Question

Assume you want to retire in 35 years and save a $12,000 at the end of the first year. Assume you will earn 8% annually

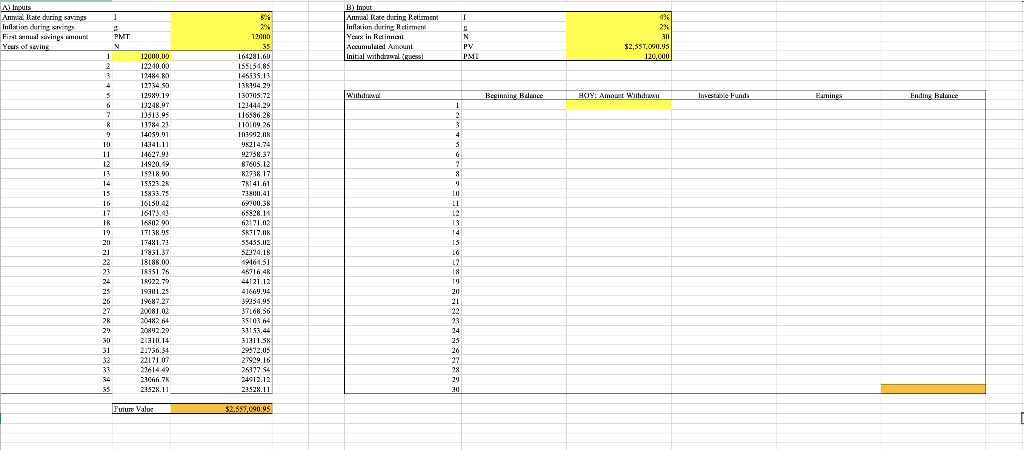

Assume you want to retire in 35 years and save a $12,000 at the end of the first year. Assume you will earn 8% annually on your investment and you expect 2% inflation before retirement. After you retired, you expect to live for another 30 years. Assume you can earn a nominal annual rate of 4% and you expect inflation to be 2% during retirement. a) Calculate how much money you are accumulating by the time you retire if you increase your annual savings by the inflation rate. b) Calculate your real annual withdrawals over the next 30 years so as to maintain a constant standard of living. Assume the first withdrawal is made at the beginning

NEED EXCEL FUNCTIONS FOR THE EXCEL !!! I have completed part A, i need help on part B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started