Question

Assume you are considering a portfolio containing two assets, L and M. asset L will represent 41% of the dollar value of the portfolio, and

Assume you are considering a portfolio containing two assets, L and M. asset L will represent 41% of the dollar value of the portfolio, and asset M will account for the other 59%. the projected returns over the next 6 years, 2018-2023, for each of these assets are summarized in the table.

a. calculate the projected portfolio return for each of the 6 years

b. calculate the average expected portfolio return over the 6 year period

c. calculate the standard deviation of expected portfolio returns over the 6 year period

d. how would you characterize the correlation of returns of the 2 assets L and M?

e. discuss any benefits of diversification achieved through creation of the portfolio

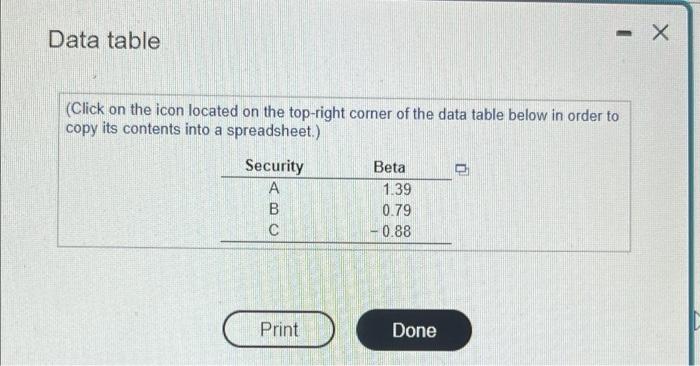

Assume the betas for secures A, B and Care as shown here a. Calculate the change in return for each security if the market experiences an increase in its rate of return of 13.5% over the next period b. Caindate the change in reten for each security if the market experiences a decrease in its rate of rehm of 10 3% over the next p c. Rank and dons the relative risk of each security on the basis of your findings Which security might perform best during an economic deben? Explai -CID a. Calculate the change in return for each security it the market experiences an increase in its rate of return of 13.5% over the ned period Security A's change in return will be (Round to two decimal places) Data table - X (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Security Beta ABC Print 1.39 0.79 -0.88 Done 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started