Assume you earn $50,000 annually and your employer offers (a) a flexible spending account to which you can contribute a maximum of $2,000 this year and (b) a 401(k) retirement account to which you may contribute up to $3,000. Your 401(k) contribution will be matched 50 percent by your employer. Assuming you can only afford to contribute a total of $3,000 to both these benefits, explain what you would do with your $3,000.Make a table similar to Table 1-2 (on page 25) to support your thinking.

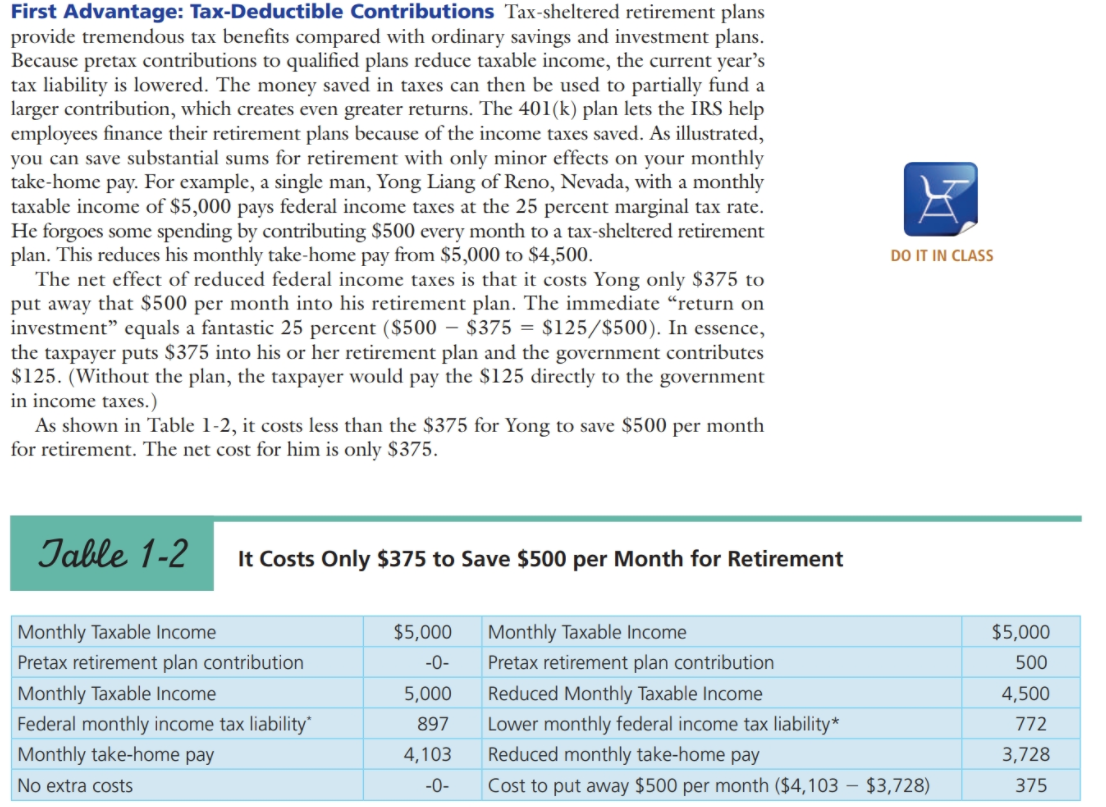

First Advantage: Tax-Deductible Contributions Tax-sheltered retirement plans provide tremendous tax benefits compared with ordinary savings and investment plans. Because pretax contributions to qualified plans reduce taxable income, the current year's tax liability is lowered. The money saved in taxes can then be used to partially fund a larger contribution, which creates even greater returns. The 401(k) plan lets the IRS help employees finance their retirement plans because of the income taxes saved. As illustrated, you can save substantial sums for retirement with only minor effects on your monthly take-home pay. For example, a single man, Yong Liang of Reno, Nevada, with a monthly taxable income of $5,000 pays federal income taxes at the 25 percent marginal tax rate. He forgoes some spending by contributing $500 every month to a tax-sheltered retirement plan. This reduces his monthly take-home pay from $5,000 to $4,500. The net effect of reduced federal income taxes is that it costs Yong only $375 to put away that $500 per month into his retirement plan. The immediate "return on investment equals a fantastic 25 percent ($500 $375 = $125/$500). In essence, the taxpayer puts $375 into his or her retirement plan and the government contributes $125. (Without the plan, the taxpayer would pay the $125 directly to the government in income taxes.) As shown in Table 1-2, it costs less than the $375 for Yong to save $500 per month for retirement. The net cost for him is only $375. DO IT IN CLASS Table 1-2 It Costs Only $375 to Save $500 per Month for Retirement Monthly Taxable income Pretax retirement plan contribution Monthly Taxable income Federal monthly income tax liability Monthly take-home pay No extra costs $5,000 -0- 5,000 897 4,103 Monthly Taxable income Pretax retirement plan contribution Reduced Monthly Taxable Income Lower monthly federal income tax liability* Reduced monthly take-home pay Cost to put away $500 per month ($4,103 $3,728) $5,000 500 4,500 772 3,728 375 -0- First Advantage: Tax-Deductible Contributions Tax-sheltered retirement plans provide tremendous tax benefits compared with ordinary savings and investment plans. Because pretax contributions to qualified plans reduce taxable income, the current year's tax liability is lowered. The money saved in taxes can then be used to partially fund a larger contribution, which creates even greater returns. The 401(k) plan lets the IRS help employees finance their retirement plans because of the income taxes saved. As illustrated, you can save substantial sums for retirement with only minor effects on your monthly take-home pay. For example, a single man, Yong Liang of Reno, Nevada, with a monthly taxable income of $5,000 pays federal income taxes at the 25 percent marginal tax rate. He forgoes some spending by contributing $500 every month to a tax-sheltered retirement plan. This reduces his monthly take-home pay from $5,000 to $4,500. The net effect of reduced federal income taxes is that it costs Yong only $375 to put away that $500 per month into his retirement plan. The immediate "return on investment equals a fantastic 25 percent ($500 $375 = $125/$500). In essence, the taxpayer puts $375 into his or her retirement plan and the government contributes $125. (Without the plan, the taxpayer would pay the $125 directly to the government in income taxes.) As shown in Table 1-2, it costs less than the $375 for Yong to save $500 per month for retirement. The net cost for him is only $375. DO IT IN CLASS Table 1-2 It Costs Only $375 to Save $500 per Month for Retirement Monthly Taxable income Pretax retirement plan contribution Monthly Taxable income Federal monthly income tax liability Monthly take-home pay No extra costs $5,000 -0- 5,000 897 4,103 Monthly Taxable income Pretax retirement plan contribution Reduced Monthly Taxable Income Lower monthly federal income tax liability* Reduced monthly take-home pay Cost to put away $500 per month ($4,103 $3,728) $5,000 500 4,500 772 3,728 375 -0