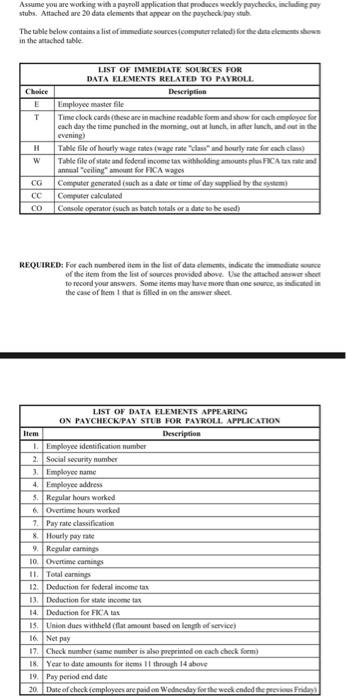

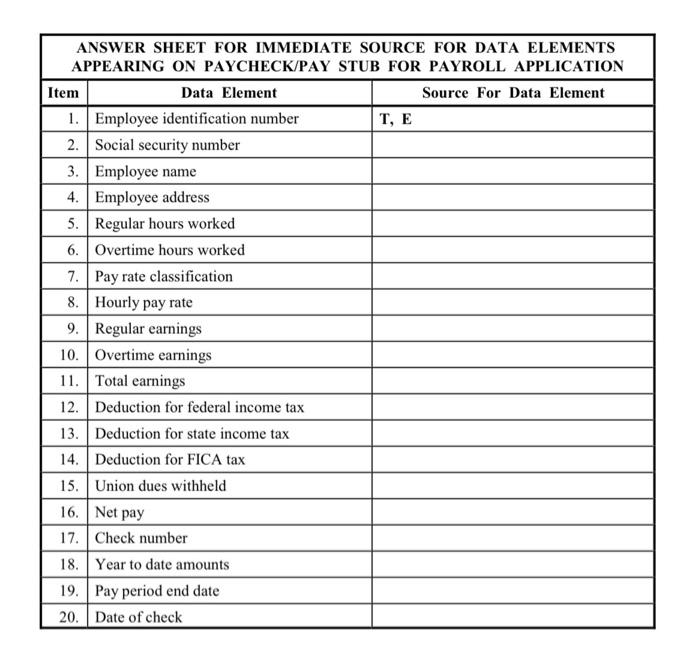

Assume you are working with a payroll application that produces weekly paycheck, including stubs. Attached are 20 data clements that appear on the paycheck pay stub The table below contains a list of immediate sources (computer related for the data de shows in the attached table Choice E T LIST OF IMMEDIATE SOURCES FOR DATA ELEMENTS RELATED TO PAYROLL Description Employee master file Time clock cards (these are in machine readable from and show for each player for each day the time punched in the morning out at lunch in atter lunch and out in the evening) Table file of hourly wage rates (wage rates and hourly rate for each class Table file of state and federal income tax withholding amounts plus FICA annual ceiling amount for FICA wages Computer generated (such as a dateer time of day supplied by the system) Computer calculated Console operator (such as batch totals or a date to be used H w CG CC CO REQUIRED: For cach numbered item in the list of data clements, andicate the immediate source of the item from the list of sources provided above. Use the attached her to record your answers. Some items may have more than one se, indicated in the case of lem that is filled in the answer sheet LIST OF DATA ELEMENTS APPEARING ON PAYCHECK/PAY STUB FOR PAYROLL APPLICATION Item Description 1. Employee identification number 2. Social security number 3. Employee name 4. Employee address 3. Regular hours worked 6 Overtime hou worked 7. Pay rate classification 8 Hourly nye 9. Regular camning 10. Overtime camins 11. Totalcarnis 12. Deduction for fodenal income 13 Deduction for state income 14. Deduction for FICA tax 15.Union dues withheldused on length of service) 16 Net pay 17. Check besame number is also preprinted on cach check foem) 18. Year to date amounts for its through 14 above 19. Pay period and date 20. Dute of check (employees are paid on Wednesday for the week ended the pers Friday ANSWER SHEET FOR IMMEDIATE SOURCE FOR DATA ELEMENTS APPEARING ON PAYCHECK/PAY STUB FOR PAYROLL APPLICATION Item Data Element Source For Data Element 1. Employee identification number T, E 2. Social security number 3. Employee name 4. Employee address 5. Regular hours worked 6. Overtime hours worked 7. Pay rate classification 8. Hourly pay rate 9. Regular earnings 10. Overtime earnings 11. Total earnings 12. Deduction for federal income tax 13. Deduction for state income tax 14. Deduction for FICA tax 15. Union dues withheld 16. Net pay 17. Check number 18. Year to date amounts 19. Pay period end date 20. Date of check