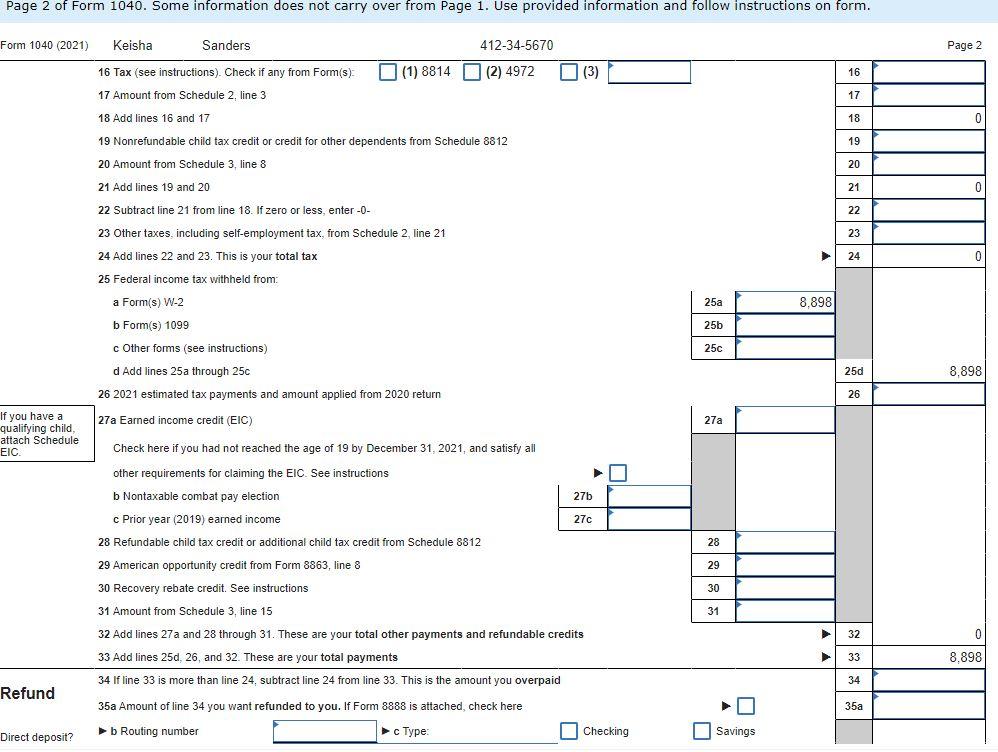

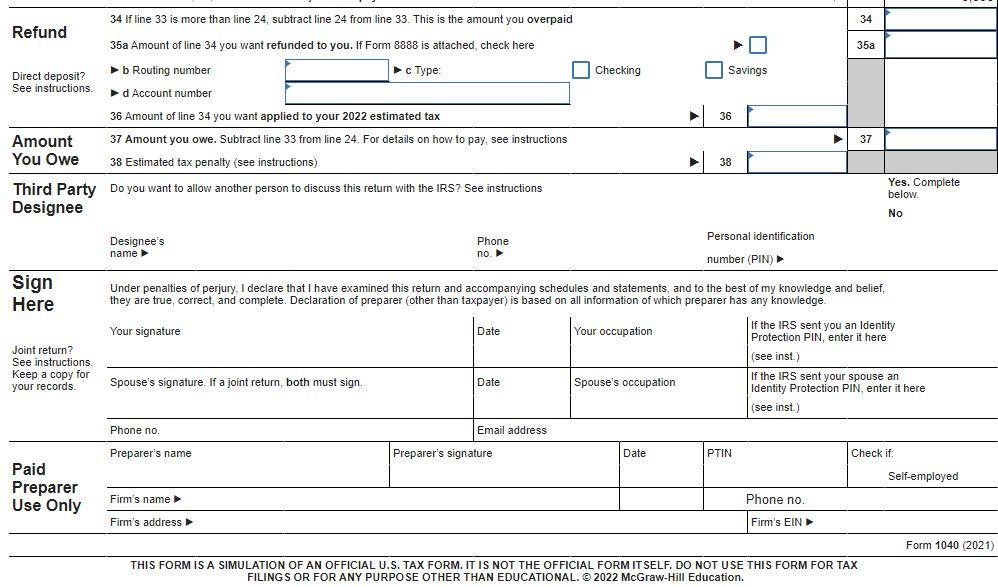

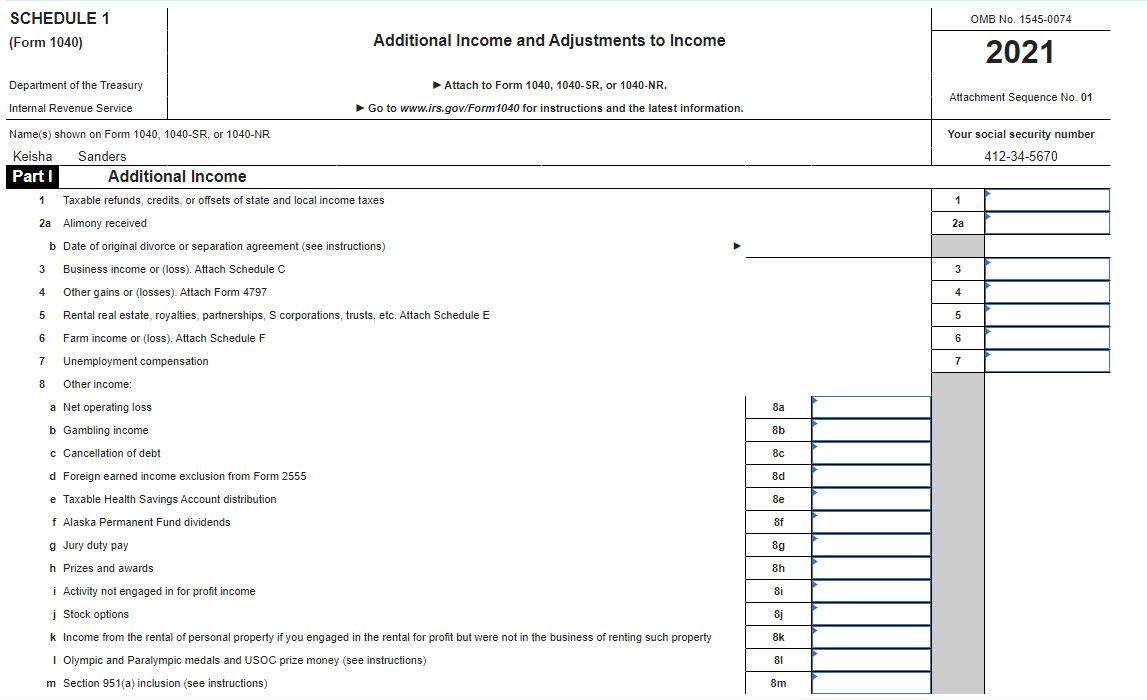

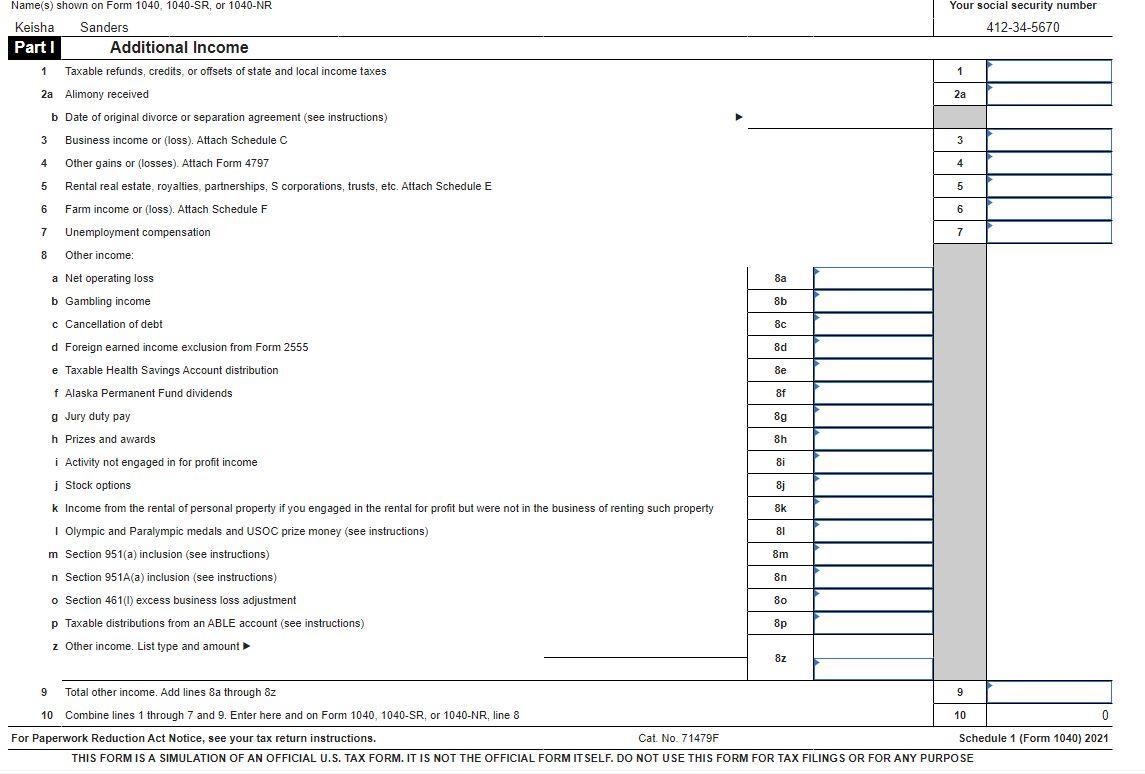

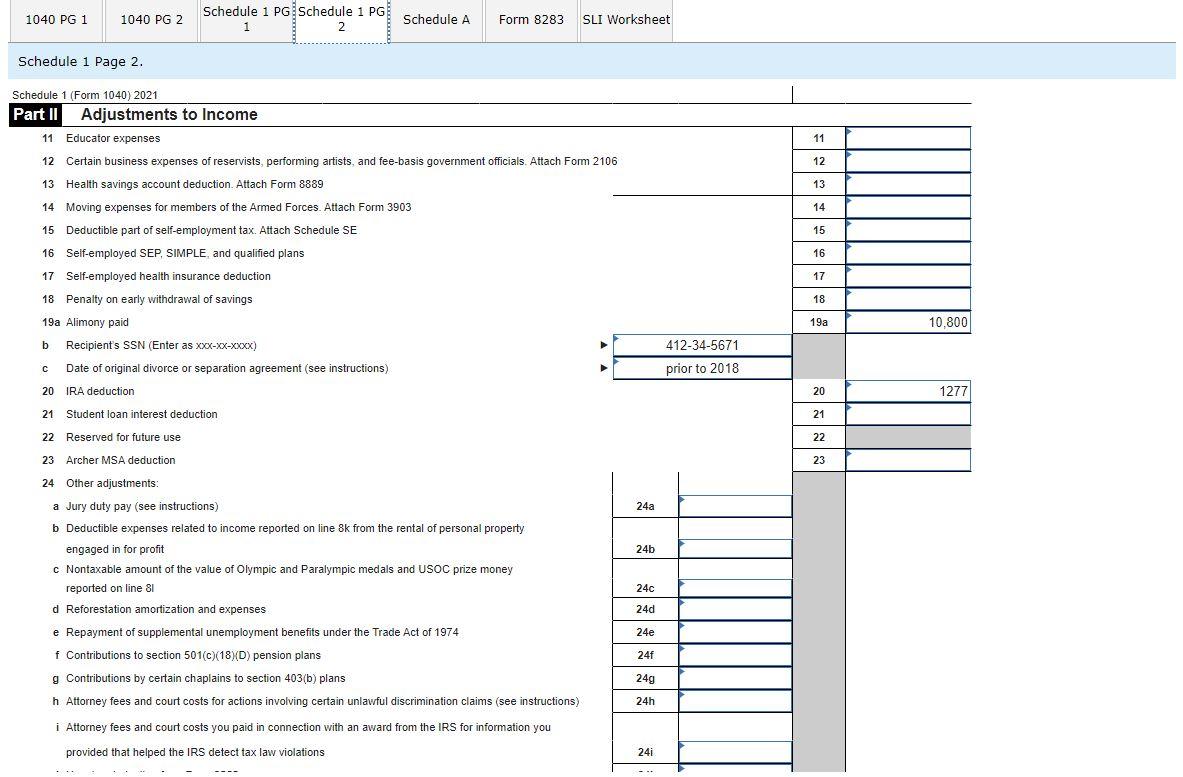

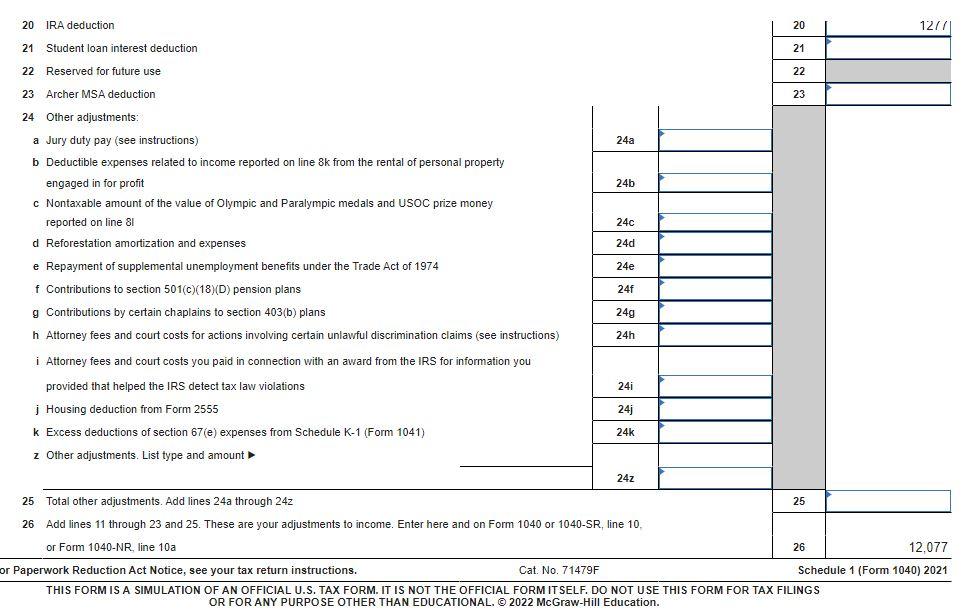

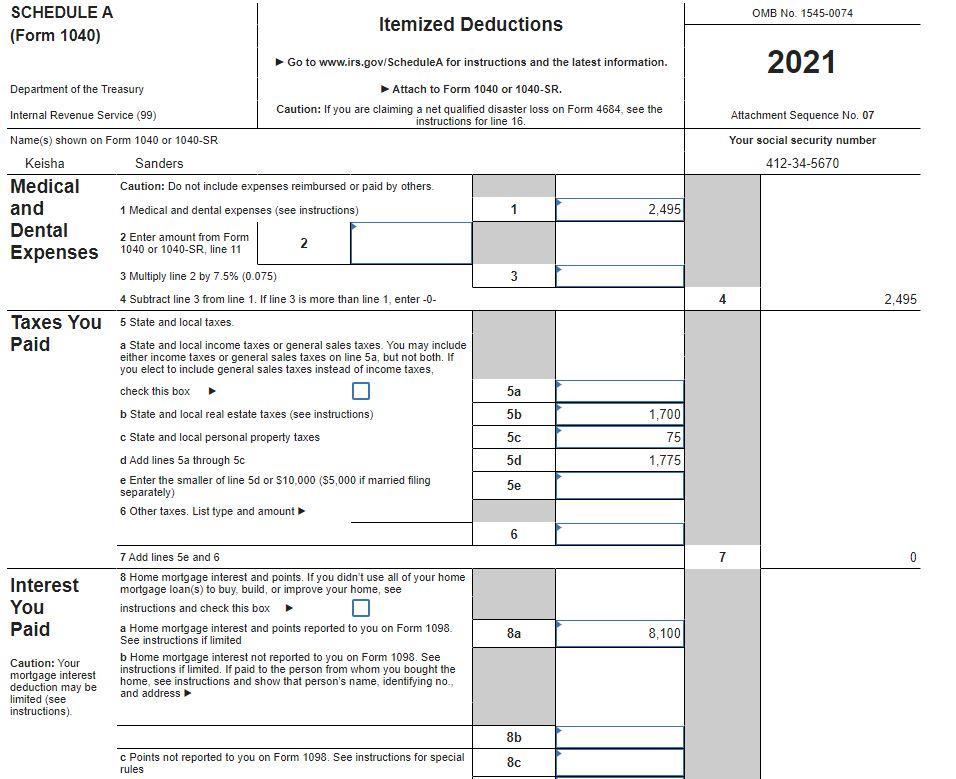

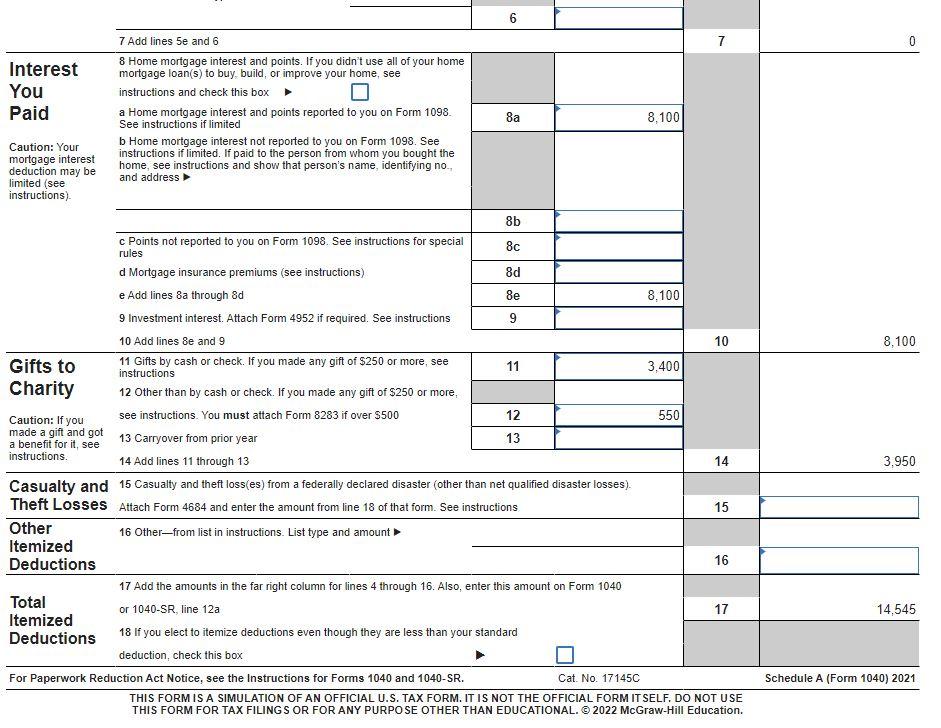

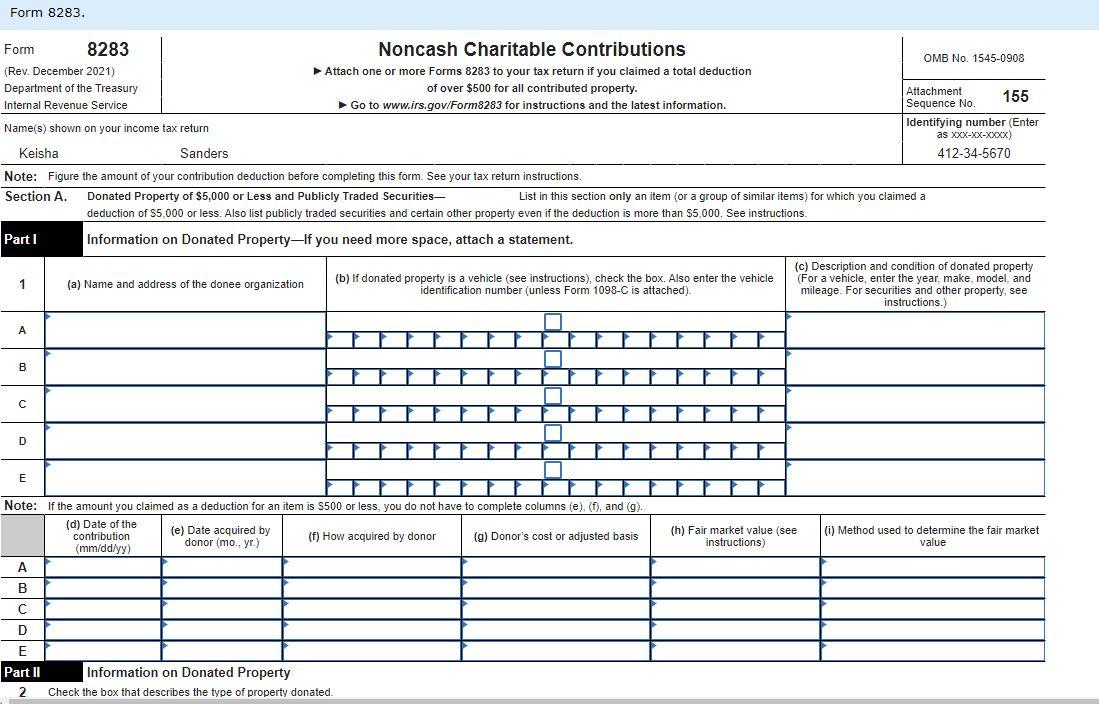

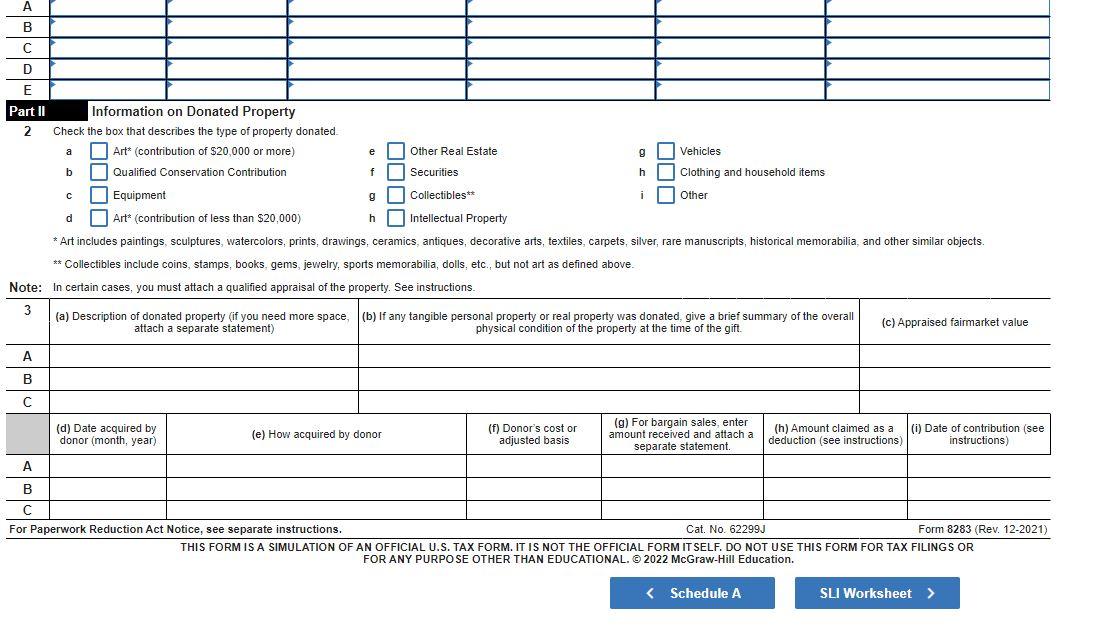

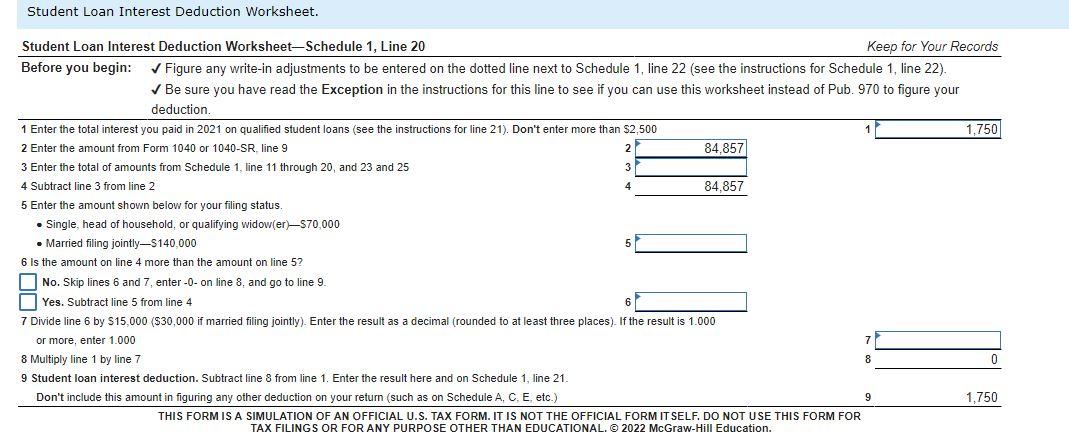

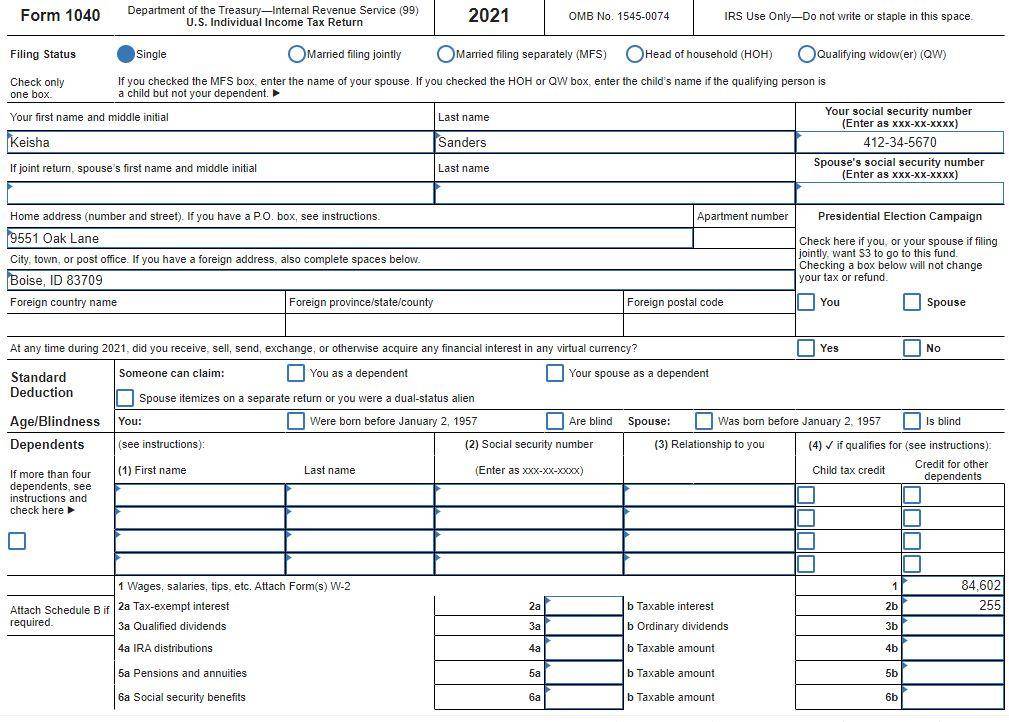

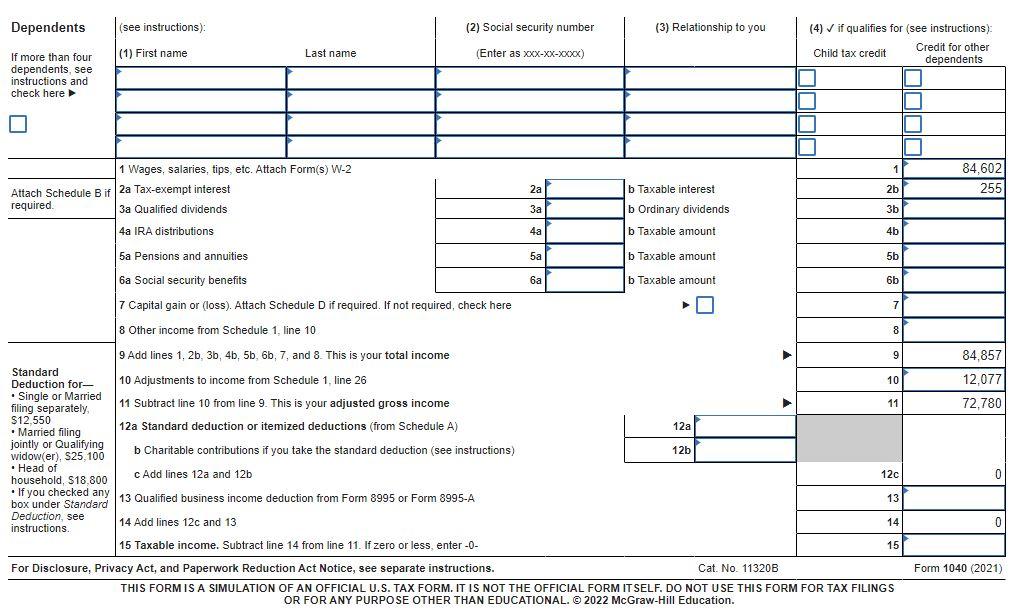

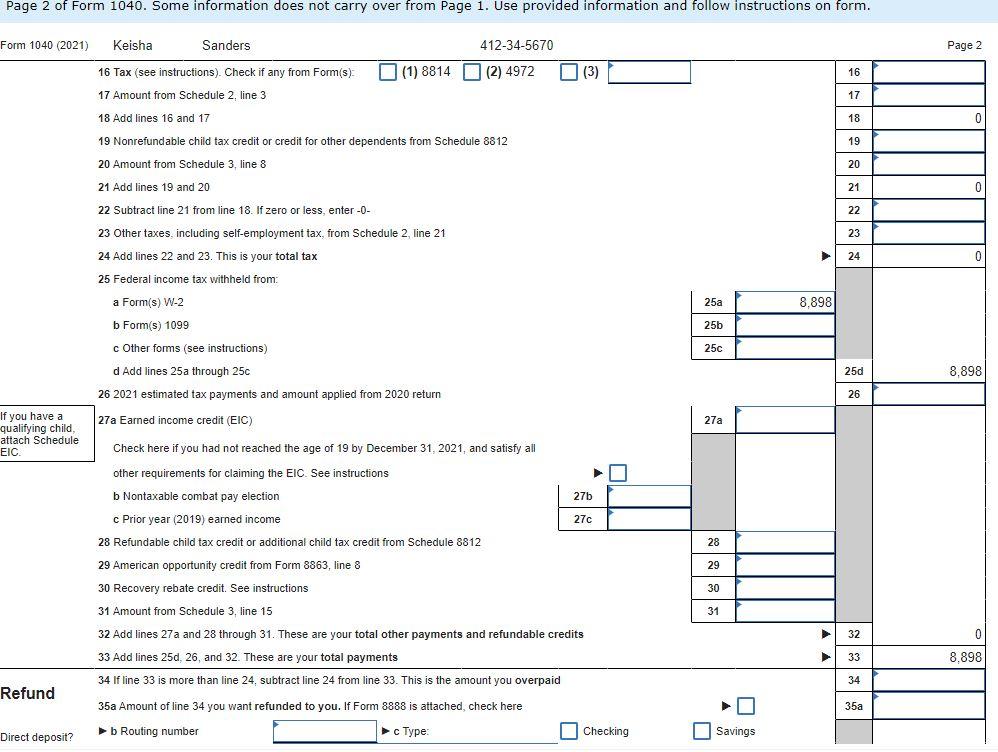

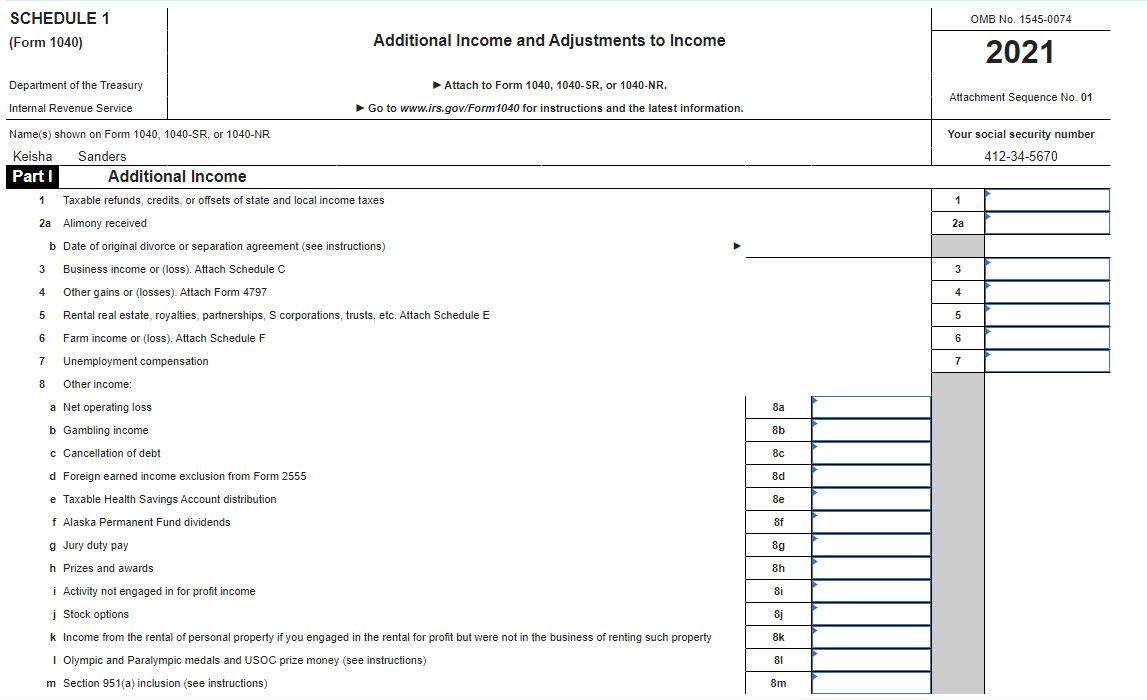

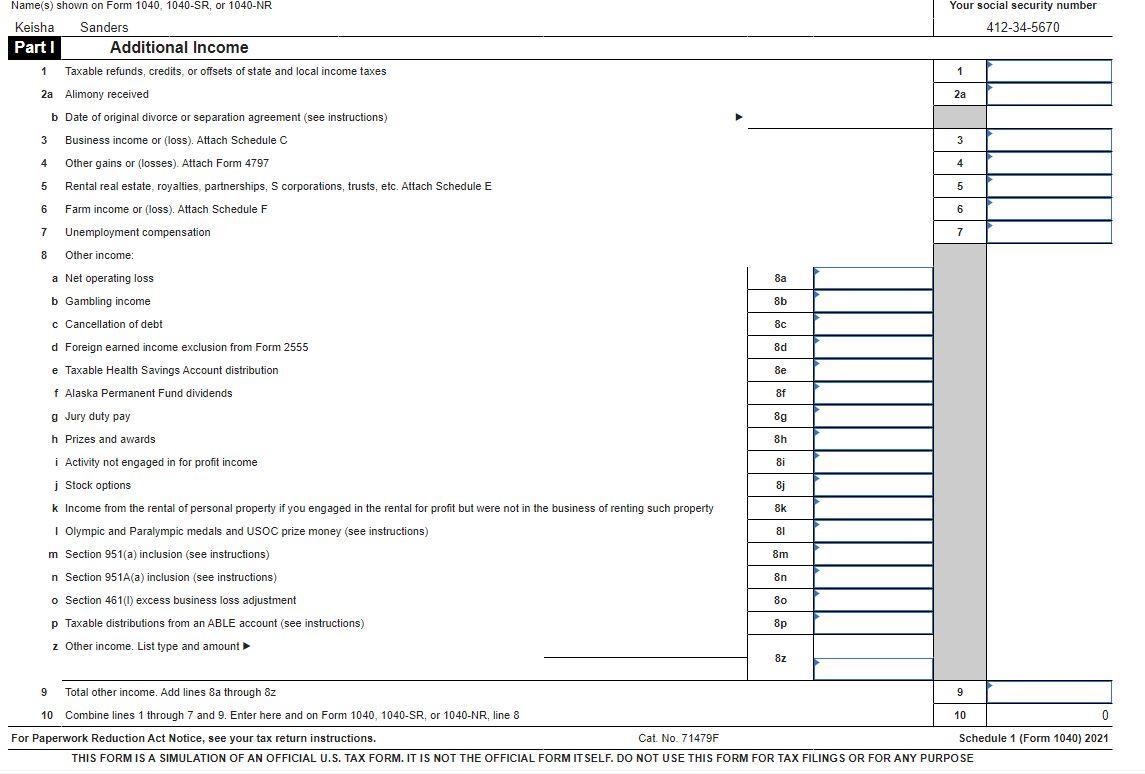

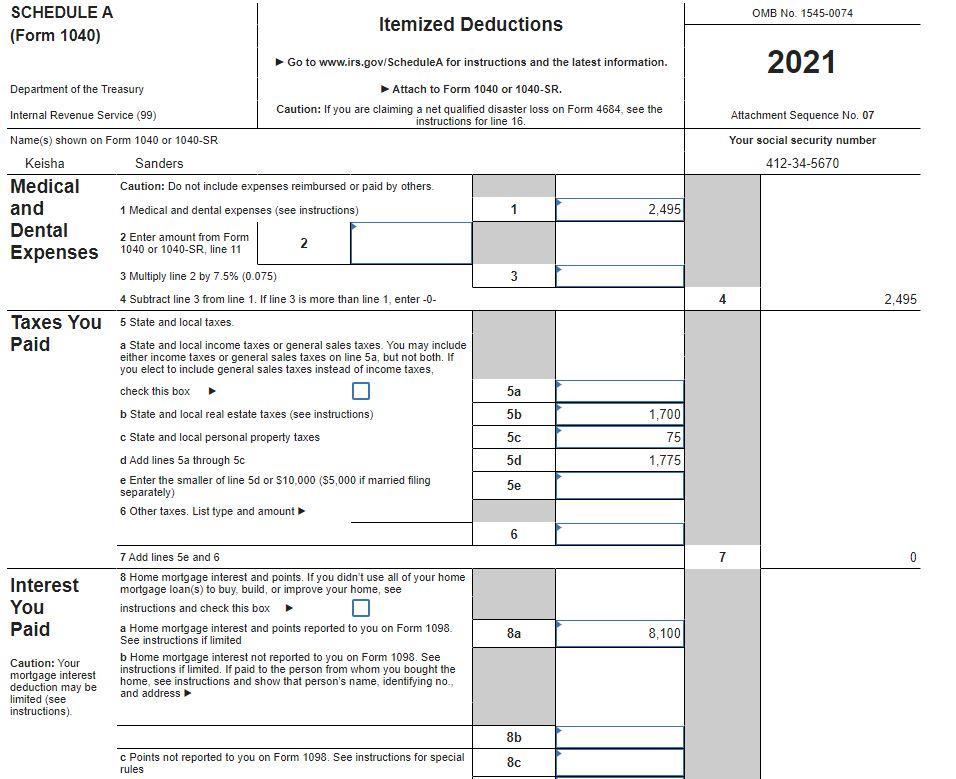

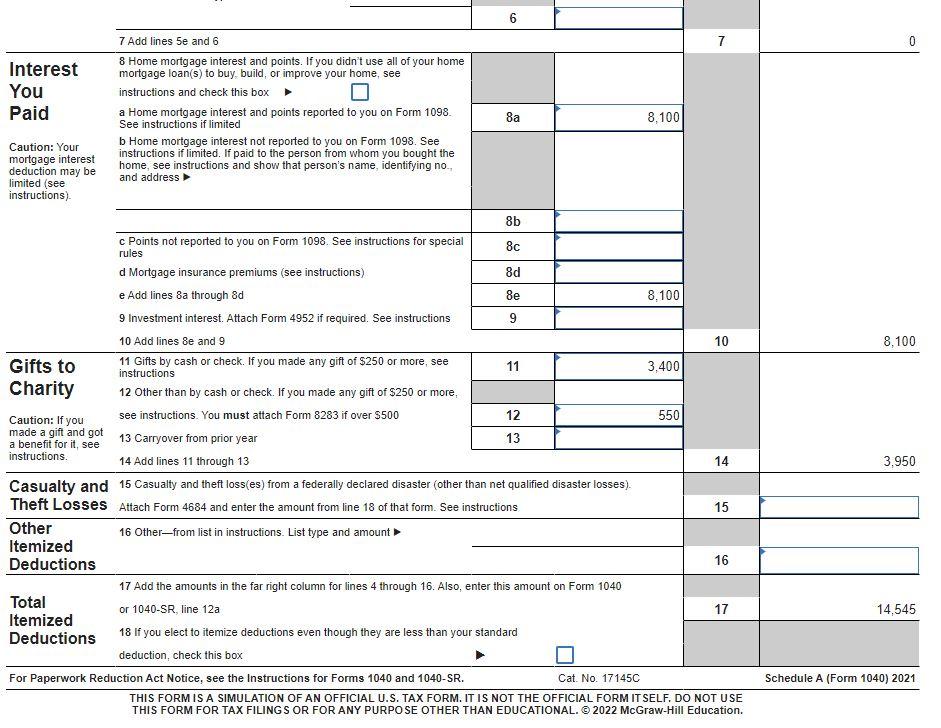

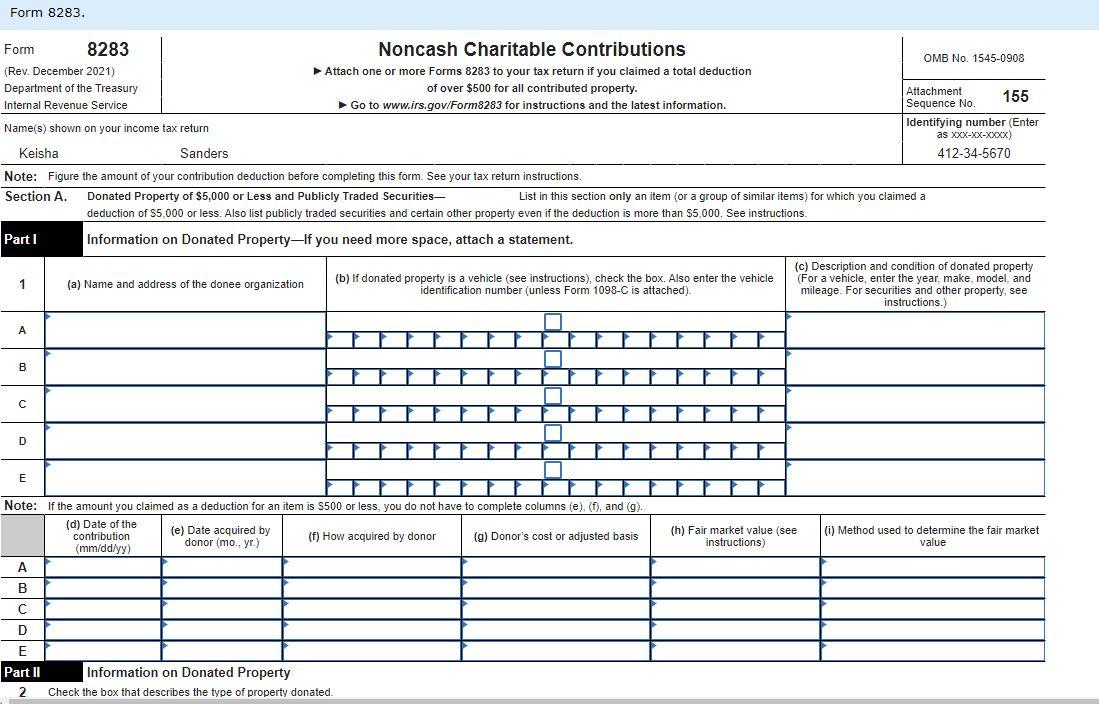

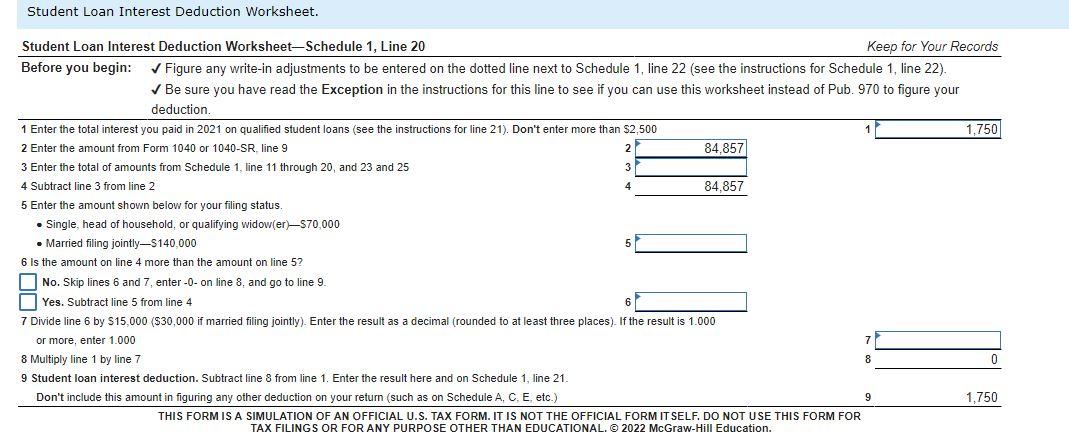

Assume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. In addition, the taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. Keisha Sanders, a divorced single taxpayer and practicing attorney, lives at 9551 Oak Lane in Boise, ID 83709. Her social security number is 412-34-5670 (date of birth 2/27/1977). Her W-2 contained the following information: Wages (box 1) = $ 84,601.55 Federal W/H (box 2) = $ 8,898.38 Social security wages (box 3) = $ 84,601.55 Social security W/H (box 4) = $ 5,245.30 Medicare wages (box 5) = $ 84,601.55 Medicare W/H (box 6) = $ 1,226.72 In addition, Keisha made alimony payments totaling $10,800 for the year to her former husband Alex, an unemployed mine worker, whose social security number is 412-34-5671. This was in regards to a divorce decree that was completed prior to November 2017 and had not been amended post 2018. She also received a 1099 INT from Idaho State Credit Union in the amount of $254.85. Keisha also has the following information for her Schedule A itemized deductions: Interest expense Home mortgage (qualified residence interest) $ 8,100 MasterCard (used exclusively for personal expenses and purchases) 675 Car loan (personal use) 710 Student loan interest 1,750 Taxes paid State income tax withheld 2,950 State income tax deficiency (for 2020) 350 Real estate property taxesprincipal residence 1,700 Personal property taxescar 75 Registration feecar 125 Medical expenses Doctors fees 635 Prescription drugs 260 Vitamins and over-the-counter drugs 250 Dental implant to correct a bite problem 1,600 Health club fee 400 Charitable contributions (all required documentation is maintained) Cash: Mosque (made ratably throughout the year and no single contribution was greater than $250) 3,100 United Way 100 PBS annual campaign 200 Property: Greater Boise Goodwillused clothing and household items Date of donation November 15, 2021 Thrift shop value at date of donation 550 Actual purchase price of the items 1,300 Required: Prepare a Form 1040 with a Schedule 1, a Schedule A, and a Form 8283 for Keisha using any other appropriate worksheets. If manually preparing the return, the Student Loan Interest Deduction worksheet can be found in IRS Publication 970, Tax Benefits for Education. Use the appropriate Tax Tables. Note: Input all the values as positive numbers. Round your final answers to the nearest whole dollar amount. Instructions can be found on certain cells within the forms. Do not skip rows, while entering Part I of Form 8283.

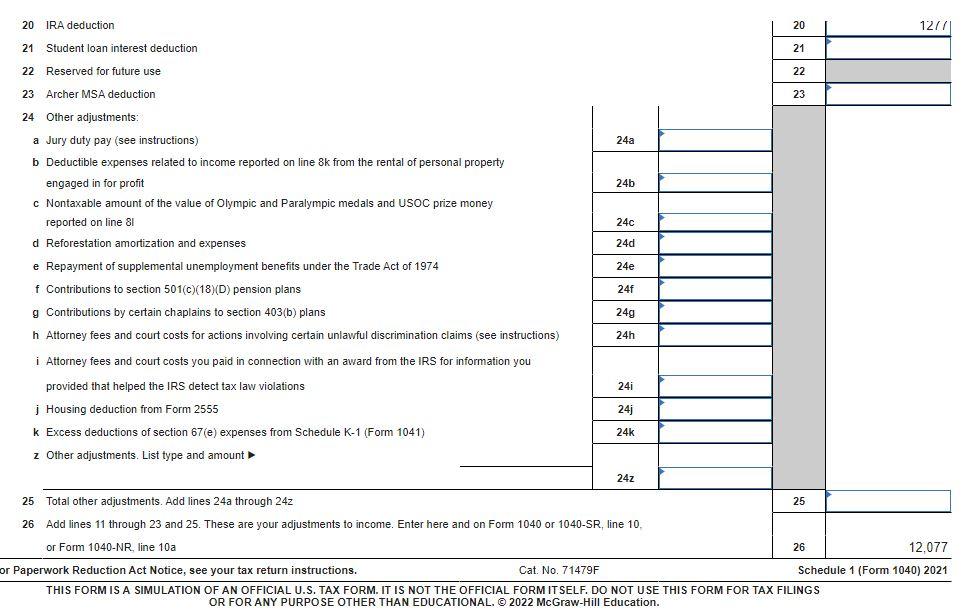

PLEASE PLEASE PLEASE USE THESE FORMS AND NOT ANY OTHER TAX FORMS THAT DIFFER!!

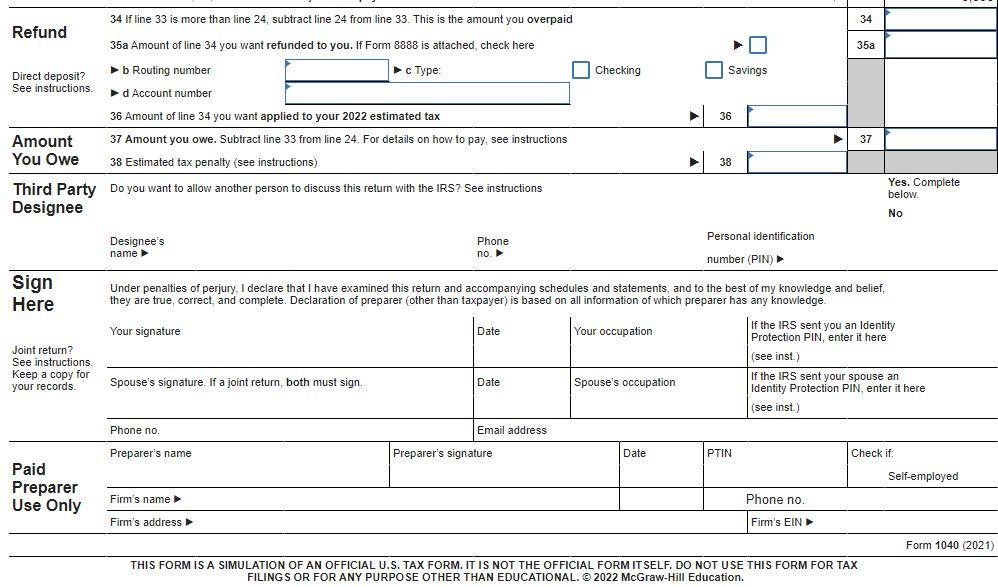

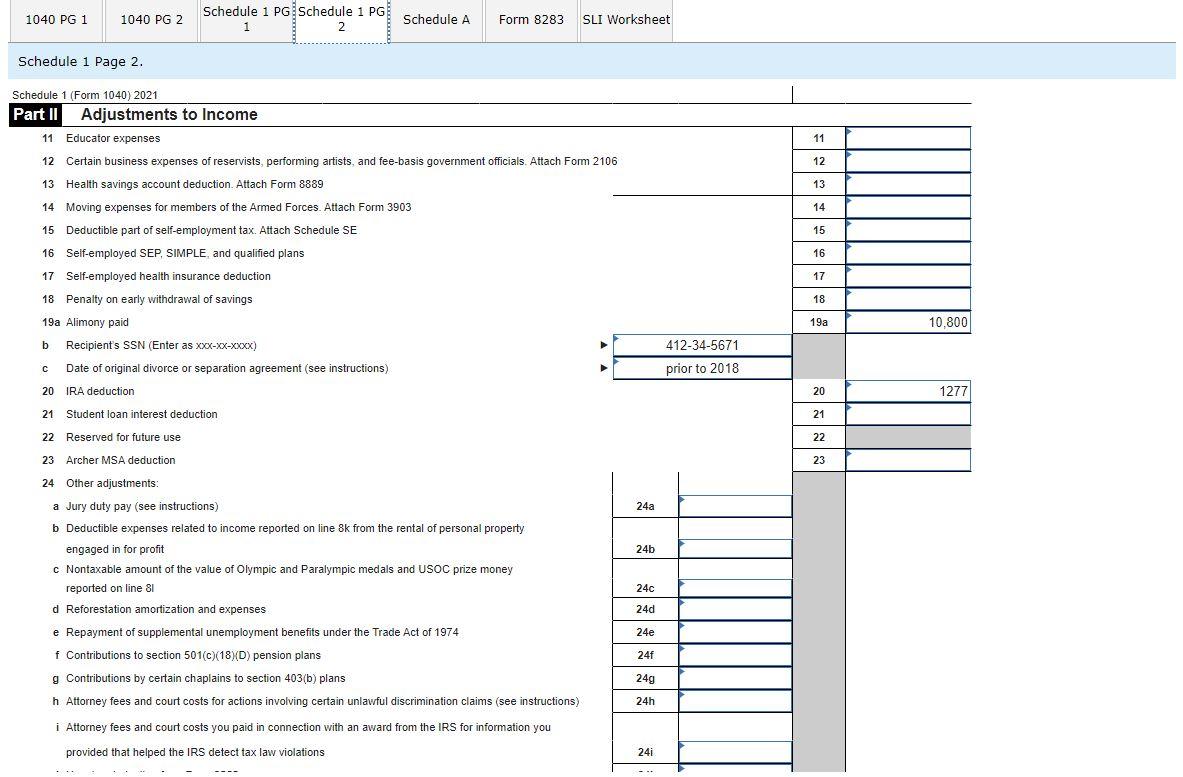

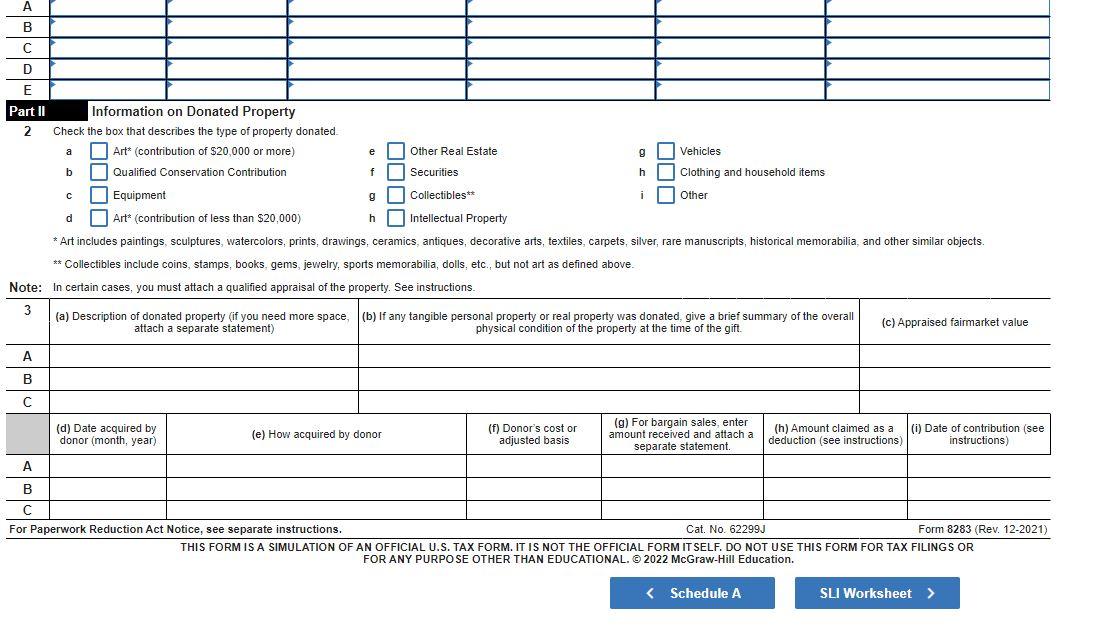

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040(2021) THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. (9) 2022 McGraw-Hill Education. If you have a qualifying child, attach Schedule ElC. Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, Here they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM IT SELF. DO NOT USE THIS FORM FOR TAX FILING S OR FOR ANY PURPO SE OTHER THAN EDUCATIONAL. 2022 McGraw-Hill Education. Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM IT SELF. DO NOT USE THIS FORM FOR TAX FILING S OR FOR ANY PURPOSE Schedule 1 Page 2. 20 IRA deduction 21 Student loan interest deduction 22 Reserved for future use 23 Archer MSA deduction 24 Other adjustments: a Jury duty pay (see instructions) b Deductible expenses related to income reported on line 8k from the rental of personal property engaged in for profit c Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 81 d Reforestation amortization and expenses e Repayment of supplemental unemployment benefits under the Trade Act of 1974 f Contributions to section 501(c)(18)(D) pension plans g Contributions by certain chaplains to section 403 (b) plans h Attorney fees and court costs for actions involving certain unlawful discrimination claims (see instructions) i Attorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IRS detect tax law violations j Housing deduction from Form 2555 k Excess deductions of section 67(e) expenses from Schedule K-1 (Form 1041) z Other adjustments. List type and amount 25 Total other adjustments. Add lines 24 a through 24z 26 Add lines 11 through 23 and 25 . These are your adjustments to income. Enter here and on Form 1040 or 10 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FIIINGS OR FOR ANY PURPO SE OTHER THAN EDUCATIONAL. 92022 McGraw-Hill Education. Form 8283. Note: Figure the amount of your contribution deduction before completing this form. See your tax return instructions. Section A. Donated Property of $5,000 or Less and Publicly Traded Securities___ List in this section only an item (or a group of similar items) for which you claimed a deduction of $5,000 or less. Also list publicly traded securities and certain other property even if the deduction is more than $5,000. See instructions. Part I Information on Donated Property-If you need more space, attach a statement. \begin{tabular}{c|l} (a) Name and address of the donee organization \\ (b) If donated property is a vehicle (see instructions), check the box. Also enter the vehicle \\ identification number (unless Form 1098-C is attached). \\ (c) Description and condition of donated property \\ (For a vehicle, enter the year, make, model, and \\ mileage. For securities and other property, see \\ instructions.) \end{tabular} Note: If the amount you claimed as a deduction for an item is $500 or less, you do not have to complete columns (e), (f), and ( g). \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & (d)Dateofthecontribution(mm/ddyy) & (e)Dateacquiredbydonor(mo.,yr.) & (f) How acquired by donor & (g) Donor's cost or adjusted basis & (h)Fairmarketvalue(seeinstructions) & (i)Methodusedtodeterminethefairmarketvalue \\ \hline A & & & & & \\ \hline B & & & & & \\ \hline C & & & & & \\ \hline D & & & & & \\ \hline E & & & \\ \hline \end{tabular} Part II Information on Donated Property 2 Check the box that describes the type of property donated. Part II Information on Donated Property 2 Check the box that describes the type of property donated. aArt*(contributionof$20,000ormore)bQualifiedConservationContributioncEquipmentdArt*(contributionoflessthan$20,000)eotherRealEstatefSecuritiesgCollectibles**hIntellectualPropertygvehicleshclothingandhouseholditemsiother * Art includes paintings, sculptures, watercolors, prints, drawings, ceramics, antiques, decorative arts, textiles, carpets, silver, rare manuscripts, historical memorabilia, and other similar objects. Collectibles include coins, stamps, books, gems, jewelry, sports memorabilia, dolls, etc., but not art as defined above. Note: In certain cases, you must attach a qualified appraisal of the property. See instructions. THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPO SE OTHER THAN EDUCATIONAL.@ 2022 McGraw-Hill Education.