Answered step by step

Verified Expert Solution

Question

1 Approved Answer

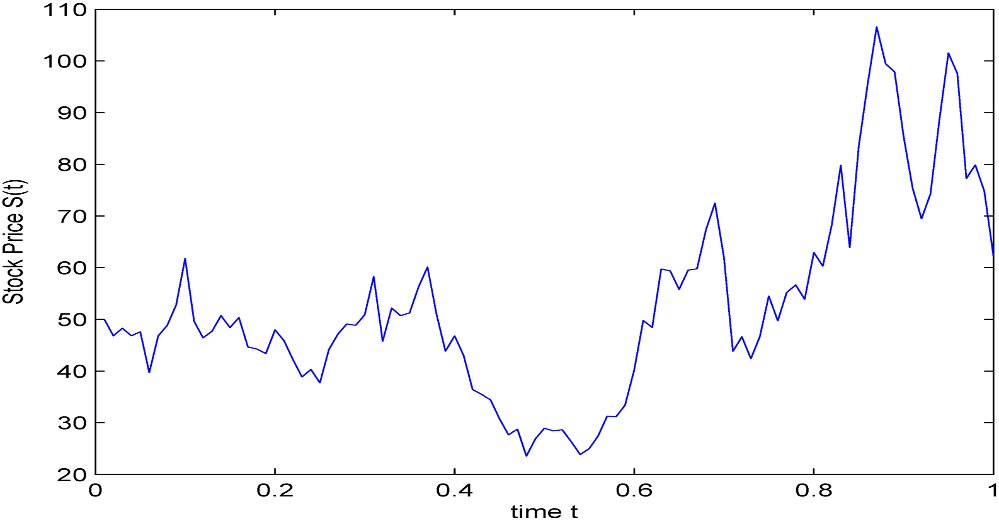

Assume you are at an investment firm and your CIO asks you to choose the stock shown below to invest clients funds. CLEARLY describe your

Assume you are at an investment firm and your CIO asks you to choose the stock shown below to invest clients funds. CLEARLY describe your investment strategy as to how you would invest $1M at t=0.2 with no future knowledge of the stock price shown in the following chart. Final pay off will take place at t=1.

a.Preserve the principal only

b.Produce mild gains (10% - 20%)

c.Speculate the future (market direction) with the goal to make 2X.

Assume call/put strike: 5% of stock price per share

For each question, define your purchase/sell criteria

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started