Question

assume you hold a Nasdaq 100 index fund worth $1,000,000 on the trading session day. You aim to use Equity index future products to hedge

assume you hold a Nasdaq 100 index fund worth $1,000,000 on the trading session day. You aim to use Equity index future products to hedge your price risk. You also have $100,000 USD cash on hand at the beginning of your trading. You must use at minimum 50% of your account balance to hedge your stock price risk. Meanwhile, you are allowed to have up to 50% of your account balance to speculating/arbitraging, and the speculation/arbitrage products are not limited to Equity Index futures (e.g., you can even use Crypto futures to earn short-term profit, but also mind the potential loss)

Summarize your speculation trading (400 words) Provide a summary on how you use future contracts to speculate/arbitrage during your trading period. The content should include but not limited to: Do you think the 50% limits allocated on speculation is too high? And why? Do you feel speculation is risky from your trading exercise? How the speculation performed and explain your profit/loss? How you feel when you experience losses from the speculation?

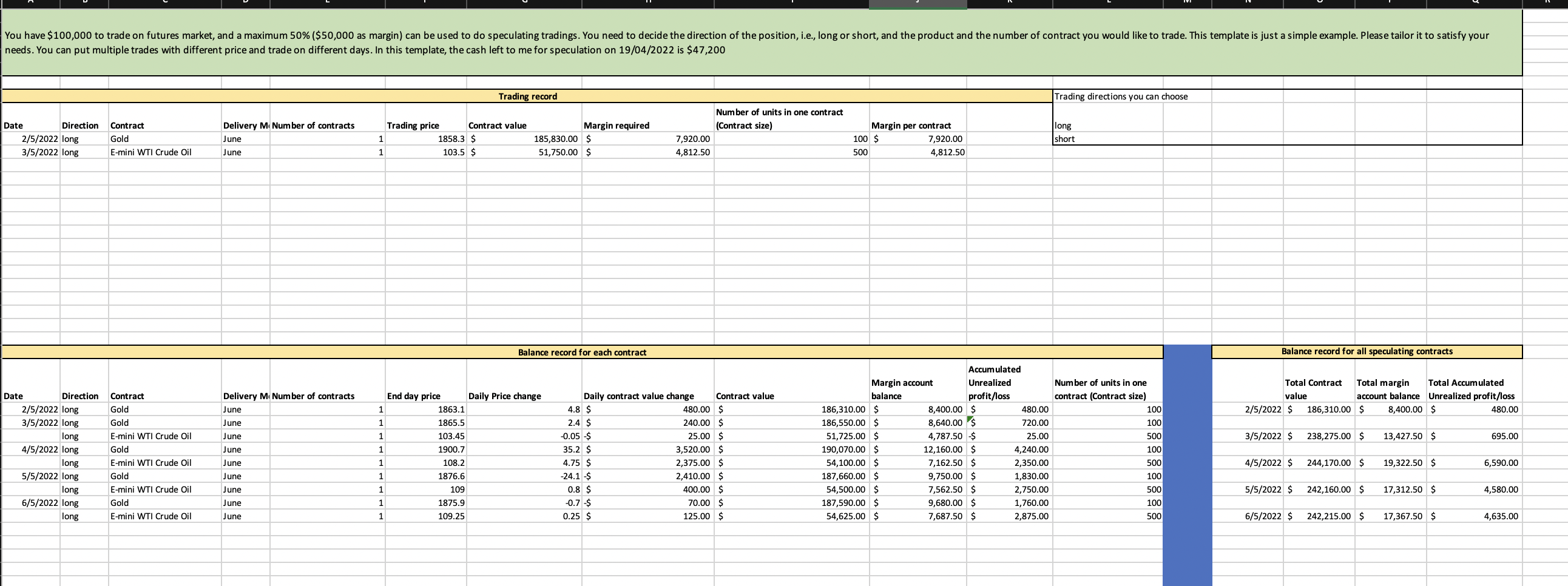

You have $100,000 to trade on futures market, and a maximum 50% ($50,000 as margin) can be used to do speculating tradings. You need to decide the direction of the position, i.e., long or short, and the product and the number of contract you would like to trade. This template is just a simple example. Please tailor it to satisfy your needs. You can put multiple trades with different price and trade on different days. In this template, the cash left to me for speculation on 19/04/2022 is $47,200 Trading record Trading directions you can choose Number of units in one contract (Contract size) Date Direction 2/5/2022 long 3/5/2022 long Contract Gold E-mini WTI Crude Oil Delivery M Number of contracts June Trading price Contract value 1 1858.3 $ 1 103.5 $ Margin required 185,830.00 $ 51,750.00 $ Margin per contract 100 $ 7,920.00 500 4,812.50 long short 7,920.00 4,812.50 June Balance record for each contract Balance record for all speculating contracts Total Contract Total margin Total Accumulated value account balance Unrealized profit/loss 2/5/2022 $ 186,310.00 $ 8,400.00 $ 480.00 Date Direction 2/5/2022 long 3/5/2022 long long 4/5/2022 long 3/5/2022 $ 238,275.00 $ 13,427.50 $ 695.00 Contract Gold Gold E-mini WTI Crude Oil Gold E-mini WTI Crude Oil Gold E-mini WTI Crude Oil Gold E-mini WTI Crude Oil Delivery M Number of contracts June June June June June June June June June End day price Daily Price change 1 1863.1 1 1865.5 1 103.45 1 1900.7 1 108.2 1 1876.6 1 109 1 1875.9 1 109.25 Daily contract value change Contract value 4.8 $ 480.00 $ 2.4 $ 240.00 $ -0.05 $ 25.00 $ 35.2 $ 3,520.00 $ 4.75 $ 2,375.00 $ -24.1 $ 2,410.00 $ 0.8 $ 400.00 $ -0.7 $ 70.00 $ 0.25 $ 125.00 $ Accumulated Margin account Unrealized balance profit/loss 186,310.00 $ 8,400.00 $ 480.00 186,550.00 $ 8,640.00 $ 720.00 51,725.00 $ 4,787.50 $ 25.00 190,070.00 $ 12,160.00 $ 4,240.00 54,100.00 $ 7,162.50 $ 2,350.00 187,660.00 $ 9,750.00 $ 1,830.00 54,500.00 $ 7,562.50 $ 2,750.00 187,590.00 $ 9,680.00 $ 1,760.00 54,625.00 $ 7,687.50 $ 2,875.00 Number of units in one contract (Contract size) 100 100 500 100 500 100 500 100 500 long 4/5/2022 $ 244,170.00 $ 19,322.50 $ 6,590.00 5/5/2022 long long 6/5/2022 long 5/5/2022 $ 242,160.00 $ 17,312.50 $ 4,580.00 long 6/5/2022 $ 242,215.00 $ 17,367.50 $ 4,635.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started