Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you are the treasurer of a multinational company based in UK and has just obtained the following quotation: spot rate of for GBP

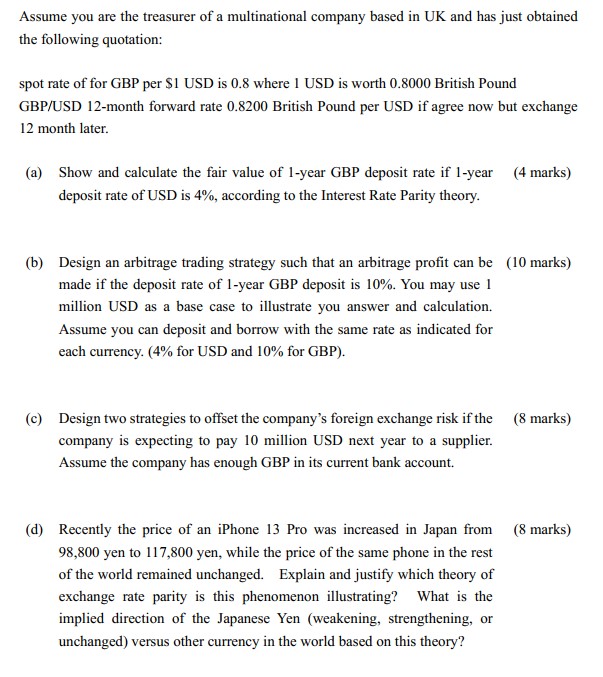

Assume you are the treasurer of a multinational company based in UK and has just obtained the following quotation: spot rate of for GBP per $1 USD is 0.8 where 1 USD is worth 0.8000 British Pound GBP/USD 12-month forward rate 0.8200 British Pound per USD if agree now but exchange 12 month later. (a) Show and calculate the fair value of 1-year GBP deposit rate if 1-year (4 marks) deposit rate of USD is 4%, according to the Interest Rate Parity theory. (b) Design an arbitrage trading strategy such that an arbitrage profit can be (10 marks) made if the deposit rate of 1-year GBP deposit is 10%. You may use 1 million USD as a base case to illustrate you answer and calculation. Assume you can deposit and borrow with the same rate as indicated for each currency. (4% for USD and 10% for GBP). (c) Design two strategies to offset the company's foreign exchange risk if the (8 marks) company is expecting to pay 10 million USD next year to a supplier. Assume the company has enough GBP in its current bank account. (d) Recently the price of an iPhone 13 Pro was increased in Japan from (8 marks) 98,800 yen to 117,800 yen, while the price of the same phone in the rest of the world remained unchanged. Explain and justify which theory of exchange rate parity is this phenomenon illustrating? What is the implied direction of the Japanese Yen (weakening, strengthening, or unchanged) versus other currency in the world based on this theory?

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a According to the Interest Rate Parity theory the forward exchange rate should be determined based on the interest rate differential between two currencies In this case we have the following informat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started