Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you and your employer each contribute HKD 5 0 0 to your Mandatory Provident Fund ( MPF ) at the end of every month

Assume you and your employer each contribute HKD to your Mandatory Provident Fund

MPF at the end of every month HKD in total Suppose the beginning account balance

is zero, and the return is compounded monthly. Write a Python program to calculate the

present value of the MPF

Let the user set a target monthly rate of return and the number of months.

Round the answer to the nearest dollar.

The output should resemble the following.

Enter a target MONTHLY rate of return without the sign:

Enter the number of months:

The total MPF of $ in months is worth $ today.

Follow the same submission requirement py file and screenshot as before.

Hint: You may apply the formula below or use loops.

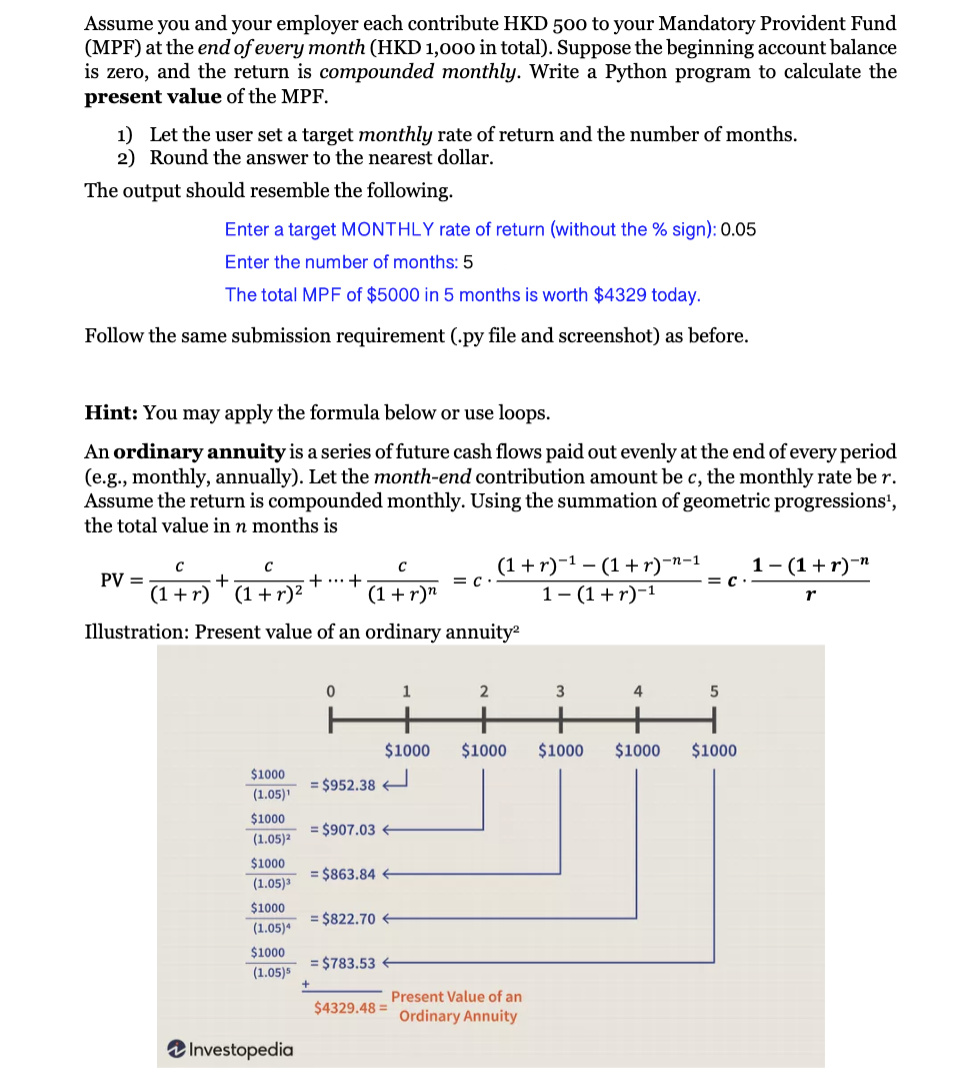

An ordinary annuity is a series of future cash flows paid out evenly at the end of every period

eg monthly, annually Let the monthend contribution amount be the monthly rate be

Assume the return is compounded monthly. Using the summation of geometric progressions

the total value in months is

cdots

Illustration: Present value of an ordinary annuity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started