Question

Assume todays date is 1 January 2034. The Board of Directors has asked you to evaluate an opportunity to export robots to a potential new

Assume today’s date is 1 January 2034. The Board of Directors has asked you to evaluate an opportunity to export robots to a potential new overseas retail customer, ‘Big Store Inc.’. ‘Big Store Inc.’ would like to run a trial promotion of your robots. The company would like to buy 100 robots from your company in 2034 at a special net sales price of W$2,500 per robot. If the 2034 trial is successful, the company has indicated it is likely to double the order quantity and would be prepared to match the net price you charge to your home customers in 2035.

Further information is provided below:

1. Special Equipment The robots for this contract with ‘Big Store Inc.’ will require some modifications from the standard robot which your company produces and this will involve additional annual fixed production overheads of W$25,000 to cover the cost of hiring the special equipment required for this purpose.

2. Raw Materials: Standard Components The robots manufactured for this order contract will require the same standard raw material components used in your business’ regular production process.

3. Raw Materials: Special Components The robots required for this contract will also require some ‘special component’ materials. The company has a stock of 150 units of these ‘special components’ in inventory which were purchased some years ago but which have been regarded as surplus to requirements and have been fully ‘written off’ in the accounts. These ‘special components’ originally cost W$500 per unit and they currently cost W$600 per unit to purchase. If not used for this project, the inventory of ‘special components’ will be sold in 2034 for sales proceeds of W$400 per unit. One ‘special component’ will be required per robot. 4 4. Staff Training Also, an extra W$12,000 as a ‘one-off cost’ for staff training will be required to ensure that production staff are able to use the special equipment required for this contract. 5. Use of Factory Space The project will require the use of some of the company’s factory space which is currently surplus to requirements and would otherwise be sub-let, which would bring in income of W$16,000 in 2034. 6. Sales Staff Time One of your company’s sales staff estimates she spent 20% of her working hours in 2033 on this project which included travelling for meetings with ‘Big Store Inc.’ executives. 7. Marketing Costs ‘Big Store Inc.’ will run a special advertising campaign in 2034 to support this trial which will cost W$80,000 but requires your company to pay for 50% of these costs. 8. Fixed Cost Recovery Rate For costing special projects such as this, your company has in the past applied a rate of 10% of net revenues arising when evaluating new orders in order to recover the business’ recurring fixed costs (including admin expenses, overheads and direct labour costs). 5 Required: Prepare a report for the Board of Directors in which you advise on whether or not the above order should be accepted. You should specifically address the following requirements:

a) Explain the principles of relevant cost analysis, including the concept of ‘opportunity costs’.

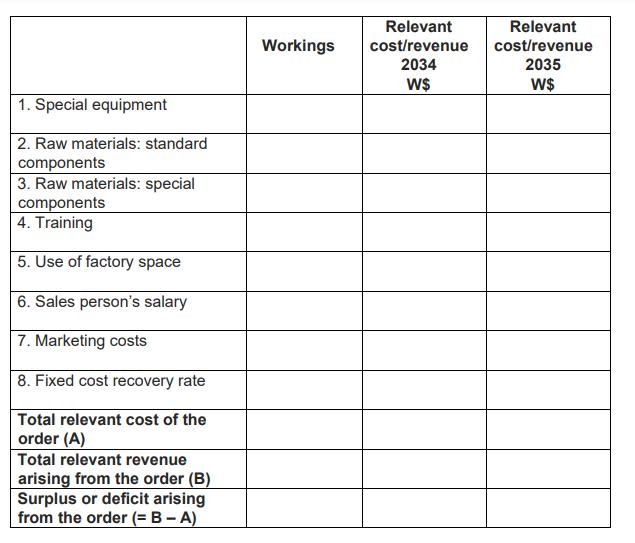

b) Calculate the annual total relevant cost and revenues of this order in both 2034 and thereafter using the table below:

c) Explain the reasoning for your treatment of each item (1 – 8) referred to in the information above as either ‘relevant’ or ‘irrelevant’ in your analysis as appropriate. Make clear any assumptions made.

d) Discuss two further considerations beyond the relevant cost analysis you have performed which you believe should be taken into account before a final decision is made.

e) Advise management on whether the order should be accepted.

Relevant Relevant Workings cost/revenue cost/revenue 2034 2035 W$ 1. Special equipment 2. Raw materials: standard components 3. Raw materials: special components 4. Training 5. Use of factory space 6. Sales person's salary 7. Marketing costs 8. Fixed cost recovery rate Total relevant cost of the order (A) Total relevant revenue arising from the order (B) Surplus or deficit arising from the order (= B- A)

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Q1 To The board of Directors XYZ Company Greeting from the XYZ Company Finance is the backbone of any organisation To have a complete knowledge about the growth prfotablity of the organisation we are ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started