Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume Tinley and Thornton form T&T Rentals, a rental real estate partnership by contributing the properties in the table below. Thornton's property is encumbered

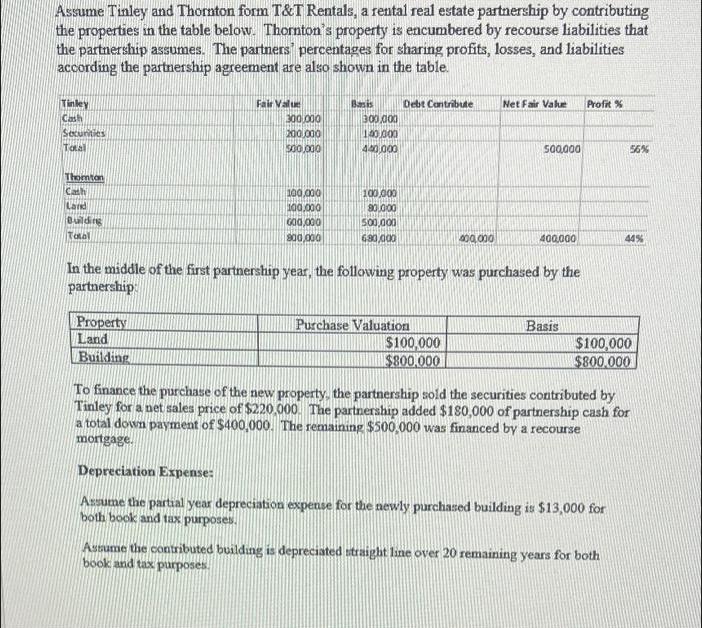

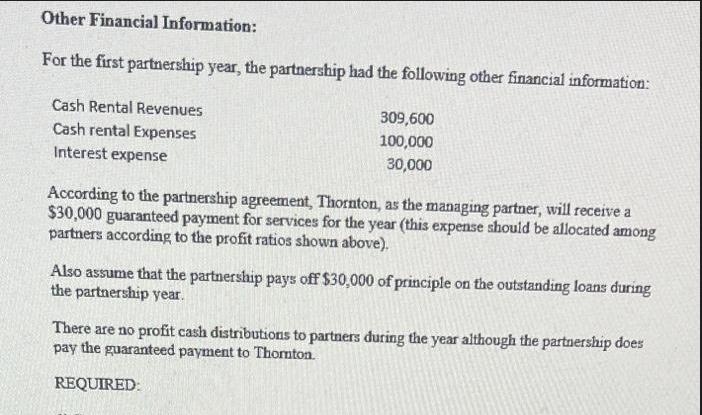

Assume Tinley and Thornton form T&T Rentals, a rental real estate partnership by contributing the properties in the table below. Thornton's property is encumbered by recourse liabilities that the partnership assumes. The partners percentages for sharing profits, losses, and liabilities according the partnership agreement are also shown in the table. Tinley Cash Securities Total Thomton Cath Land Building Total Fair Value Property Land Building 300.000 200,000 500,000 100,000 100.000 G00,000 900,000 Basis 300,000 100,000 440,000 100,000 80,000 500,000 680,000 Debt Contribute Purchase Valuation 400,000 $100,000 $800,000 Net Fair Value In the middle of the first partnership year, the following property was purchased by the partnership: 500,000 400,000 Basis Profit % 56% 44% $100,000 $800,000 Assume the contributed building is depreciated straight line over 20 remaining years for both book and tax purposes. To finance the purchase of the new property, the partnership sold the securities contributed by Tinley for a net sales price of $220,000. The partnership added $180,000 of partnership cash for a total down payment of $400,000. The remaining $500,000 was financed by a recourse mortgage. Depreciation Expense: Assume the partial year depreciation expense for the newly purchased building is $13,000 for both book and tax purposes. Other Financial Information: For the first partnership year, the partnership had the following other financial information: Cash Rental Revenues Cash rental Expenses Interest expense 309,600 100,000 30,000 According to the partnership agreement, Thornton, as the managing partner, will receive a $30,000 guaranteed payment for services for the year (this expense should be allocated among partners according to the profit ratios shown above). Also assume that the partnership pays off $30,000 of principle on the outstanding loans during the partnership year. There are no profit cash distributions to partners during the year although the partnership does pay the guaranteed payment to Thornton. REQUIRED: Set up the initial partnership balance sheet

Step by Step Solution

★★★★★

3.25 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries for TT Rentals Partnership for the First Fiscal Year Journal Entry 1 Recording of Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started