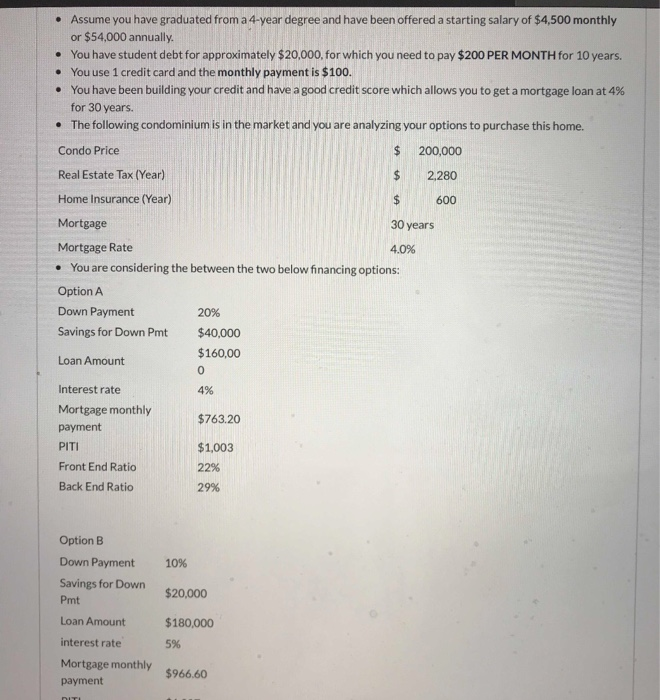

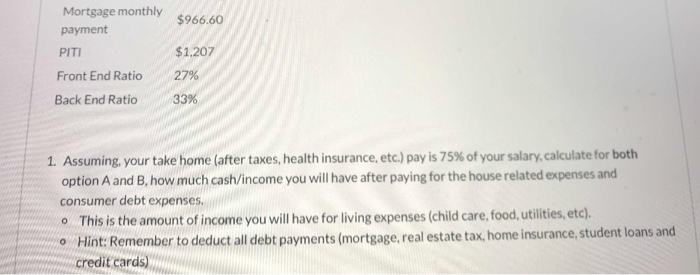

Assume you have graduated from a 4-year degree and have been offered a starting salary of $4,500 monthly or $54,000 annually You have student debt for approximately $20,000, for which you need to pay $200 PER MONTH for 10 years. You use 1 credit card and the monthly payment is $100. You have been building your credit and have a good credit score which allows you to get a mortgage loan at 4% for 30 years. e . e . The following condominium is in the market and you are analyzing your options to purchase this home. . Condo Price $ 200,000 2280 Real Estate Tax (Year) Home Insurance (Year) $600 Mortgage 30 years Mortgage Rate 4.0% You are considering the between the two below financing options: . Option A Down Payment 20% Savings for Down Pmt $40,000 $160,00 Loan Amount 0 Interest rate 4% Mortgage monthly $763.20 payment PITI $1,003 Front End Ratio 22% Back End Ratio 29% Option B Down Payment 10% Savings for Down $20,000 Pmt Loan Amount $180,000 interest rate 5% Mortgage monthly $966.60 payment Mortgage monthly $966.60 payment $1.207 PITI Front End Ratio 27% 33% Back End Ratio 1. Assuming, your take home (after taxes, health insurance, etc.) pay is 75% of your salary, calculate for both option A and B, how much cash/income you will have after paying for the house related expenses and consumer debt expenses o This is the amount of income you will have for living expenses (child care. food, utilities, etc). o Hint: Remember to deduct all debt payments (mortgage, real estate ta credit cards) x, home insurance, student loans and Assume you have graduated from a 4-year degree and have been offered a starting salary of $4,500 monthly or $54,000 annually You have student debt for approximately $20,000, for which you need to pay $200 PER MONTH for 10 years. You use 1 credit card and the monthly payment is $100. You have been building your credit and have a good credit score which allows you to get a mortgage loan at 4% for 30 years. e . e . The following condominium is in the market and you are analyzing your options to purchase this home. . Condo Price $ 200,000 2280 Real Estate Tax (Year) Home Insurance (Year) $600 Mortgage 30 years Mortgage Rate 4.0% You are considering the between the two below financing options: . Option A Down Payment 20% Savings for Down Pmt $40,000 $160,00 Loan Amount 0 Interest rate 4% Mortgage monthly $763.20 payment PITI $1,003 Front End Ratio 22% Back End Ratio 29% Option B Down Payment 10% Savings for Down $20,000 Pmt Loan Amount $180,000 interest rate 5% Mortgage monthly $966.60 payment Mortgage monthly $966.60 payment $1.207 PITI Front End Ratio 27% 33% Back End Ratio 1. Assuming, your take home (after taxes, health insurance, etc.) pay is 75% of your salary, calculate for both option A and B, how much cash/income you will have after paying for the house related expenses and consumer debt expenses o This is the amount of income you will have for living expenses (child care. food, utilities, etc). o Hint: Remember to deduct all debt payments (mortgage, real estate ta credit cards) x, home insurance, student loans and