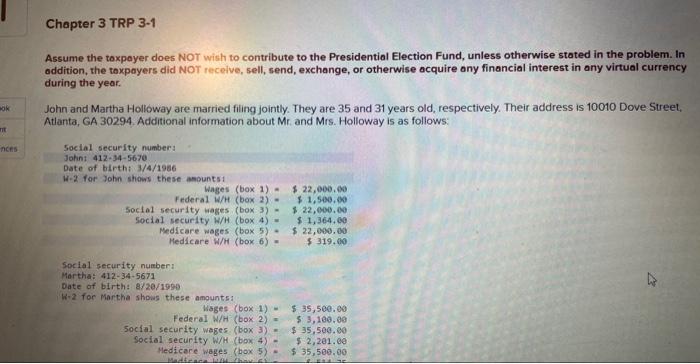

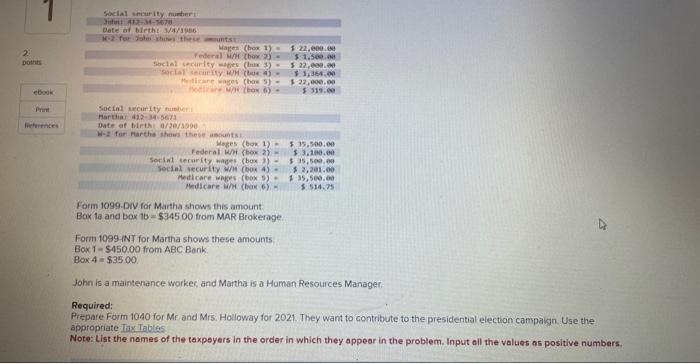

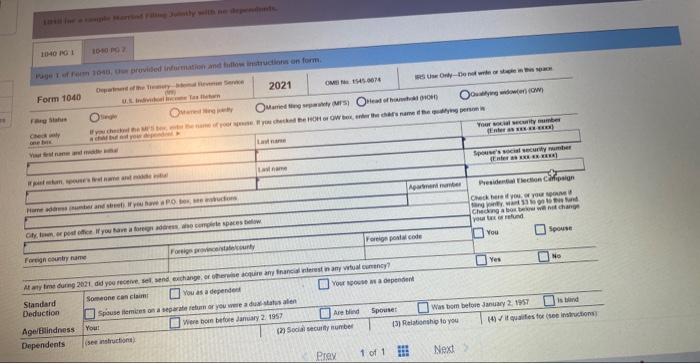

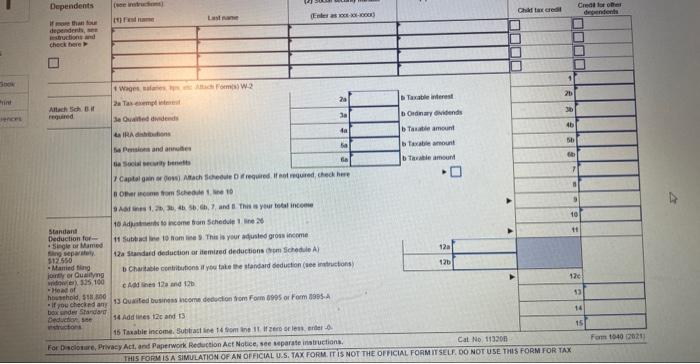

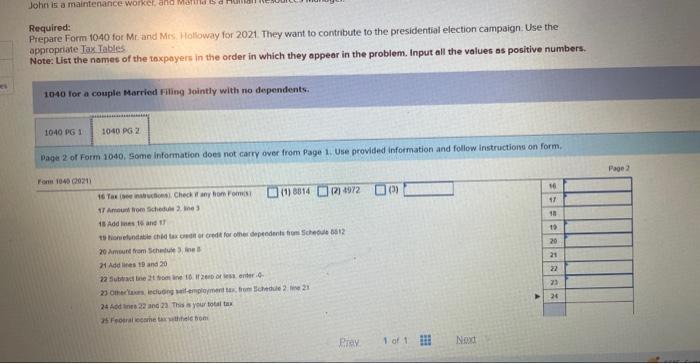

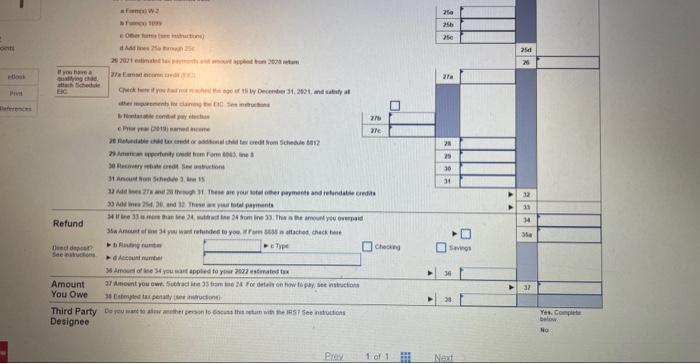

Assume the toxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. In addition, the toxpayers did NOT recelve, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. John and Martha Holloway are married filing jointly. They are 35 and 31 years old, respectively. Their address is 10010 Dove Street, Atlanta, GA 30294 . Additional information about Mr. and Mrs. Holloway is as follows: Form 1099.DN for Martha shows this amount. Box ta and box 16=$345, 00 from MAR Brokerage. Form 1099-NT for Martha shows these amounts Box 1=$450.00 from ABC Bonk Box4=$3500 John is a maintenance workes, and Martha is a Human Resources Manager: Required: Prepare Form 1040 for Mf and Mrs. Holloway for 2021. They want to contribute to the presidential election campaign. Use the appropriate Tax Tables Note: List the names of the taxpeyers in the order in which they appear in the problem. Input all the values as positive numbers, THIS FORM IS A SIMULATIOY OF AN OF FICLAL U.S. TAX FORM. IT IS NOT THE OH ICIAL FORM IT SELF. DO NOT USE THIS FORM FOR TAX Required: Prepare Form 1040 for Mr and Mrs. I Iolloway for 2021 They want to contribute to the presidential election campaign. Use the appropriate Tax Tables. Note: List the names of the toxpayers in the order in which they appear in the problem. Input all the values as positive numbers. 1040 for a couplis Married Filing Jointly with no dependent. Page 2 of Form 1040, Some Information does not carry over from Page 1. Use provided information and follow instructions on form. Pray 1. of 1 H Nit Naxt Assume the toxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. In addition, the toxpayers did NOT recelve, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. John and Martha Holloway are married filing jointly. They are 35 and 31 years old, respectively. Their address is 10010 Dove Street, Atlanta, GA 30294 . Additional information about Mr. and Mrs. Holloway is as follows: Form 1099.DN for Martha shows this amount. Box ta and box 16=$345, 00 from MAR Brokerage. Form 1099-NT for Martha shows these amounts Box 1=$450.00 from ABC Bonk Box4=$3500 John is a maintenance workes, and Martha is a Human Resources Manager: Required: Prepare Form 1040 for Mf and Mrs. Holloway for 2021. They want to contribute to the presidential election campaign. Use the appropriate Tax Tables Note: List the names of the taxpeyers in the order in which they appear in the problem. Input all the values as positive numbers, THIS FORM IS A SIMULATIOY OF AN OF FICLAL U.S. TAX FORM. IT IS NOT THE OH ICIAL FORM IT SELF. DO NOT USE THIS FORM FOR TAX Required: Prepare Form 1040 for Mr and Mrs. I Iolloway for 2021 They want to contribute to the presidential election campaign. Use the appropriate Tax Tables. Note: List the names of the toxpayers in the order in which they appear in the problem. Input all the values as positive numbers. 1040 for a couplis Married Filing Jointly with no dependent. Page 2 of Form 1040, Some Information does not carry over from Page 1. Use provided information and follow instructions on form. Pray 1. of 1 H Nit Naxt