Question

Assume you are helping your wealthy friend decide if a shopping mall would be a good investment. In order to build this facility, your friend

Assume you are helping your wealthy friend decide if a shopping mall would be a good investment.

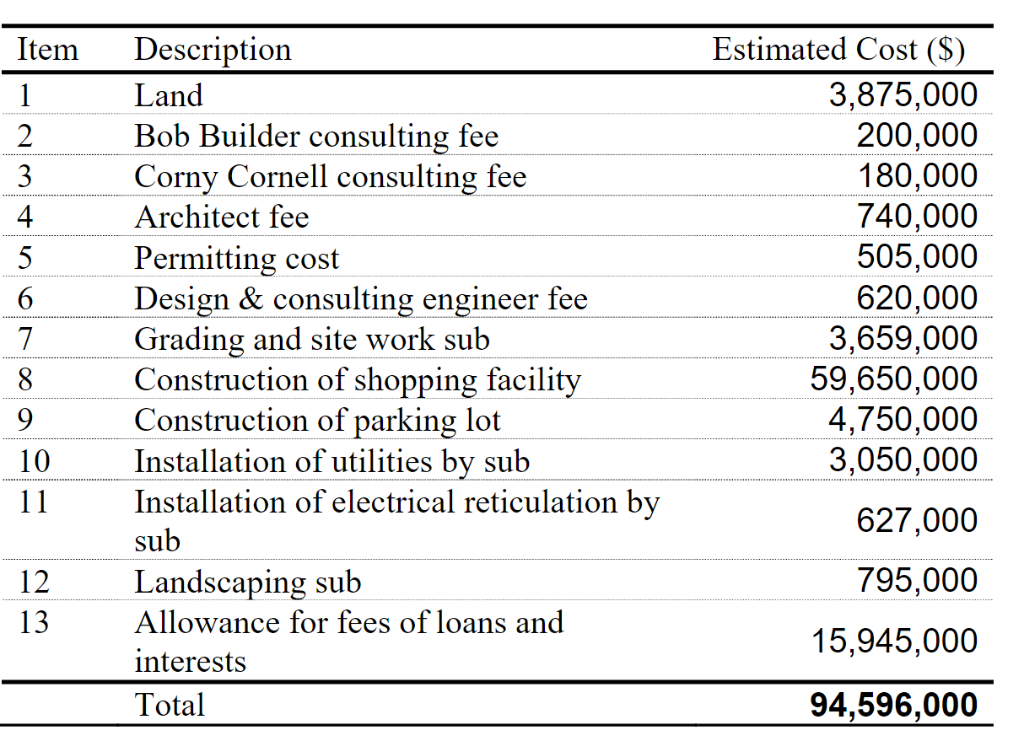

In order to build this facility, your friend requires a loan of $82,096,000 after using up their $12.5 million inheritance. Interest on the loan is estimated to be 9%, compounded annually, over a period of 20 years. Your friend estimates the 400,000 square foot mall will generate $35.65 per square foot. Maintenance and operating costs will be 4% of the total project cost, given in the table below. Assume the facility will begin to operate in year 2, and the equity is used in year 1.

Determine the:

1) Gross annual revenue

2) Annual maintenance costs

3) Net annual revenue

4) Estimated annual debt service

5) Estimated annual profit

6) Net present value, if the discount rate is 12.75%

7) Internal rate of return for the investment

Please show all of your work. I will give a thumbs up for a complete, correct solution. Thanks.

Item Description Land Bob Builder consulting fee Corny Cornell consulting fee Architect fee Permitting cost Design & consulting engineer fee Grading and site work sub Construction of shopping facility Construction of parking lot Installation of utilities bv sub Installation of electrical reticulation by sub Landscaping sub Allowance for fees of loans and nterests Total Estimated Cost (S) 3,875,000 200,000 180,000 740,000 505,000 620,000 3,659,000 59,650,000 4,750,000 3,050,000 4 6 627,000 795,000 12 13 15,945,000 94,596,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started