Answered step by step

Verified Expert Solution

Question

1 Approved Answer

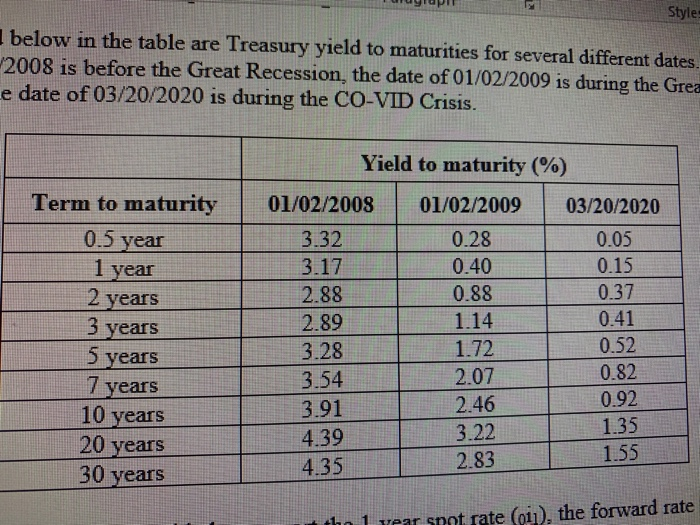

Assume there were no events that changed investors perceptions about future interest rates and that the Pure Expectations Theory is correct. Based on the 01/02/2008

Assume there were no events that changed investors perceptions about future interest rates and that the Pure Expectations Theory is correct. Based on the 01/02/2008 information, discuss the anticipated future 1-year interest rates over the next three years. Be sure to answer the following items: (a) Are interest rates expected to decrease orincrease, and if so, by how much? (b) If we expect interest rates to change, do we expect them to change at an increasing or decreasing rate? (c) Is there any economic news embedded in the forward rates that you can share with someone who has not studied the term structure of interest rates?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started