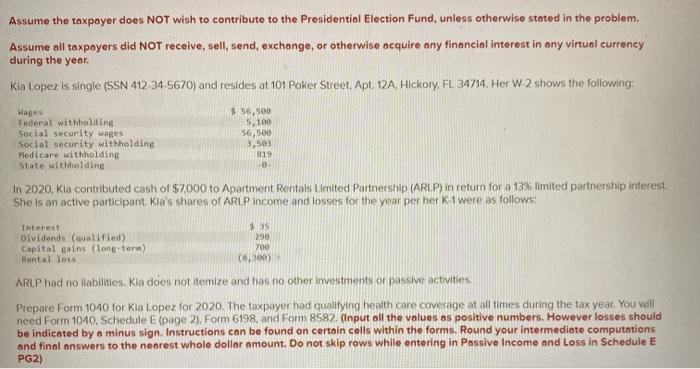

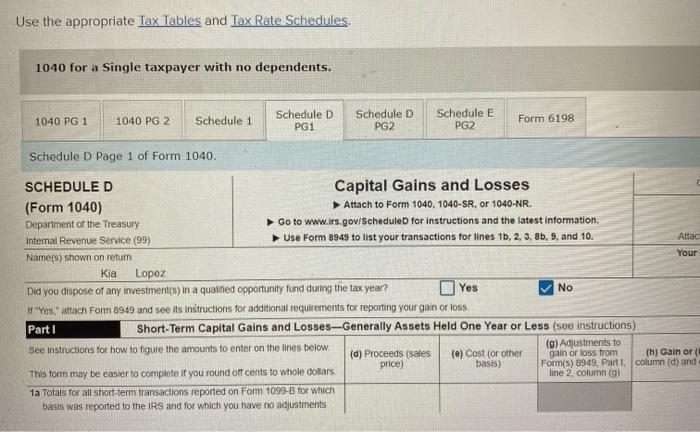

Assume the toxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. Assume all taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. Kia Lopez is single (SSN 412-34-5670) and resides at 101 Poker Street, Apt. 12A, Hickory, FL 34714. Her W-2 shows the following: Wages $ 56,500 Federal withholding 5.100 Social security wages 56,500 Social security withholding 3,503 Medicare withholding 819 State withholding 0 In 2020, Kla contributed cash of $7,000 to Apartment Rentals Limited Partnership (ARLP) in return for a 13% limited partnership interest She is an active participant Kla's shares of ARLP income and losses for the year per her ki were as follows: Interest Dividends (qualified) Capital gains (long tera) Rental loss $ 35 290 700 (8,300) ARLP had no itabilities, Kia does not itemize and has no other investments or passive activities Prepare Form 1040 for Kia Lopez for 2020. The taxpayer had qualifying health care coverage at all times during the tax year. You will need Form 1040, Schedule E (page 2). Form 6198, and Form 8582. (Input all the values as positive numbers. However losses should be indicated by a minus sign. Instructions can be found on certain cells within the forms. Round your intermediate computations and final answers to the nearest whole dollar amount. Do not skip rows while entering in Passive Income and Loss in Schedule E PG2) Use the appropriate Tax Tables and Tax Rate Schedules, 1040 for a single taxpayer with no dependents. 1040 PG 1 1040 PG 2 Schedule 1 Schedule D PG1 Schedule D PG2 Schedule E PG2 Form 6198 Schedule D Page 1 of Form 1040. SCHEDULED Capital Gains and Losses (Form 1040) Attach to Form 1040 1040-SR, or 1040-NR. Department of the Treasury Go to www.irs.gov/Scheduled for instructions and the latest information. Internal Revenue Service (99) Use Form 8949 to list your transactions for lines 1b, 2, 3, 8, 9, and 10. Atlas Name(s) shown on return Your Kia Lopez Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Yes No "Yes, attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss Part 1 Short-Term Capital Gains and Losses-Generally Assets Held One Year or Less (see instructions) See instructions for how to figure the amounts to enter on the lines below. (g) Adjustments to (d) Proceeds (sales (e) Cost (or other gain or loss from (h) Gain or price) basis) Form(s) 0949, Part 1 column (d) and This form may be easier to complete if you round off cents to whole dollars line 2 column (9) 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments Assume the toxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. Assume all taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. Kia Lopez is single (SSN 412-34-5670) and resides at 101 Poker Street, Apt. 12A, Hickory, FL 34714. Her W-2 shows the following: Wages $ 56,500 Federal withholding 5.100 Social security wages 56,500 Social security withholding 3,503 Medicare withholding 819 State withholding 0 In 2020, Kla contributed cash of $7,000 to Apartment Rentals Limited Partnership (ARLP) in return for a 13% limited partnership interest She is an active participant Kla's shares of ARLP income and losses for the year per her ki were as follows: Interest Dividends (qualified) Capital gains (long tera) Rental loss $ 35 290 700 (8,300) ARLP had no itabilities, Kia does not itemize and has no other investments or passive activities Prepare Form 1040 for Kia Lopez for 2020. The taxpayer had qualifying health care coverage at all times during the tax year. You will need Form 1040, Schedule E (page 2). Form 6198, and Form 8582. (Input all the values as positive numbers. However losses should be indicated by a minus sign. Instructions can be found on certain cells within the forms. Round your intermediate computations and final answers to the nearest whole dollar amount. Do not skip rows while entering in Passive Income and Loss in Schedule E PG2) Use the appropriate Tax Tables and Tax Rate Schedules, 1040 for a single taxpayer with no dependents. 1040 PG 1 1040 PG 2 Schedule 1 Schedule D PG1 Schedule D PG2 Schedule E PG2 Form 6198 Schedule D Page 1 of Form 1040. SCHEDULED Capital Gains and Losses (Form 1040) Attach to Form 1040 1040-SR, or 1040-NR. Department of the Treasury Go to www.irs.gov/Scheduled for instructions and the latest information. Internal Revenue Service (99) Use Form 8949 to list your transactions for lines 1b, 2, 3, 8, 9, and 10. Atlas Name(s) shown on return Your Kia Lopez Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Yes No "Yes, attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss Part 1 Short-Term Capital Gains and Losses-Generally Assets Held One Year or Less (see instructions) See instructions for how to figure the amounts to enter on the lines below. (g) Adjustments to (d) Proceeds (sales (e) Cost (or other gain or loss from (h) Gain or price) basis) Form(s) 0949, Part 1 column (d) and This form may be easier to complete if you round off cents to whole dollars line 2 column (9) 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments