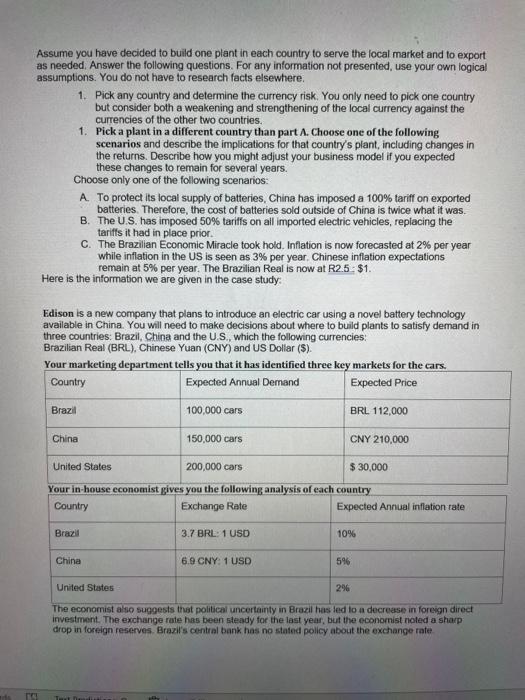

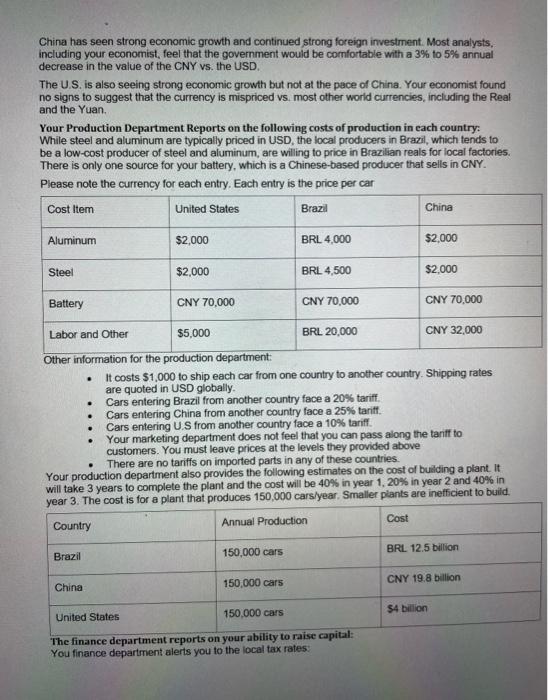

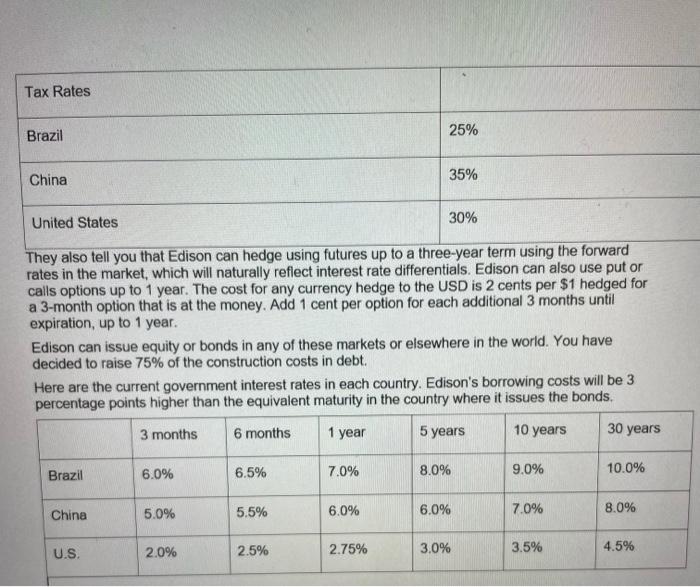

Assume you have decided to build one plant in each country to serve the local market and to export as needed. Answer the following questions. For any information not presented, use your own logical assumptions. You do not have to research facts elsewhere. 1. Pick any country and determine the currency risk. You only need to pick one country but consider both a weakening and strengthening of the local currency against the currencies of the other two countries. 1. Pick a plant in a different country than part A. Choose one of the following scenarios and describe the implications for that country's plant, including changes in the returns. Describe how you might adjust your business model if you expected these changes to remain for several years. Choose only one of the following scenarios: A. To protect its local supply of batteries, China has imposed a 100% tariff on exported batteries. Therefore, the cost of batteries sold outside of China is twice what it was. B. The U.S. has imposed 50% tariffs on all imported electric vehicles, replacing the tariffs it had in place prior. C. The Brazilian Economic Miracle took hold. Inflation is now forecasted at 2% per year while inflation in the US is seen as 3% per year. Chinese inflation expectations remain at 5% per year. The Brazilian Real is now at R2.5 $1. Here is the information we are given in the case study Edison is a new company that plans to introduce an electric car using a novel battery technology available in China. You will need to make decisions about where to build plants to satisfy demand in three countries: Brazil, China and the U.S., which the following currencies: Brazilian Real (BRL), Chinese Yuan (CNY) and US Dollar ($) Your marketing department tells you that it has identified three key markets for the cars. . Country Expected Annual Demand Expected Price Brazil 100,000 cars BRL 112,000 China 150,000 cars CNY 210,000 United States 200,000 cars $ 30,000 Your in-house economist gives you the following analysis of each country Country Exchange Rate Expected Annual inflation rate Brazil 3.7 BRL: 1 USD 10% China 6.9 CNY: 1 USD 596 United States 2% The economist also suggests that political uncertainty in Brazil has led to a decrease in foreign direct investment. The exchange rate has been steady for the last year, but the economist noled a sharp drop in foreign reserves. Brazil's central bank has no stated policy about the exchange rate ra China has seen strong economic growth and continued strong foreign investment. Most analysts, including your economist, feel that the government would be comfortable with a 3% to 5% annual decrease in the value of the CNY vs. the USD. The U.S. is also seeing strong economic growth but not at the pace of China. Your economist found no signs to suggest that the currency is mispriced vs. most other world currencies, including the Real and the Yuan Your Production Department Reports on the following costs of production in each country: While steel and aluminum are typically priced in USD, the local producers in Brazil, which tends to be a low-cost producer of steel and aluminum, are willing to price in Brazilian reals for local factories. There is only one source for your battery, which is a Chinese-based producer that sells in CNY Please note the currency for each entry. Each entry is the price per car Cost Item United States Brazil China Aluminum $2,000 BRL 4,000 $2,000 Steel $2,000 BRL 4,500 $2,000 Battery CNY 70,000 CNY 70,000 CNY 70,000 . . . Labor and Other $5,000 BRL 20,000 CNY 32,000 Other information for the production department: It costs $1,000 to ship each car from one country to another country. Shipping rates are quoted in USD globally. Cars entering Brazil from another country face a 20% tariff Cars entering China from another country face a 25% tariff Cars entering U.S from another country face a 10% tariff Your marketing department does not feel that you can pass along the tanff to customers. You must leave prices at the levels they provided above There are no tariffs on imported parts in any of these countries. Your production department also provides the following estimates on the cost of building a plant. It will take 3 years to complete the plant and the cost will be 40% in year 1.20% in year 2 and 40% in year 3. The cost is for a plant that produces 150,000 cars/year. Smaller plants are inefficient to build. Country Annual Production Cost . Brazil 150,000 cars BRL 12.5 billion China 150.000 cars CNY 19.8 billion 150,000 cars United States $4 billion The finance department reports on your ability to raise capital: You finance department alerts you to the local tax rates Tax Rates Brazil 25% China 35% United States 30% They also tell you that Edison can hedge using futures up to a three-year term using the forward rates in the market, which will naturally reflect interest rate differentials. Edison can also use put or calls options up to 1 year. The cost for any currency hedge to the USD is 2 cents per $1 hedged for a 3-month option that is at the money. Add 1 cent per option for each additional 3 months until expiration, up to 1 year. Edison can issue equity or bonds in any of these markets or elsewhere in the world. You have decided to raise 75% of the construction costs in debt. Here are the current government interest rates in each country. Edison's borrowing costs will be 3 percentage points higher than the equivalent maturity in the country where it issues the bonds. 3 months 6 months 1 year 5 years 10 years 30 years Brazil 6.0% 6.5% 7.0% 8.0% 9.0% 10.0% 5.0% 5.5% China 6.0% 6.0% 7.0% 8.0% 2.0% U.S. 2.5% 2.75% 3.0% 3.5% 4.5%