Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you are the treasurer of a multinational company based in Switzerland and has just obtained the following quotation: USD/CHF spot rate 0.9150 USD/CHF

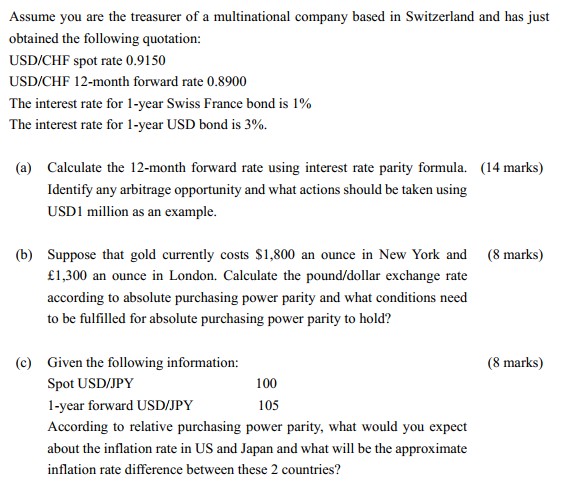

Assume you are the treasurer of a multinational company based in Switzerland and has just obtained the following quotation: USD/CHF spot rate 0.9150 USD/CHF 12-month forward rate 0.8900 The interest rate for 1-year Swiss France bond is 1% The interest rate for 1-year USD bond is 3%. (a) Calculate the 12-month forward rate using interest rate parity formula. (14 marks) Identify any arbitrage opportunity and what actions should be taken using USD1 million as an example. (b) Suppose that gold currently costs $1,800 an ounce in New York and (8 marks) 1,300 an ounce in London. Calculate the pound/dollar exchange rate according to absolute purchasing power parity and what conditions need to be fulfilled for absolute purchasing power parity to hold? (c) Given the following information: Spot USD/JPY 100 1-year forward USD/JPY 105 According to relative purchasing power parity, what would you expect about the inflation rate in US and Japan and what will be the approximate inflation rate difference between these 2 countries? (8 marks)

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Using interest rate parity formula Forward rate Spot rate x 1domestic interest rate 1foreign inter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started