Answered step by step

Verified Expert Solution

Question

1 Approved Answer

V Pharma is a medical firm focusing on producing vaccines for epidemic diseases. Its major shareholders include the United Nations (UN), World Health Organization

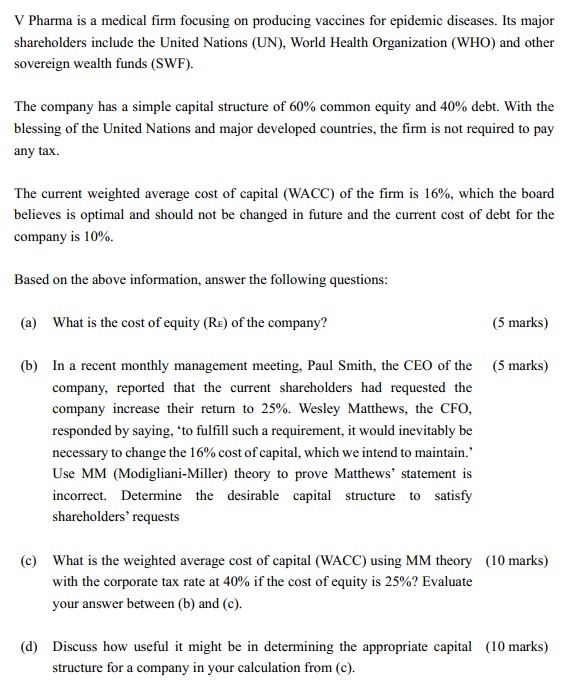

V Pharma is a medical firm focusing on producing vaccines for epidemic diseases. Its major shareholders include the United Nations (UN), World Health Organization (WHO) and other sovereign wealth funds (SWF). The company has a simple capital structure of 60% common equity and 40% debt. With the blessing of the United Nations and major developed countries, the firm is not required to pay any tax. The current weighted average cost of capital (WACC) of the firm is 16%, which the board believes is optimal and should not be changed in future and the current cost of debt for the company is 10%. Based on the above information, answer the following questions: (a) What is the cost of equity (RE) of the company? (b) In a recent monthly management meeting, Paul Smith, the CEO of the (5 marks) company, reported that the current shareholders had requested the company increase their return to 25%. Wesley Matthews, the CFO, responded by saying, 'to fulfill such a requirement, it would inevitably be necessary to change the 16% cost of capital, which we intend to maintain.' Use MM (Modigliani-Miller) theory to prove Matthews' statement is incorrect. Determine the desirable capital structure to satisfy shareholders' requests (5 marks) (c) What is the weighted average cost of capital (WACC) using MM theory (10 marks) with the corporate tax rate at 40% if the cost of equity is 25%? Evaluate your answer between (b) and (c). (d) Discuss how useful it might be in determining the appropriate capital (10 marks) structure for a company in your calculation from (c).

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the cost of equity RE of the company we can use the Capital Asset Pricing Model CAPM formula RE RF RM RF Where RE Cost of equity RF Ris...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started