Answered step by step

Verified Expert Solution

Question

1 Approved Answer

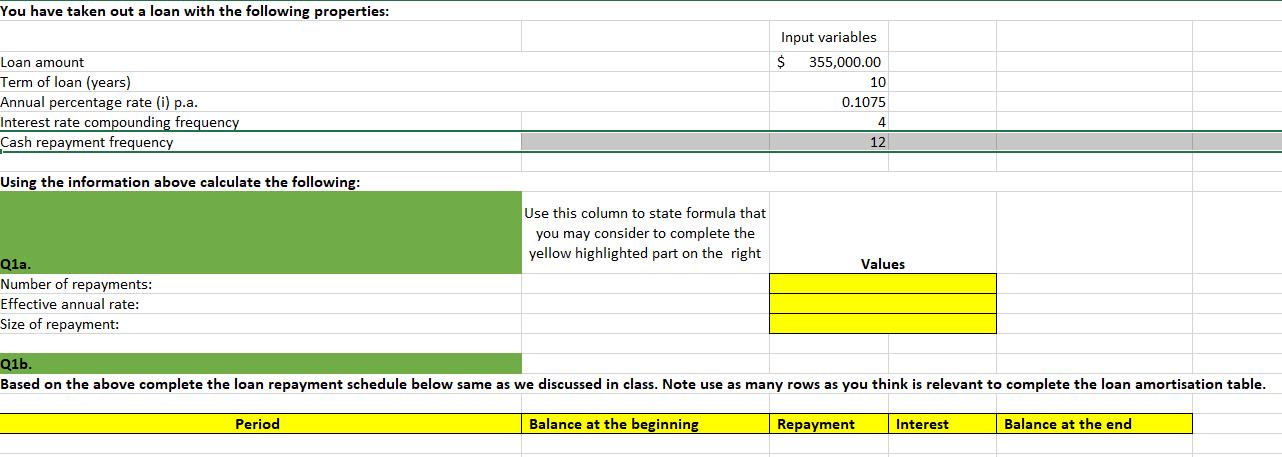

Assume you take a loan of $355,000. The loan is for 10 years, and the annual interest rate offered by bank is 10.75 per cent.

Assume you take a loan of $355,000. The loan is for 10 years, and the annual interest rate offered by bank is 10.75 per cent. If the cash repayment frequency is on monthly basis and interest payment frequency is on quarterly basis, using the worksheet "Amortisation_Q1"

You have taken out a loan with the following properties: Loan amount Term of loan (years) Annual percentage rate (i) p.a. Interest rate compounding frequency Cash repayment frequency Using the information above calculate the following: Q1a. Number of repayments: Effective annual rate: Size of repayment: Use this column to state formula that you may consider to complete the yellow highlighted part on the right Period Input variables $ 355,000.00 10 0.1075 4 12 Values Q1b. Based on the above complete the loan repayment schedule below same as we discussed in class. Note use as many rows as you think is relevant to complete the loan amortisation table. Balance at the beginning Repayment Balance at the end Interest

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started