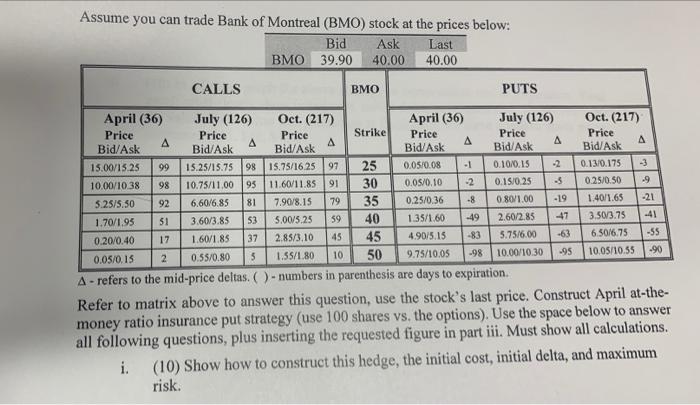

Assume you can trade Bank of Montreal (BMO) stock at the prices below: Bid Ask Last BMO 39.90 40.00 40.00 CALLS PUTS BMO April (36) July (126) Oct. (217) April (36) July (126) Oct. (217) Price Price Price Strike Price Price Price A Bid/Ask Bid/Ask Bid/Ask Bid/ Ask Bid/Ask Bid/Ask 15.00/15.25 99 15.25/15.75 98 15.75/16.25 97 25 0.05/0.08 - 1 0.10/0.15 0.13/0.175 -3 10.00/10.38 98 10.75/11.00 95 11.60/11.85 91 30 0.05/0,10 -2 0.15/0.25 -3 0.25/0.50 .9 5.25/5.50 92 6.60/6.85 81 7.90/8.15 79 35 0.25/0.36 -8 0.80/1.00 -19 1.40/1.65 -21 1.70/1.95 51 3.60/3.85 53 5.00/5.25 59 40 1.35/1.60 -49 2.60/2.85 -47 3.50/3.75 0.20/0.40 17 1.60/1.85 37 2.85/3.10 45 45 4.90/5.15 -83 5.75/6.00 -63 6.50/6.75 -55 0.05/0.15 2 0.55/0.80 5 1.55/1.80 10 50 9.75/10.05 .98 10.00/10.30 .95 10.05/10.55 -90 A - refers to the mid-price deltas.-numbers in parenthesis are days to expiration. Refer to matrix above to answer this question, use the stock's last price. Construct April at-the- money ratio insurance put strategy (use 100 shares vs. the options). Use the space below to answer all following questions, plus inserting the requested figure in part iii. Must show all calculations. i. (10) Show how to construct this hedge, the initial cost, initial delta, and maximum risk. - ii. (10) Your calculations must clearly show all steps; in calculating breakeven point(s), the value of the deltas and profit/loss at Expiration for three possible stock price outcomes ($35, $40, $45). iii. (10) In a figure, graph the above strategy at construction and at Expiration. Your graph must clearly show initial cost, initial delta, maximum risk, breakeven point(s), the value of the deltas and profit/loss at Expiration for three possible stock price outcomes ($35, $40, $45). Assume you can trade Bank of Montreal (BMO) stock at the prices below: Bid Ask Last BMO 39.90 40.00 40.00 CALLS PUTS BMO April (36) July (126) Oct. (217) April (36) July (126) Oct. (217) Price Price Price Strike Price Price Price A Bid/Ask Bid/Ask Bid/Ask Bid/ Ask Bid/Ask Bid/Ask 15.00/15.25 99 15.25/15.75 98 15.75/16.25 97 25 0.05/0.08 - 1 0.10/0.15 0.13/0.175 -3 10.00/10.38 98 10.75/11.00 95 11.60/11.85 91 30 0.05/0,10 -2 0.15/0.25 -3 0.25/0.50 .9 5.25/5.50 92 6.60/6.85 81 7.90/8.15 79 35 0.25/0.36 -8 0.80/1.00 -19 1.40/1.65 -21 1.70/1.95 51 3.60/3.85 53 5.00/5.25 59 40 1.35/1.60 -49 2.60/2.85 -47 3.50/3.75 0.20/0.40 17 1.60/1.85 37 2.85/3.10 45 45 4.90/5.15 -83 5.75/6.00 -63 6.50/6.75 -55 0.05/0.15 2 0.55/0.80 5 1.55/1.80 10 50 9.75/10.05 .98 10.00/10.30 .95 10.05/10.55 -90 A - refers to the mid-price deltas.-numbers in parenthesis are days to expiration. Refer to matrix above to answer this question, use the stock's last price. Construct April at-the- money ratio insurance put strategy (use 100 shares vs. the options). Use the space below to answer all following questions, plus inserting the requested figure in part iii. Must show all calculations. i. (10) Show how to construct this hedge, the initial cost, initial delta, and maximum risk. - ii. (10) Your calculations must clearly show all steps; in calculating breakeven point(s), the value of the deltas and profit/loss at Expiration for three possible stock price outcomes ($35, $40, $45). iii. (10) In a figure, graph the above strategy at construction and at Expiration. Your graph must clearly show initial cost, initial delta, maximum risk, breakeven point(s), the value of the deltas and profit/loss at Expiration for three possible stock price outcomes ($35, $40, $45)