Question

Assume todays settlement price on a CME GBP futures contract is $1.4948/. You have a short position in one contract (with the standardized contract size

Assume todays settlement price on a CME GBP futures contract is $1.4948/. You have a short position in one contract (with the standardized contract size of 62,500). Your initial performance bond account currently has a balance of $4,000 and the maintenance level is $2,500. The next three days settlement prices are $1.4908, $1.5088, and $1.5208.

Fill out the following table by calculating the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day.

| Day | Settlement price ($/) | Daily Gain/Loss ($) | Account balance ($) |

| 0 | 1.4948 | -- | $4,000 |

| 1 | 1.4908 |

|

|

| 2 | 1.5088 |

|

|

| 3 | 1.5208 |

|

|

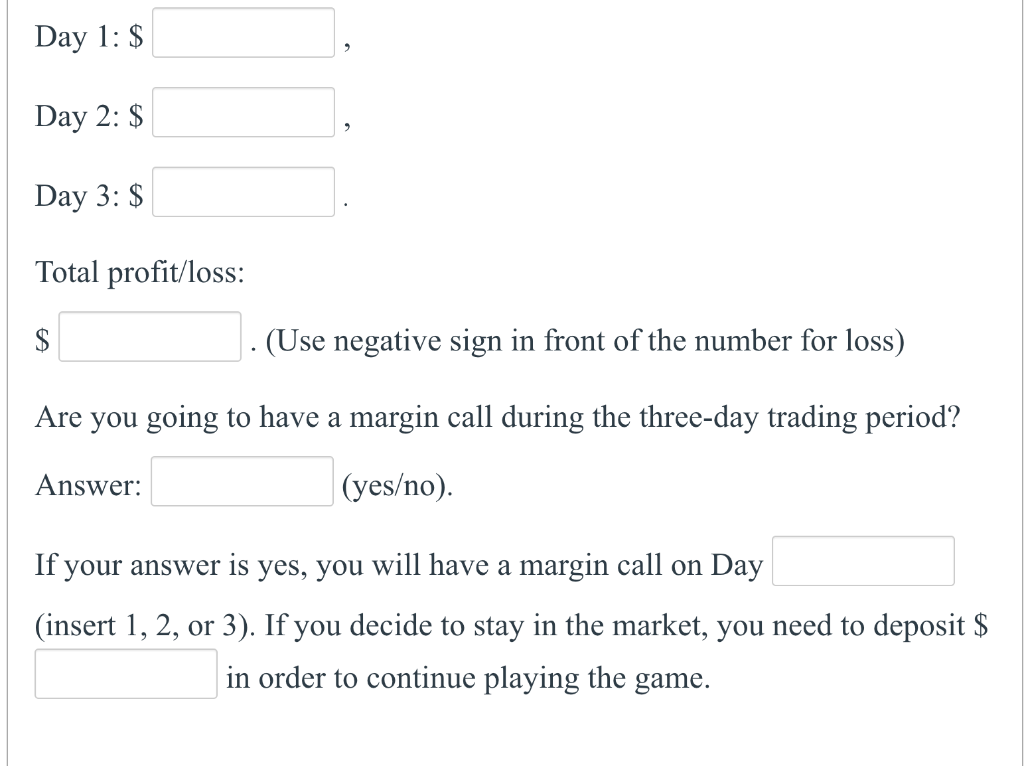

Daily account balance (please fill out ONLY the account balance, not daily profit/loss):

Day 1: $ Day 2:$ Day 3: \$ Total profit/loss: $ (Use negative sign in front of the number for loss) Are you going to have a margin call during the three-day trading period? Answer: (yeso). If your answer is yes, you will have a margin call on Day (insert 1,2, or 3). If you decide to stay in the market, you need to deposit in order to continue playing the game. Day 1: $ Day 2:$ Day 3: \$ Total profit/loss: $ (Use negative sign in front of the number for loss) Are you going to have a margin call during the three-day trading period? Answer: (yeso). If your answer is yes, you will have a margin call on Day (insert 1,2, or 3). If you decide to stay in the market, you need to deposit in order to continue playing the game

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started