Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you make the following investments: a. You invest a lump sum of $7,250 for three years at 14% interest. What is the investment's value

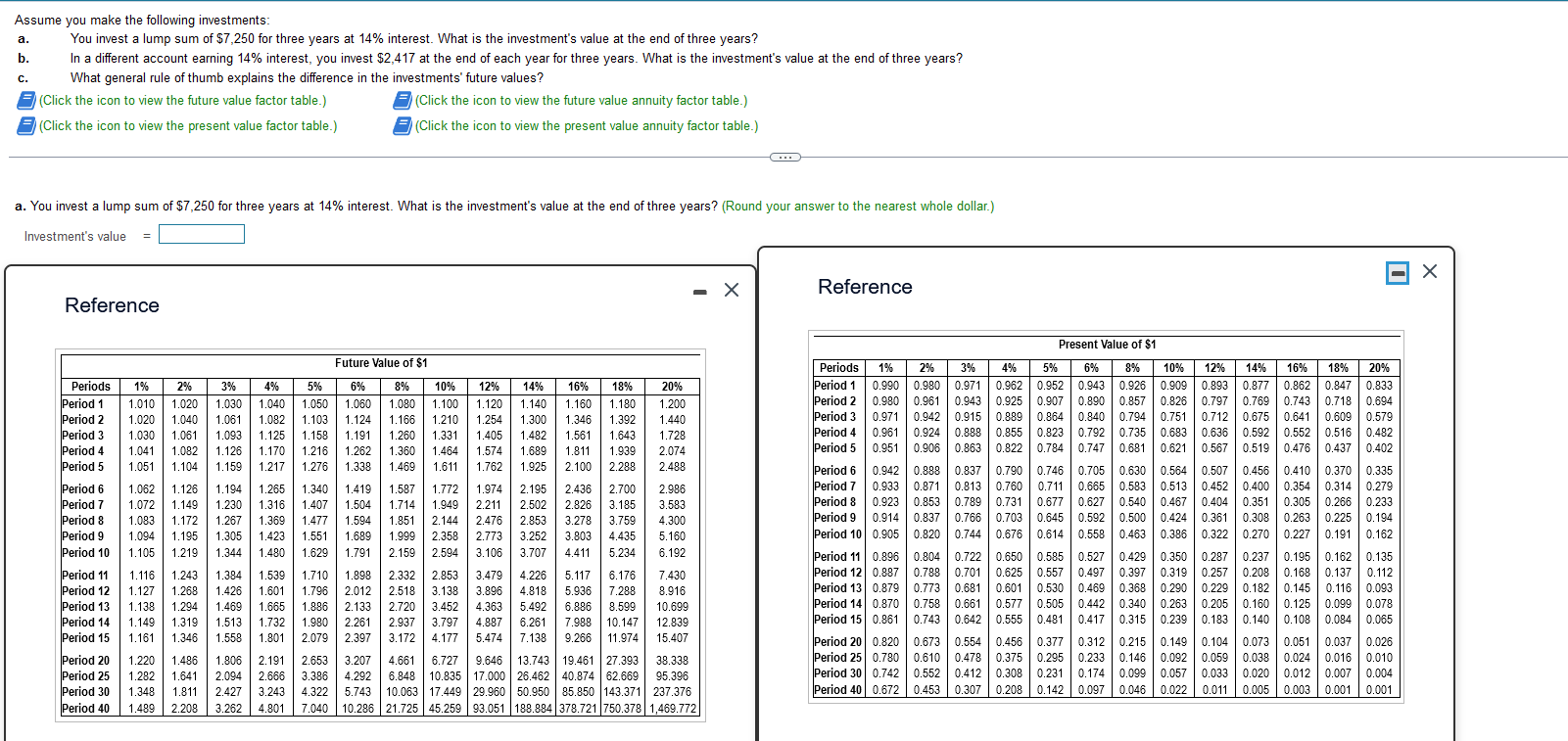

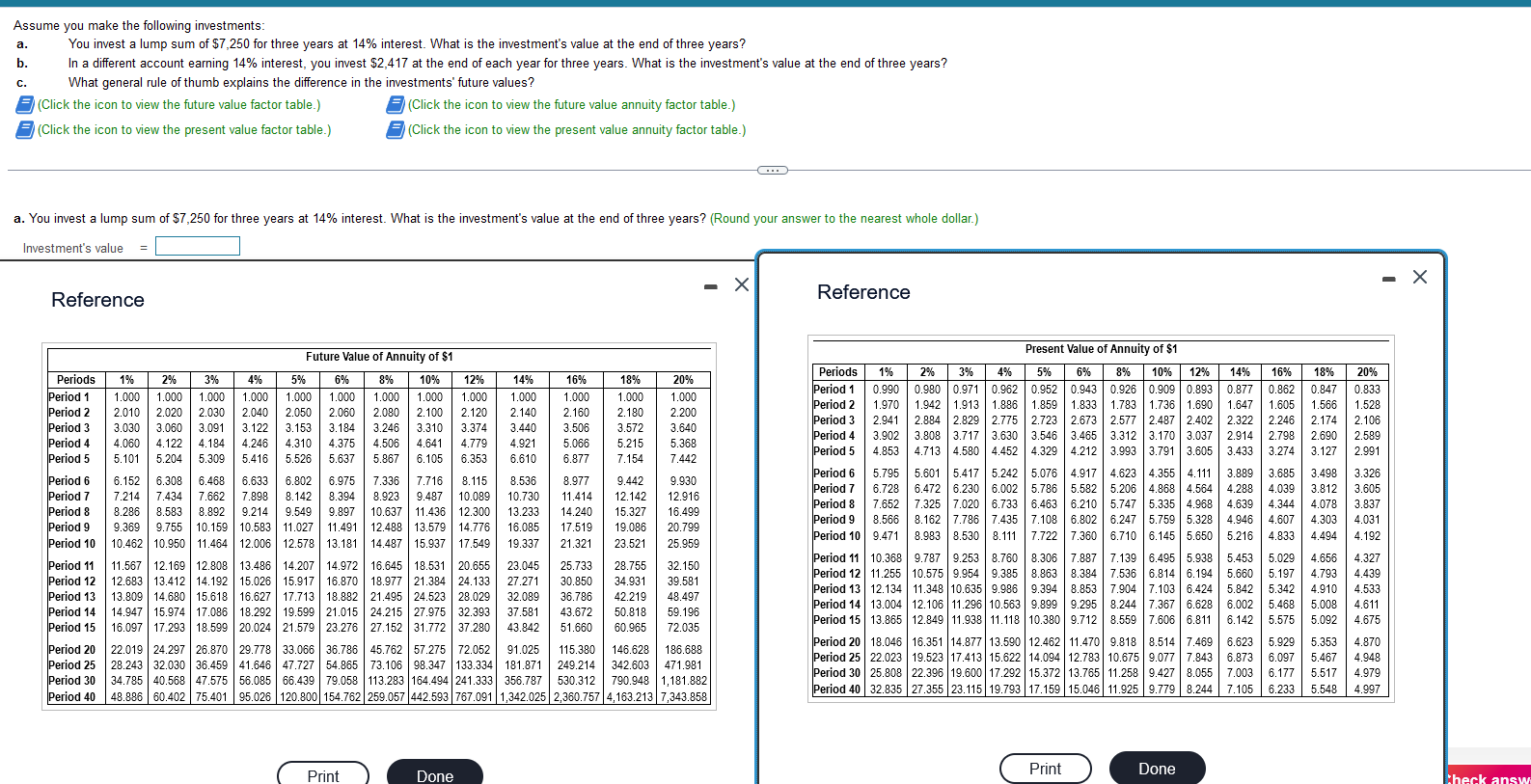

Assume you make the following investments: a. You invest a lump sum of $7,250 for three years at 14% interest. What is the investment's value at the end of three years? b. In a different account earning 14% interest, you invest $2,417 at the end of each year for three years. What is the investment's value at the end of three years? c. What general rule of thumb explains the difference in the investments' future values? (Click the icon to view the future value factor table.) (Click the icon to view the present value factor table.) (Click the icon to view the future value annuity factor table.) (Click the icon to view the present value annuity factor table.) a. You invest a lump sum of $7,250 for three years at 14% interest. What is the investment's value at the end of three years? (Round your answer to the nearest whole dollar.) Investment's value = Reference Assume you make the following investments: a. You invest a lump sum of $7,250 for three years at 14% interest. What is the investment's value at the end of three years? b. In a different account earning 14% interest, you invest $2,417 at the end of each year for three years. What is the investment's value at the end of three years? c. What general rule of thumb explains the difference in the investments' future values? ' (Click the icon to view the future value factor table. (Click the icon to view the present value factor table.) (Click the icon to view the future value annuity factor table.) (Click the icon to view the present value annuity factor table.) a. You invest a lump sum of $7,250 for three years at 14% interest. What is the investment's value at the end of three years? (Round your answer to the nearest whole dollar.) Investment's value = Reference Reference

Assume you make the following investments: a. You invest a lump sum of $7,250 for three years at 14% interest. What is the investment's value at the end of three years? b. In a different account earning 14% interest, you invest $2,417 at the end of each year for three years. What is the investment's value at the end of three years? c. What general rule of thumb explains the difference in the investments' future values? (Click the icon to view the future value factor table.) (Click the icon to view the present value factor table.) (Click the icon to view the future value annuity factor table.) (Click the icon to view the present value annuity factor table.) a. You invest a lump sum of $7,250 for three years at 14% interest. What is the investment's value at the end of three years? (Round your answer to the nearest whole dollar.) Investment's value = Reference Assume you make the following investments: a. You invest a lump sum of $7,250 for three years at 14% interest. What is the investment's value at the end of three years? b. In a different account earning 14% interest, you invest $2,417 at the end of each year for three years. What is the investment's value at the end of three years? c. What general rule of thumb explains the difference in the investments' future values? ' (Click the icon to view the future value factor table. (Click the icon to view the present value factor table.) (Click the icon to view the future value annuity factor table.) (Click the icon to view the present value annuity factor table.) a. You invest a lump sum of $7,250 for three years at 14% interest. What is the investment's value at the end of three years? (Round your answer to the nearest whole dollar.) Investment's value = Reference Reference Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started