Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you are a loan officer for a bank and Frank Farmer requests a loan based on her balance sheet shown below. I would

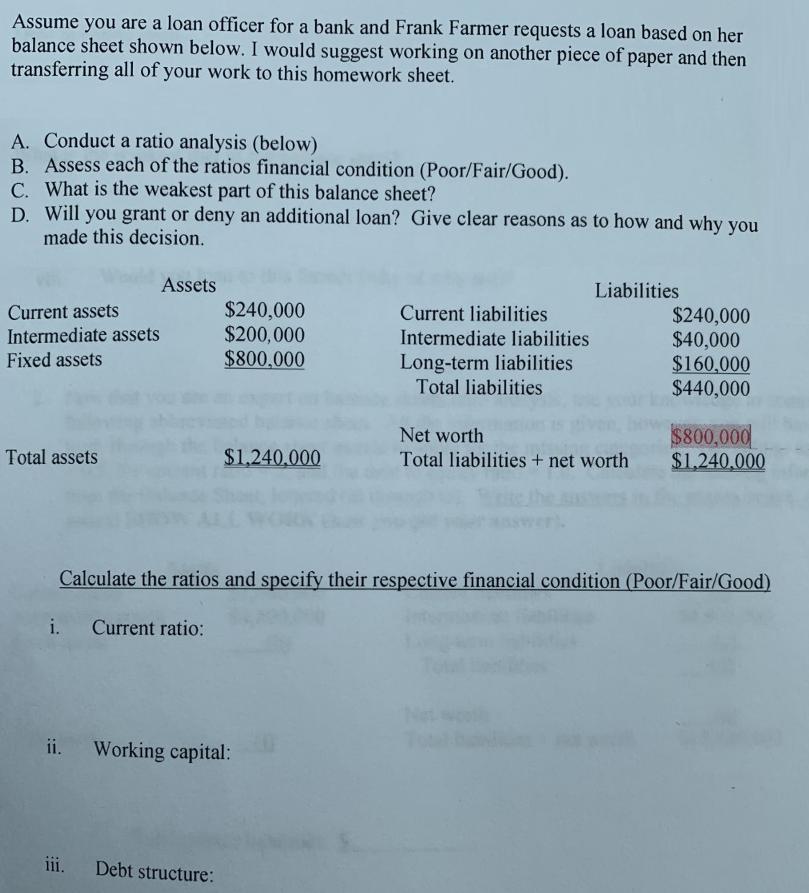

Assume you are a loan officer for a bank and Frank Farmer requests a loan based on her balance sheet shown below. I would suggest working on another piece of paper and then transferring all of your work to this homework sheet. A. Conduct a ratio analysis (below) B. Assess each of the ratios financial condition (Poor/Fair/Good). C. What is the weakest part of this balance sheet? D. Will you grant or deny an additional loan? Give clear reasons as to how and why you made this decision. Assets Liabilities Current assets Intermediate assets $240,000 $200,000 $800,000 Current liabilities $240,000 $40,000 $160,000 $440,000 Intermediate liabilities Fixed assets Long-term liabilities Total liabilities Net worth Total liabilities + net worth $800,000 $1.240.000 Total assets $1,240.000 wer. Calculate the ratios and specify their respective financial condition (Poor/Fair/Good) i. Current ratio: ii. Working capital: iii. Debt structure:

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Current Ratio Current AssetsCurrent Liabilities 2400002400001 Wor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started