Question

Assume you work for a corn merchandising firm. You purchase corn to satisfy export contracts. It is March 1 and your firm is receiving orders

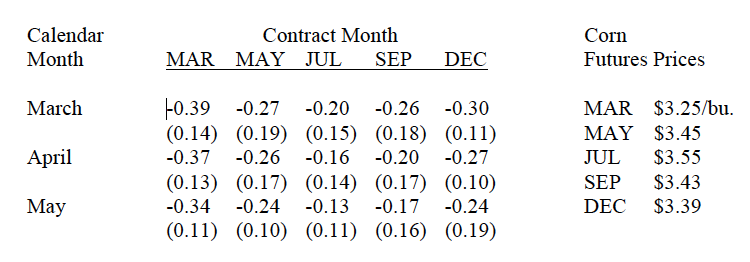

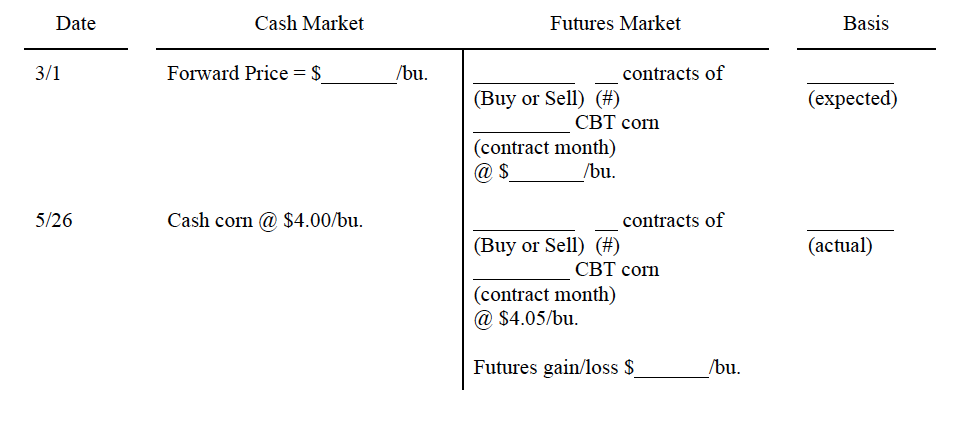

Assume you work for a corn merchandising firm. You purchase corn to satisfy export contracts. It is March 1 and your firm is receiving orders and scheduling deliveries of wheat to be shipped the last week of May. You will need 100,000 bushels of corn but you will not have it in storage. You will buy it in the cash market. You must manage this price risk as best possible. Use the following basis table and futures prices to complete the T-account below. Fill out the empty spaces in the T-account below. Circle the basis information used.

Calculate the net purchase price above. Calculate the difference between the Net Price and the Forward Price. If the Net Price is not equal to the Forward Price then explain why. Was the hedge a good decision?

Calendar Contract Month MAR MAY JULSEP DEC Corn Futures Prices Month March April May 0.39-0.27-0.20-0.26-0.30 (0.14) (0.19) (0.15) (0.18) (0.11) -0.37 -0.26 -0.16 -0.20 -0.27 (0.13) (0.17) (0.14) (0.17) (0.10) -0.34 -0.24 -0.13 -0.17 -0.24 0.11) (0.10) (0.11) (0.16) (0.19) MAR $3.25/bu. MAY $3.45 JUL $3.55 SEP $3.43 DEC $3.39Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started