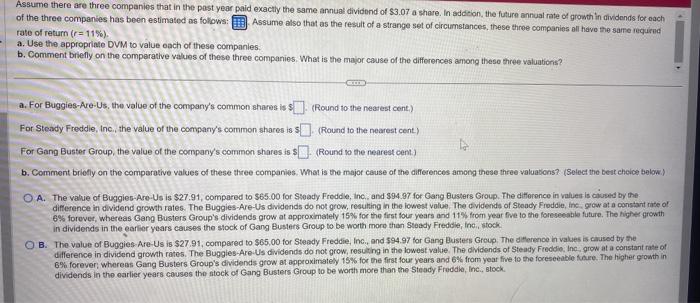

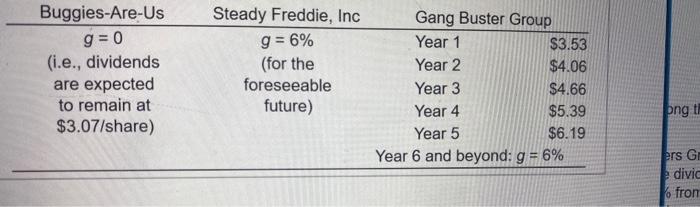

Assume there are three companies that in the pest year paid exactly the same annual dividend of $3.07 a share. In addition, the future annual rate of growth in dividends for each of the three companses has been estimated as follows: Assume also that as the result of a strange set of circumstances, these three companies all havo the same requined rate of return (r=115). a. Use the appropriate DVM to value each of these companies: b. Comment briefly on the comparative values of these three companies. What is the major cause of the differences among these three valuations? a. For Buggies-Are-Us, the value of the company's common shares is \$ (Round to the neasest cent,) For Steady Freddie, Inc, the value of the company's common shares is \& (Round to the nearest cent.) For Gang Buster Group, the value of the company's common shares is \$ (Round wo the nearest cent.) b. Comment briefly on the comparative values of these three companies. What is the major cause of the differences among these three valuasons? (Select the best cheice below.) A. The value of Buggies-Are-Us is \$27.91, compared to $65.00 for Ssoady Freddle, inc, and $94.97 for Gang Busters Group. The difference in values is ciussed by the difference in dividend growth rates. The Buggies-Are-Us dividends do not grow, resulting in the lowest volue. The cividends of Stoody Froddie, inc. grew at a constart rite of 6% forever, whereas Gang Busters Group's dividends grow at approximately 15% for the first four years and 11% from year five to the foreseeable future. The higher growth in dividends in the earier years causes the stock of Gang Busters Group to be worth more than Steady Freddie, inc., stock: B. The value of Buggies-Are-Us is $27,91, compared to $65.00 for Steady Freddie, Inc., and $94.97 for Gang Busters Group. The ditterence in values is causod by the difference in dividend growth rates. The Buggies-Are-Us dividends do not grow, resuting in the lowest value. The didends of Steady Freddie. Inc grow at a constant rate of 6% forever; wheress Gang Busters Group's dividends grow at approxirnatey 15% for the first four years and 64% from year five to the foreseedelio kicire. The higher growth in dividends in the earlier yeafs causes the stock of Gang. Busters Group to be worth more than the Steady Freddih, inc, stock. \begin{tabular}{cccc} Buggies-Are-Us & Steady Freddie, Inc & \multicolumn{2}{l}{ Gang Buster Group } \\ \hlineg=0 & g=6% & Year 1 & $3.53 \\ (i.e., dividends & (for the & Year 2 & $4.06 \\ are expected & foreseeable & Year 3 & $4.66 \\ to remain at & future) & Year 4 & $5.39 \\ $3.07/ share) & & Year 5 & $6.19 \\ & & Year 6 and beyond: g=6% \\ \hline \end{tabular}