Answered step by step

Verified Expert Solution

Question

1 Approved Answer

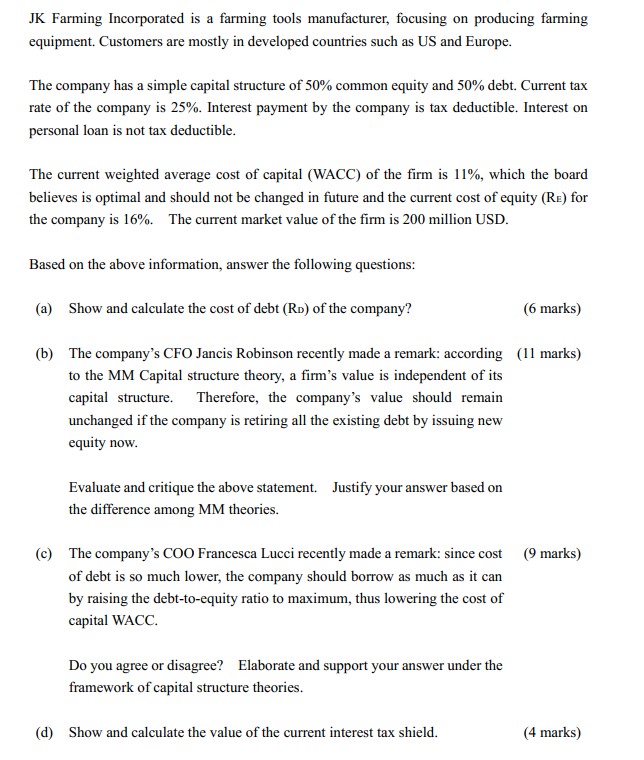

JK Farming Incorporated is a farming tools manufacturer, focusing on producing farming equipment. Customers are mostly in developed countries such as US and Europe.

JK Farming Incorporated is a farming tools manufacturer, focusing on producing farming equipment. Customers are mostly in developed countries such as US and Europe. The company has a simple capital structure of 50% common equity and 50% debt. Current tax rate of the company is 25%. Interest payment by the company is tax deductible. Interest on personal loan is not tax deductible. The current weighted average cost of capital (WACC) of the firm is 11%, which the board believes is optimal and should not be changed in future and the current cost of equity (RE) for the company is 16%. The current market value of the firm is 200 million USD. Based on the above information, answer the following questions: (a) Show and calculate the cost of debt (RD) of the company? (b) The company's CFO Jancis Robinson recently made a remark: according (11 marks) to the MM Capital structure theory, a firm's value is independent of its capital structure. Therefore, the company's value should remain unchanged if the company is retiring all the existing debt by issuing new equity now. Evaluate and critique the above statement. Justify your answer based on the difference among MM theories. (c) The company's COO Francesca Lucci recently made a remark: since cost (9 marks) of debt is so much lower, the company should borrow as much as it can by raising the debt-to-equity ratio to maximum, thus lowering the cost of capital WACC. Do you agree or disagree? Elaborate and support your answer under the framework of capital structure theories. (6 marks) (d) Show and calculate the value of the current interest tax shield. (4 marks)

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the cost of debt Ro we need to use the formula Ro Rd Ra Rd Debt Equity where Rd is the riskfree rate Ra is the cost of equity Debt is t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started