Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume two competitors, American International Group (AIG), Inc., and Axa, SA., are locked in a bitter pricing struggle in the reinsurance business. In the

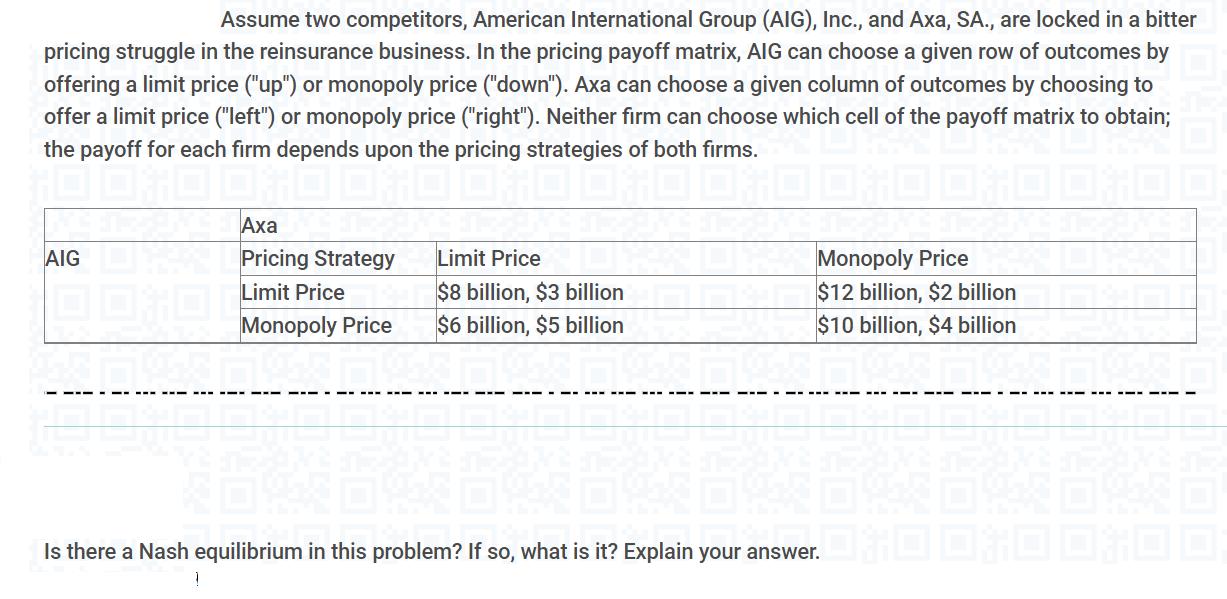

Assume two competitors, American International Group (AIG), Inc., and Axa, SA., are locked in a bitter pricing struggle in the reinsurance business. In the pricing payoff matrix, AIG can choose a given row of outcomes by offering a limit price ("up") or monopoly price ("down"). Axa can choose a given column of outcomes by choosing to offer a limit price ("left") or monopoly price ("right"). Neither firm can choose which cell of the payoff matrix to obtain; the payoff for each firm depends upon the pricing strategies of both firms. KNO AIG Axa Pricing Strategy Limit Price Monopoly Price Limit Price $8 billion, $3 billion $6 billion, $5 billion Monopoly Price $12 billion, $2 billion $10 billion, $4 billion 635 wer. D D D; Is there a Nash equilibrium in this problem? If so, what is it? Explain your answer.

Step by Step Solution

★★★★★

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Yes there is a Nash equilibrium in this problem A Nash equilibrium occurs when neither firm has an i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started