Question

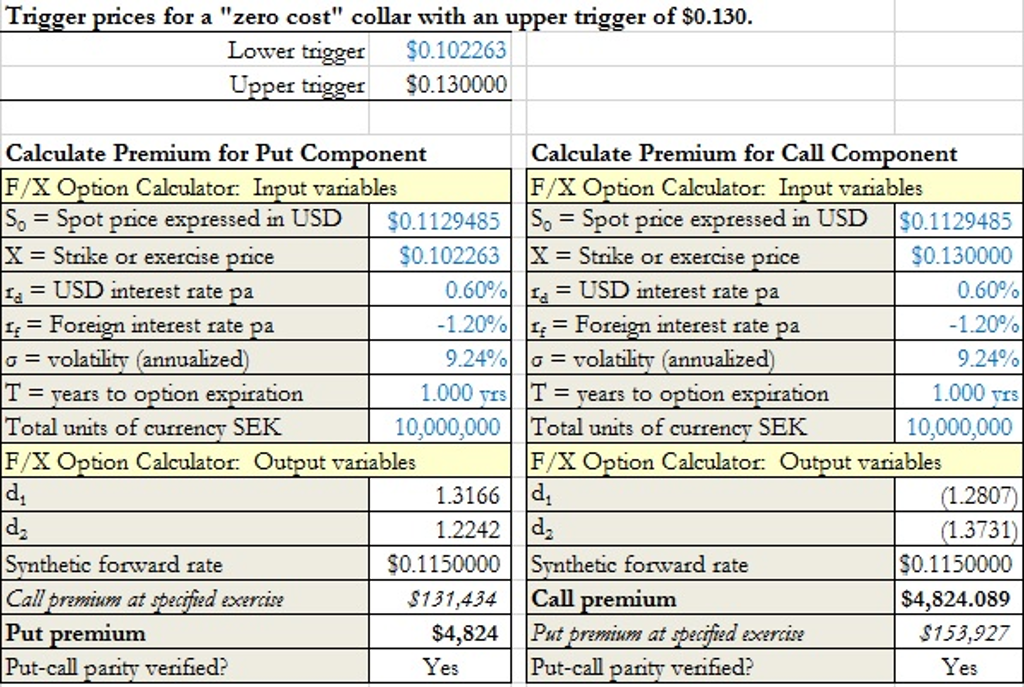

Assume the upper trigger price on the collar were held fixed at $0.13 per SEK. Identify a new lower trigger (to the sixth decimal place)

Assume the upper trigger price on the collar were held fixed at $0.13 per SEK. Identify a new lower trigger (to the sixth decimal place) at which the firm could enter into a "zero-cost" collar contract.

I used solver to find a lower limit trigger of .102263 by solving the Put Premium for 4,824.09 to match the call premium.

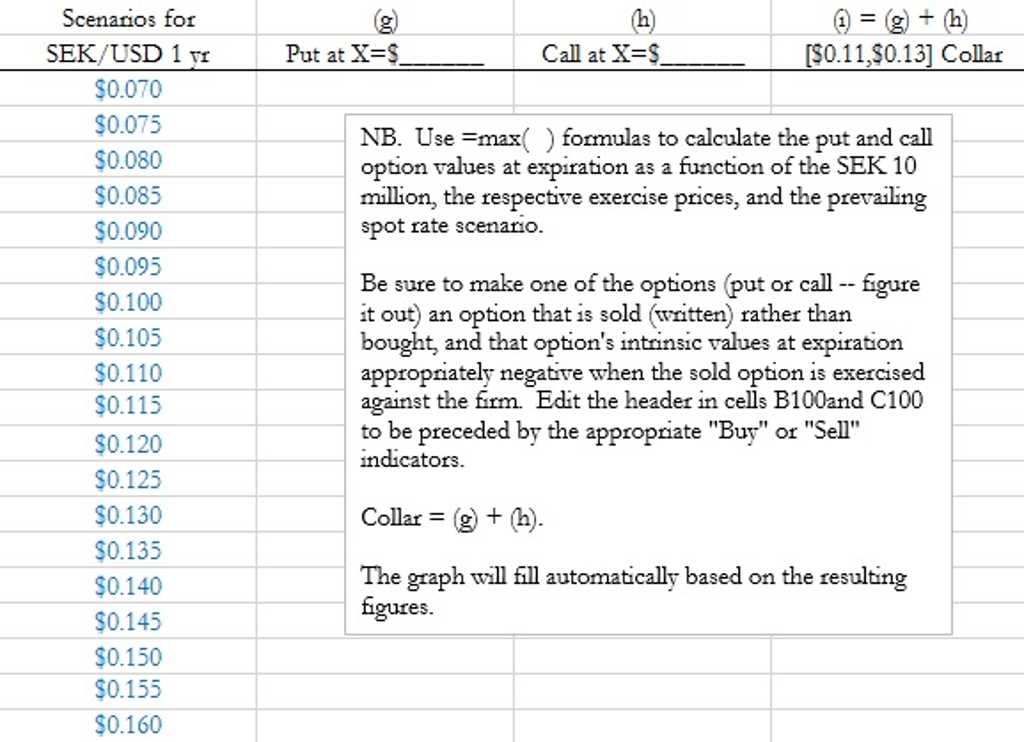

B2. Conceptualizing a collar as a combination of a put and a call:

My Main question is, what are the values for the Put and Call options at each of the forward rates, using the correct formulas. I'm not sure if you have to use an =if() formula for either column.

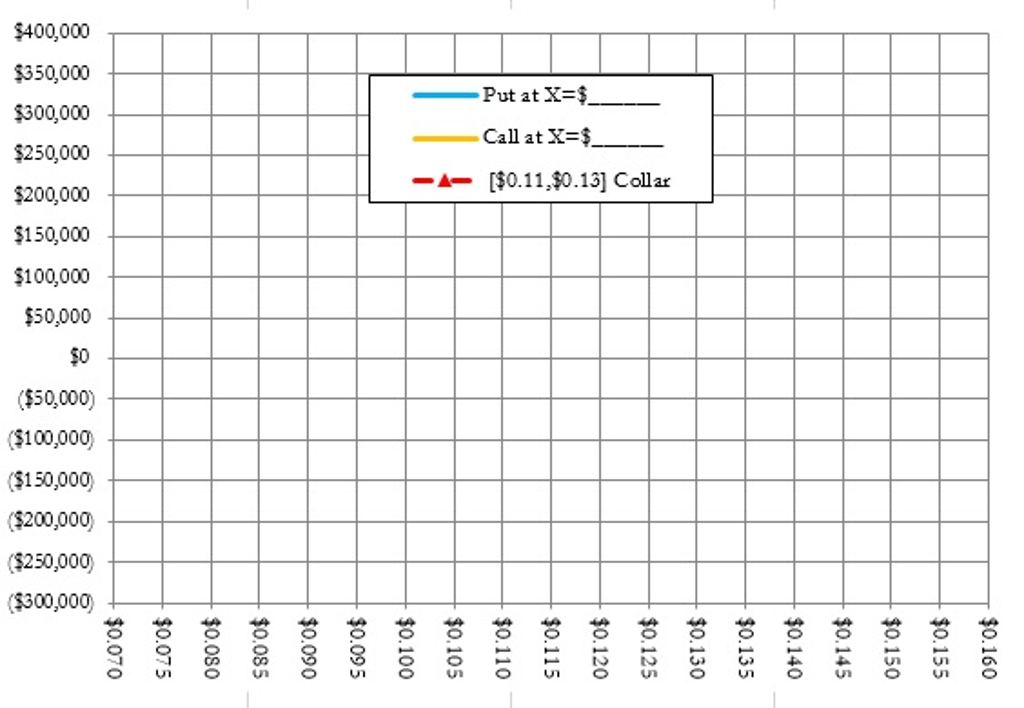

And once you have those, if you could graph them. If the values are correct, they will not intersect with the Legend box on the graph below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started