Question

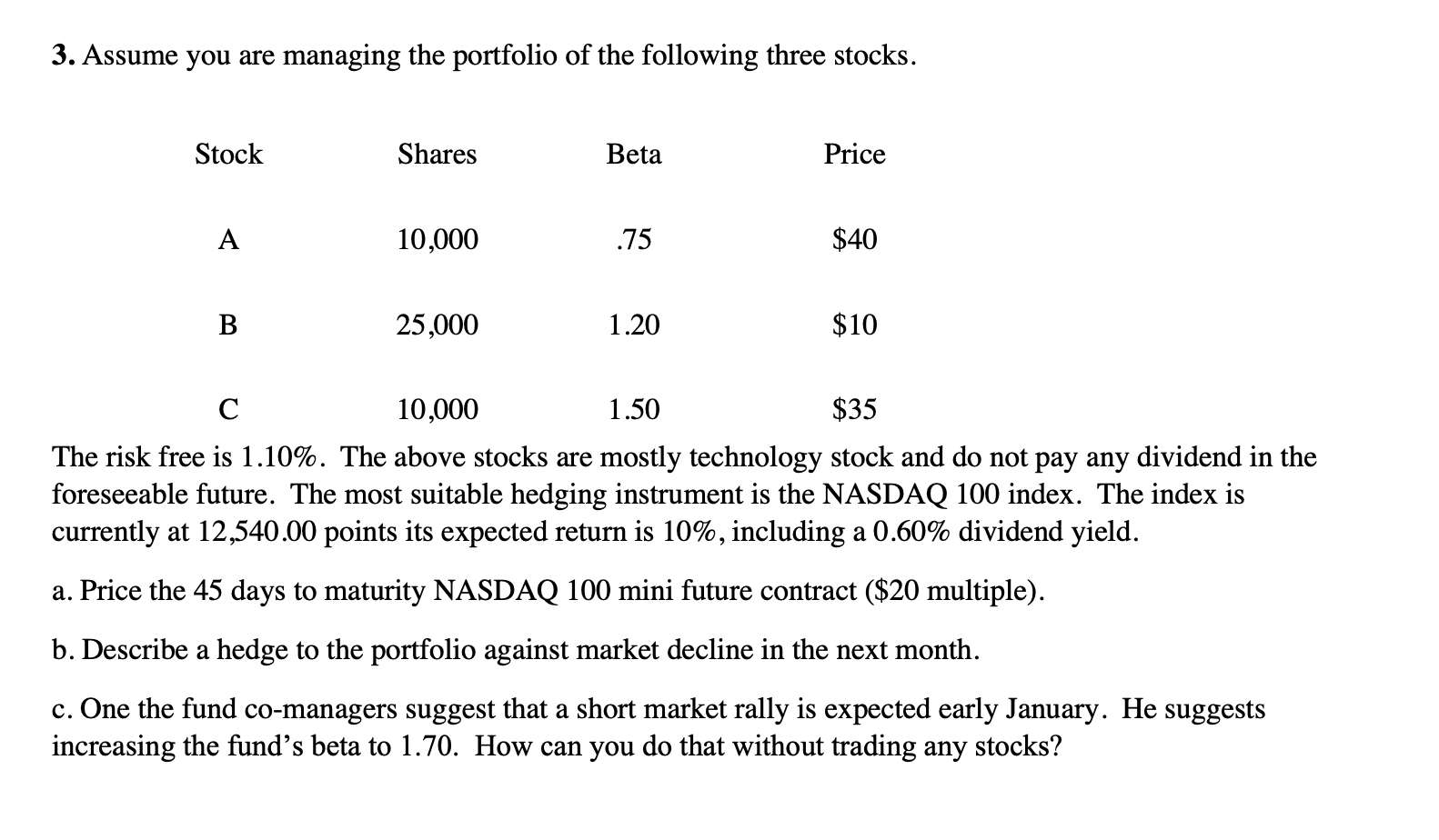

Assume you are managing the portfolio of the following three stocks. Stock Shares Beta Price A 10,000 .75 $40 B 25,000 1.20 $10 C 10,000

Assume you are managing the portfolio of the following three stocks. Stock Shares Beta Price A 10,000 .75 $40 B 25,000 1.20 $10 C 10,000 1.50 $35 The risk free is 1.10%. The above stocks are mostly technology stock and do not pay any dividend in the foreseeable future. The most suitable hedging instrument is the NASDAQ 100 index. The index is currently at 12,540.00 points its expected return is 10%, including a 0.60% dividend yield.

a. Price the 45 days to maturity NASDAQ 100 mini future contract ($20 multiple).

b. Describe a hedge to the portfolio against market decline in the next month.

c. One the fund co-managers suggest that a short market rally is expected early January. He suggests increasing the funds beta to 1.70. How can you do that without trading any stocks?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started