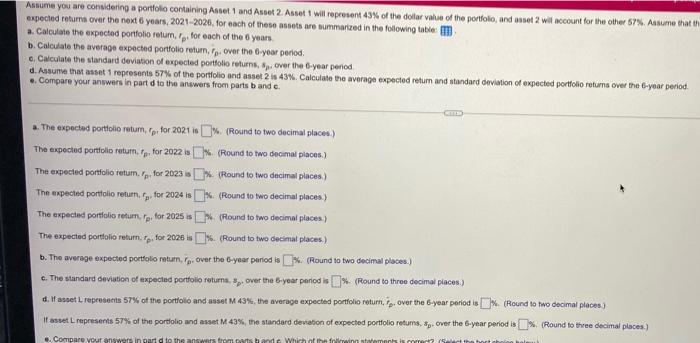

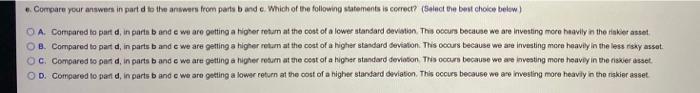

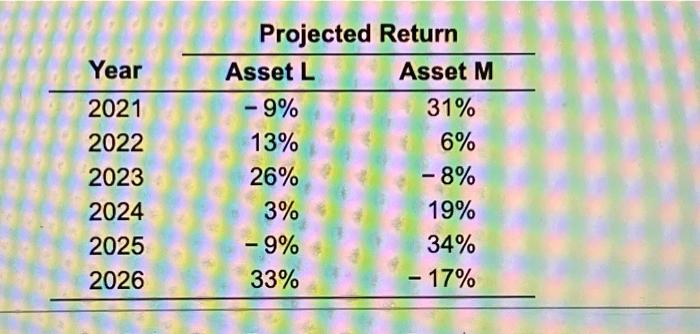

Assume you are considering as portfolio containing Antet 1 and Auset 2. Aseet 1 will represent 43% of the solar value of the portfolio, and asset 2 wil account for the other 57%. Assume that th expected retume over the next 6 years 2021-2026, for each of these assets are summarized in the following tobie a. Calculate the expected portfolio rotum. for each of the years b. Calculate the average expected portfolio retum, fp, over the year period e Calculate the standard deviation of expected portfolio returns over the 6-year period d. Assume that asset 1 represents 57% of the portfolio and asset 2 is 43%. Calculate the average expected return and standard deviation of expected portfolio returns over the 6-year period .. Compare your answers in part d to the answers from parts bande CH is a. The expected portfolio rotum, fo. for 2021 8 %. (Round to two decimal places) The expected portfolio return, Te, for 2022 % (Round to two decimal places.) The expected portfolio ratum. Fr. for 2023 aC Round to two decimal places) The expected portfolio return, fp, for 2024 * 6. (Round to two decimal places) The expected portfolio return to for 2025 is (Round to two decimal places) The expected portfolio return, Tp. for 2026 is % (Round to two decimal places.) b. The average expected portfolio return, is over the year period is % (Round to two decimal places) 6. The standard deviation of expected portfolio returna. over the year period is I (Round to three decimal places) d. I asset represents 57% of the portfolio and asset M 43%, the average expected portfolio return, Fe, over the 5-year period is % (Round to two decimal places) It asset represents 57% of the portfolio and asset M 43%, the standard deviation of expected portfolio retums, #p, over the 6-year period is % (Round to three decimal places.) .. Compare your answers in part d to the answers from parts and which in stepsistert Compare your answers in part d to the answers from parts and e. Which of the following statements is correct? (Select the best choice below) O A. Compared to part d, in parts and e we are getting a higher return at the cost of a lower standard deviation. The occurs because we are investing more heavily in the risk asset O B. Compared to part d, in parts b and we are getting a higher return at the cost of a higher standard deviation. This occurs because we are investing more heavily in the less risky asset OC. Compared to pan d, in parts b and we are getting a higher return at the cost of a higher standard deviation This occurs because we are investing more heavey in the risker asset. OD. Compared to part d, in parts and e we are getting a lower return at the cost of a higher standard deviation. This cours because we are investing more heavily in the riskier asset Year Projected Return Asset L Asset M -9% 31% 13% 6% 26% -8% 3% 19% -9% 34% 33% - 17% 2021 2022 2023 2024 2025 2026