Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you have received a settlement in the amount of J$1,000,000.00. You now have the option of investing in stocks with the short-term goal

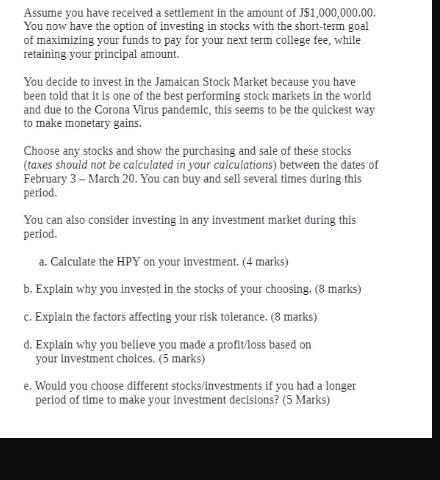

Assume you have received a settlement in the amount of J$1,000,000.00. You now have the option of investing in stocks with the short-term goal of maximizing your funds to pay for your next term college fee, while retaining your principal amount. You decide to invest in the Jamaican Stock Market because you have been told that it is one of the best performing stock markets in the world and due to the Corona Virus pandemic, this seems to be the quickest way to make monetary gains. Choose any stocks and show the purchasing and sale of these stocks (taxes should not be calculated in your calculations) between the dates of February 3 - March 20. You can buy and sell several times during this period. You can also consider investing in any investment market during this period. a. Calculate the HPY on your investment. (4 marks) b. Explain why you invested in the stocks of your choosing. (8 marks) c. Explain the factors affecting your risk tolerance. (8 marks) d. Explain why you believe you made a profit/loss based on your investment choices. (5 marks) e. Would you choose different stocks/investments if you had a longer period of time to make your investment decisions? (5 Marks)

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Disclaimer This scenario is for educational purposes only and does not constitute financial advice Investing in the stock market carries inherent risk...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started