Assumed from the Production Accounting example the following: The Shepherd Field is jointly owned by Tyler Company (60% WI), which acts as field operator, and Our Oil Company (40% WI). There is a 1/8 royalty, which is shared proportionally by Tyler and Our Oil Company. Gas price for the month is $4.50/Mmbtu. Assume production taxes were 5%. Based on gas analysis the heating content is 1.03 Btu. ANSWER What is the value of gas sales? What is the amount of gross revenue Tyler Oil Company & Our Oil Company should record? What is the gross amount should Tyler Oil Company & Our Oil Company record for their proportionate share of royalty and severance tax? What amount of gross revenue, royalty, severance taxes and net revenue should Tyler Company record for each lease (A-B-C-D-E-F)? Provide the revenue entry by Tyler Company if PURCHASER assumes the responsibility of distributing severance taxes and royalty. Provide the revenue entry by Our Oil if PURCHASER assumes the responsibility and receives 100% of the proceeds

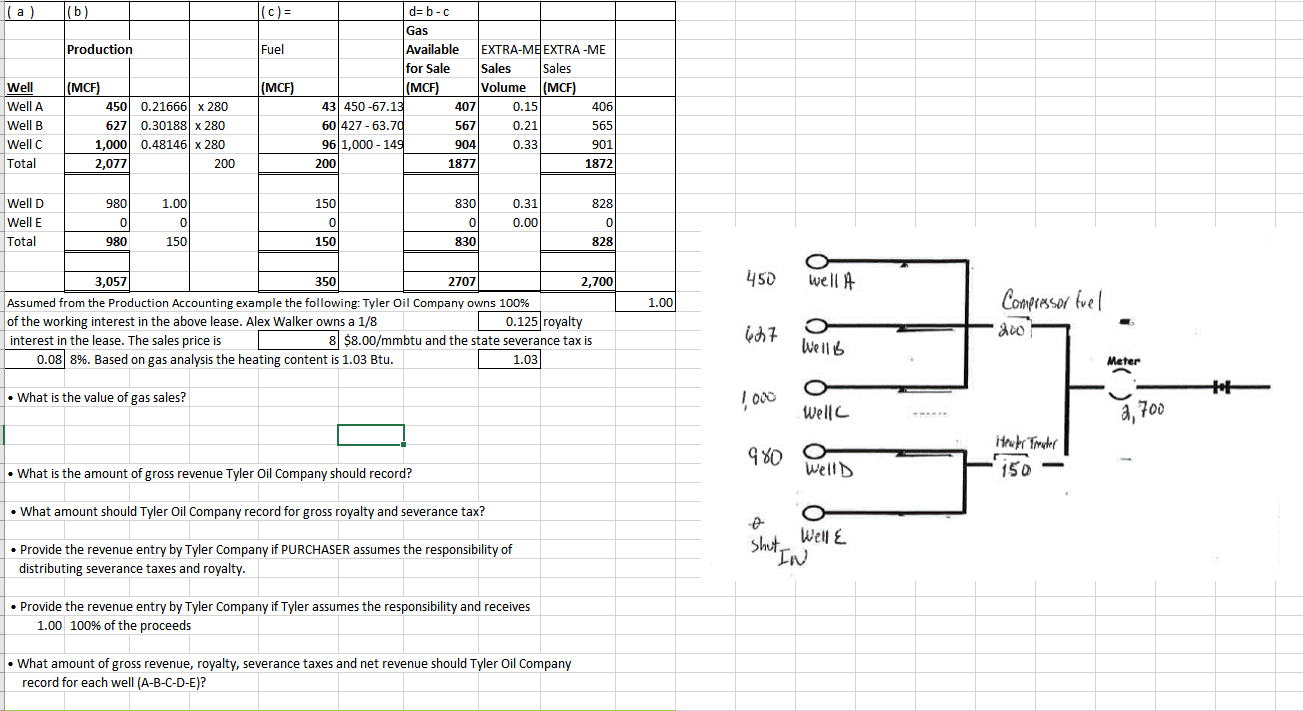

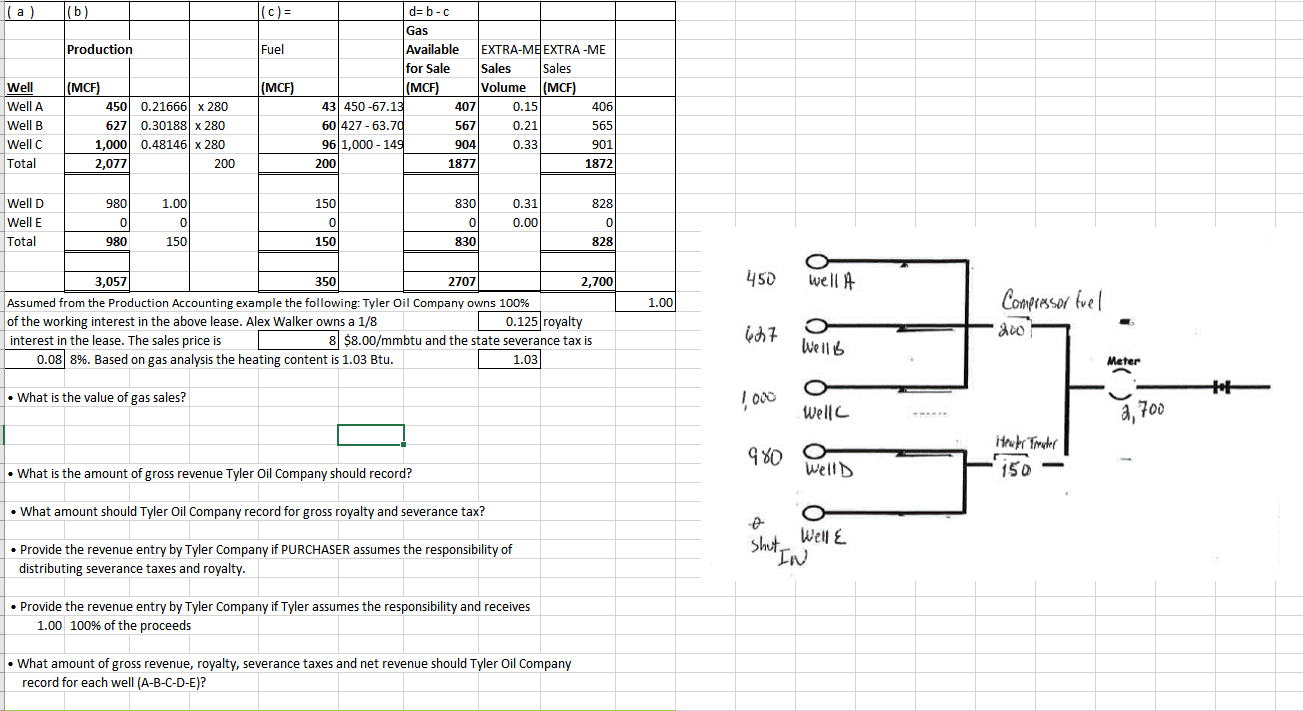

(a) (b (c) = Production Fuel (MCF) Well Well A Well B Wellc Total (MCF) 450 0.21666 x 280 627 0.30188 x 280 1,000 0.48146 x 280 2,077 200 d=b-C Gas Available EXTRA-ME EXTRA-ME for Sale Sales Sales (MCF) Volume (MCF) 43 450-67.13 407 0.15 406 60|427-63.70 567 0.21 5651 96 1,000 - 149 904 0.33 901 2001 1877 1872 Well D Well E Total 980 0 980 1.00 0 150 1501 0 150 8301 0 830 0.31 0.00 828 0 828 450 well A 1.00 3,057 350 2707 2,700 Assumed from the Production Accounting example the following: Tyler Oil Company owns 100% of the working interest in the above lease. Alex Walker owns a 1/8 0.125 royalty interest in the lease. The sales price is 8 $8.00/mmbtu and the state severance tax is 0.08 8%. Based on gas analysis the heating content is 1.03 Btu. 1.03 Compressor fuel 200 ich7 Wells Meter to What is the value of gas sales? 1000 well 2,700 Huber Trader 980 What is the amount of gross revenue Tyler Oil Company should record? WellD 150 What amount should Tyler Oil Company record for gross royalty and severance tax? shut Welle Provide the revenue entry by Tyler Company if PURCHASER assumes the responsibility of distributing severance taxes and royalty. 'IN Provide the revenue entry by Tyler Company if Tyler assumes the responsibility and receives 1.00 100% of the proceeds What amount of gross revenue, royalty, severance taxes and net revenue should Tyler Oil Company record for each well (A-B-C-D-E)? (a) (b (c) = Production Fuel (MCF) Well Well A Well B Wellc Total (MCF) 450 0.21666 x 280 627 0.30188 x 280 1,000 0.48146 x 280 2,077 200 d=b-C Gas Available EXTRA-ME EXTRA-ME for Sale Sales Sales (MCF) Volume (MCF) 43 450-67.13 407 0.15 406 60|427-63.70 567 0.21 5651 96 1,000 - 149 904 0.33 901 2001 1877 1872 Well D Well E Total 980 0 980 1.00 0 150 1501 0 150 8301 0 830 0.31 0.00 828 0 828 450 well A 1.00 3,057 350 2707 2,700 Assumed from the Production Accounting example the following: Tyler Oil Company owns 100% of the working interest in the above lease. Alex Walker owns a 1/8 0.125 royalty interest in the lease. The sales price is 8 $8.00/mmbtu and the state severance tax is 0.08 8%. Based on gas analysis the heating content is 1.03 Btu. 1.03 Compressor fuel 200 ich7 Wells Meter to What is the value of gas sales? 1000 well 2,700 Huber Trader 980 What is the amount of gross revenue Tyler Oil Company should record? WellD 150 What amount should Tyler Oil Company record for gross royalty and severance tax? shut Welle Provide the revenue entry by Tyler Company if PURCHASER assumes the responsibility of distributing severance taxes and royalty. 'IN Provide the revenue entry by Tyler Company if Tyler assumes the responsibility and receives 1.00 100% of the proceeds What amount of gross revenue, royalty, severance taxes and net revenue should Tyler Oil Company record for each well (A-B-C-D-E)