Answered step by step

Verified Expert Solution

Question

1 Approved Answer

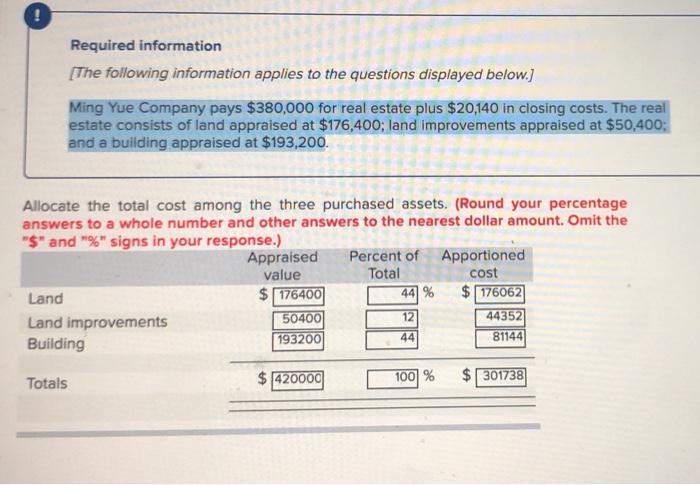

CoursHeroTranscribedText ! Required information [The following information applies to the questions displayed below.] Ming Yue Company pays $380,000 for real estate plus $20,140 in closing

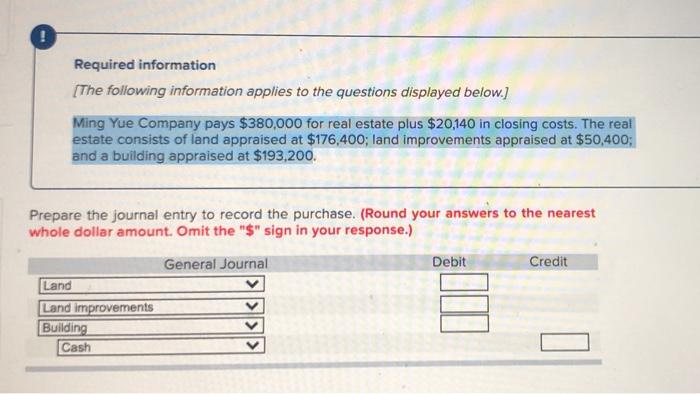

! Required information [The following information applies to the questions displayed below.] Ming Yue Company pays $380,000 for real estate plus $20,140 in closing costs. The real estate consists of land appraised at $176,400; land improvements appraised at $50,400; and a building appraised at $193,200. Allocate the total cost among the three purchased assets. (Round your percentage answers to a whole number and other answers to the nearest dollar amount. Omit the "$" and "%" signs in your response.) Appraised value Percent of Apportioned Land Land improvements Building Totals Total cost $176400 44% $176062 50400 12 44352 193200 44 81144 $420000 100% $301738

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution To allocate the total cost among the three purchased assets we need to compute the apportio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started