Answered step by step

Verified Expert Solution

Question

1 Approved Answer

39. Assume there were 6,000 units in beginning work in process, 60% complete. 20,000 units were completed during the month. Ending work in process

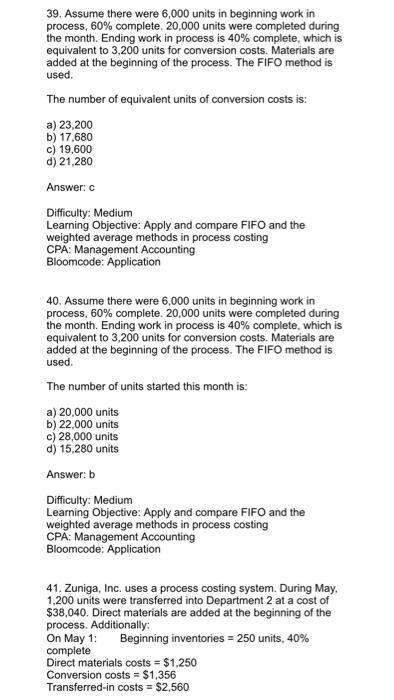

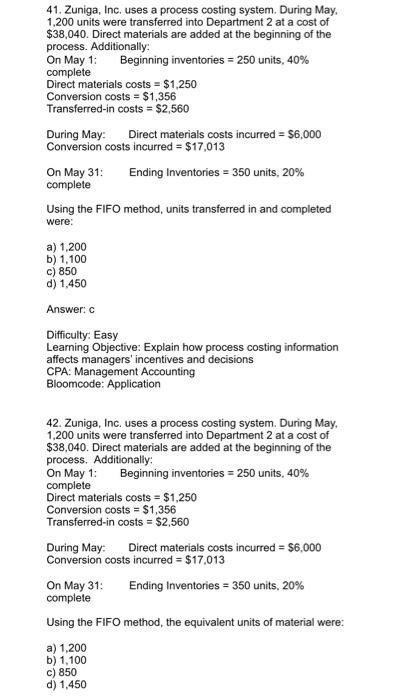

39. Assume there were 6,000 units in beginning work in process, 60% complete. 20,000 units were completed during the month. Ending work in process is 40% complete, which is equivalent to 3,200 units for conversion costs. Materials are added at the beginning of the process. The FIFO method is used. The number of equivalent units of conversion costs is: a) 23,200 b) 17,680 c) 19,600 d) 21,280 Answer: c Difficulty: Medium Learning Objective: Apply and compare FIFO and the weighted average methods in process costing CP: Management Accounting Bloomcode: Application 40. Assume there were 6,000 units in beginning work in process, 60% complete. 20,000 units were completed during the month. Ending work in process is 40% complete, which is equivalent to 3,200 units for conversion costs. Materials are added at the beginning of the process. The FIFO method is used. The number of units started this month is: a) 20.000 units b) 22,000 units c) 28,000 units d) 15,280 units Answer: b Difficulty: Medium Learning Objective: Apply and compare FiIFO and the weighted average methods in process costing CPA: Management Accounting Bloomcode: Application 41. Zuniga, Inc. uses a process costing system. During May, 1,200 units were transferred into Department 2 at a cost of $38,040. Direct materials are added at the beginning of the process. Additionally: On May 1: complete Direct materials costs = $1,250 Conversion costs $1,356 Transferred-in costs = $2,560 Beginning inventories = 250 units, 40% 41. Zuniga, Inc. uses a process costing system. During May, 1,200 units were transferred into Department 2 at a cost of $38,040. Direct materials are added at the beginning of the process. Additionally: On May 1: complete Direct materials costs = $1,250 Conversion costs = $1,356 Transferred-in costs = $2,560 Beginning inventories = 250 units, 40% During May: Direct materials costs incurred = $6,000 Conversion costs incurred = $17,013 On May 31: complete Ending Inventories = 350 units, 20% Using the FIFO method, units transferred in and completed were: a) 1,200 b) 1,100 c) 850 d) 1,450 Answer: c Difficulty: Easy Learning Objective: Explain how process costing information affects managers' incentives and decisions CPA: Management Accounting Bloomcode: Application 42. Zuniga, Inc. uses a process costing system. During May, 1,200 units were transferred into Department 2 at a cost of $38,040. Direct materials are added at the beginning of the process. Additionally: On May 1: complete Direct materials costs = $1,250 Conversion costs = $1,356 Transferred-in costs = $2,560 Beginning inventories = 250 units, 40% During May: Direct materials costs incurred = $6,000 Conversion costs incurred = $17.013 On May 31: complete Ending Inventories = 350 units, 20% Using the FIFO method, the equivalent units of material were: a) 1,200 b) 1,100 c) 850 d) 1,450

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Q39 UNITS TO ACCOUNT FOR Beginning Work in Process units 6000 Add Units Started in Process 22000 Tot...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started