Answered step by step

Verified Expert Solution

Question

1 Approved Answer

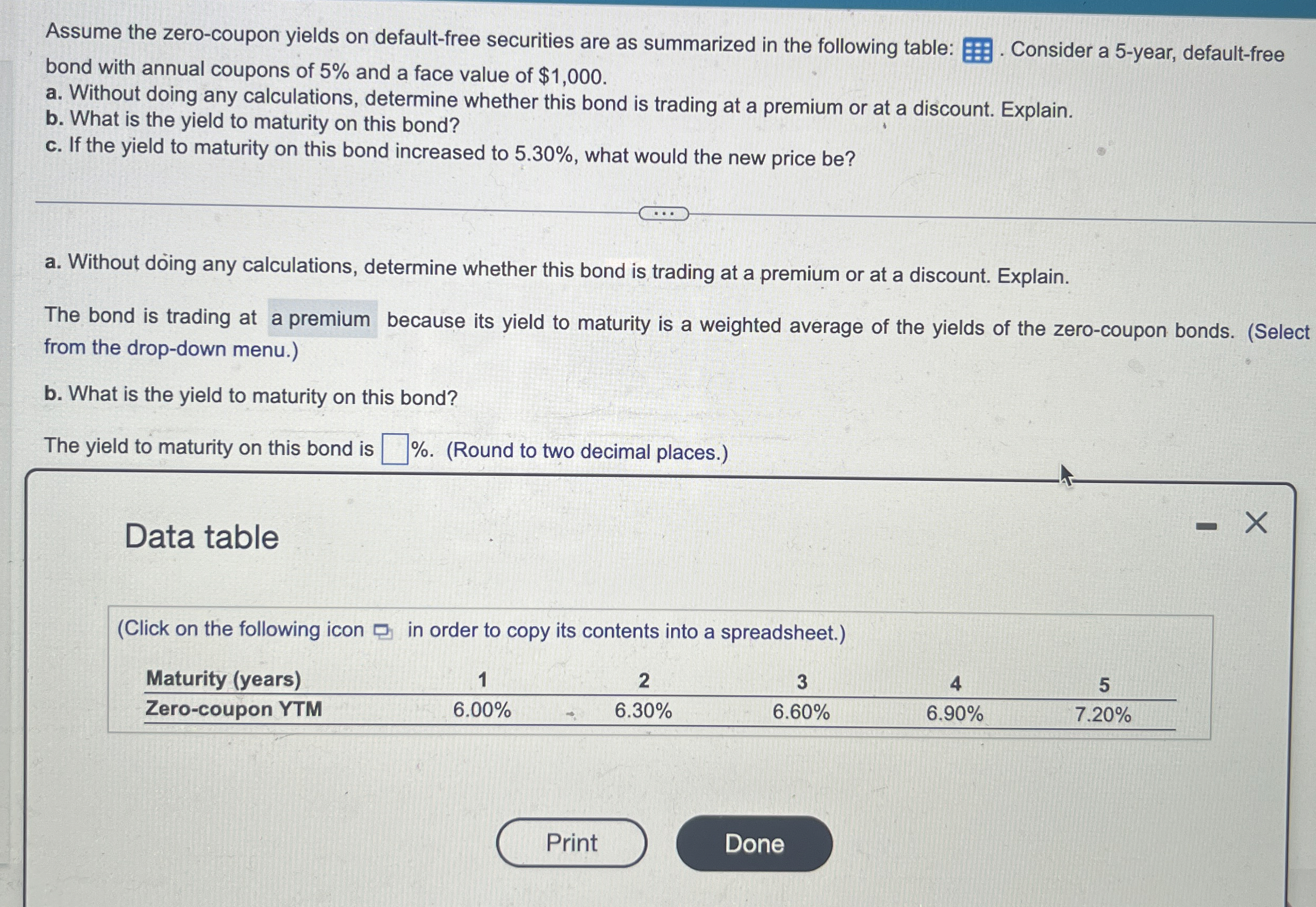

Assume the zero - coupon yields on default - free securities are as summarized in the following table: bond with annual coupons of 5 %

Assume the zerocoupon yields on defaultfree securities are as summarized in the following table:

bond with annual coupons of and a face value of $

a Without doing any calculations, determine whether this bond is trading at a premium or at a discount. Explain.

b What is the yield to maturity on this bond?

c If the yield to maturity on this bond increased to what would the new price be

a Without doing any calculations, determine whether this bond is trading at a premium or at a discount. Explain.

The bond is trading at a premium because its yield to maturity is a weighted average of the yields of the zerocoupon bonds. Select

from the dropdown menu.

b What is the yield to maturity on this bond?

The yield to maturity on this bond is

Round to two decimal places.

Data table

Click on the following icon in order to copy its contents into a spreadsheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started