Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume we're at the end of this year planning next year's financial statements. Calculate the following using indirect planning assumptions as indicated. ( To keep

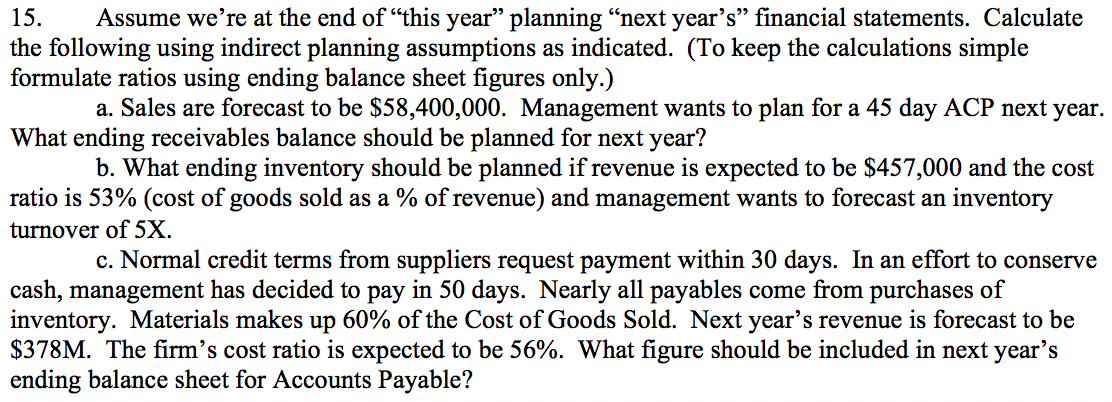

Assume we're at the end of "this year" planning "next year's" financial statements. Calculate

the following using indirect planning assumptions as indicated. To keep the calculations simple

formulate ratios using ending balance sheet figures only.

a Sales are forecast to be $ Management wants to plan for a day ACP next year.

What ending receivables balance should be planned for next year?

b What ending inventory should be planned if revenue is expected to be $ and the cost

ratio is cost of goods sold as a of revenue and management wants to forecast an inventory

turnover of

c Normal credit terms from suppliers request payment within days. In an effort to conserve

cash, management has decided to pay in days. Nearly all payables come from purchases of

inventory. Materials makes up of the Cost of Goods Sold. Next year's revenue is forecast to be

$ The firm's cost ratio is expected to be What figure should be included in next year's

ending balance sheet for Accounts Payable?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started