Answered step by step

Verified Expert Solution

Question

1 Approved Answer

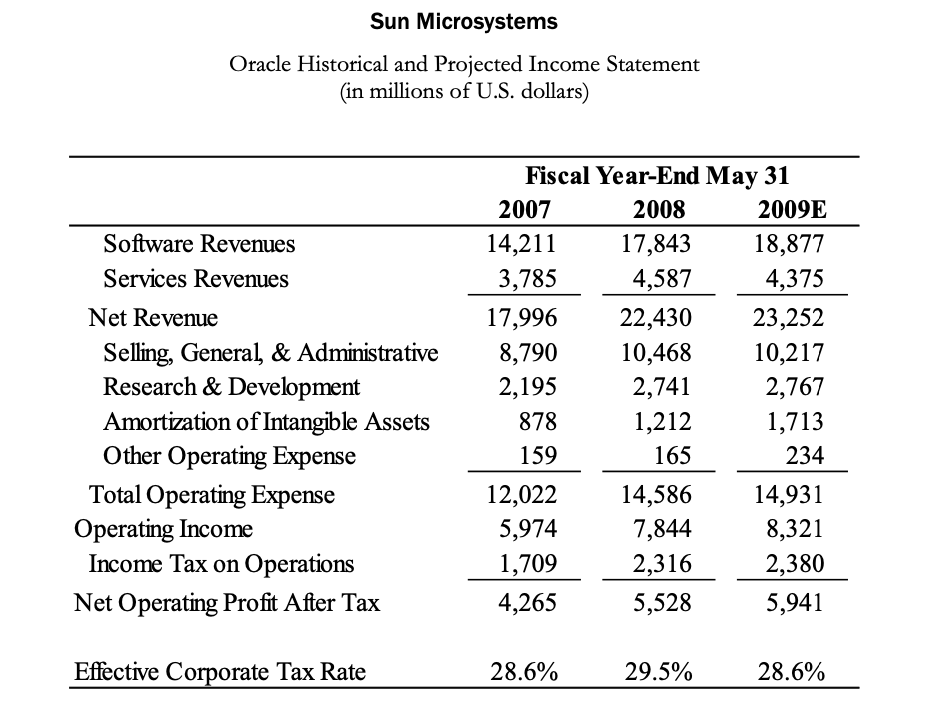

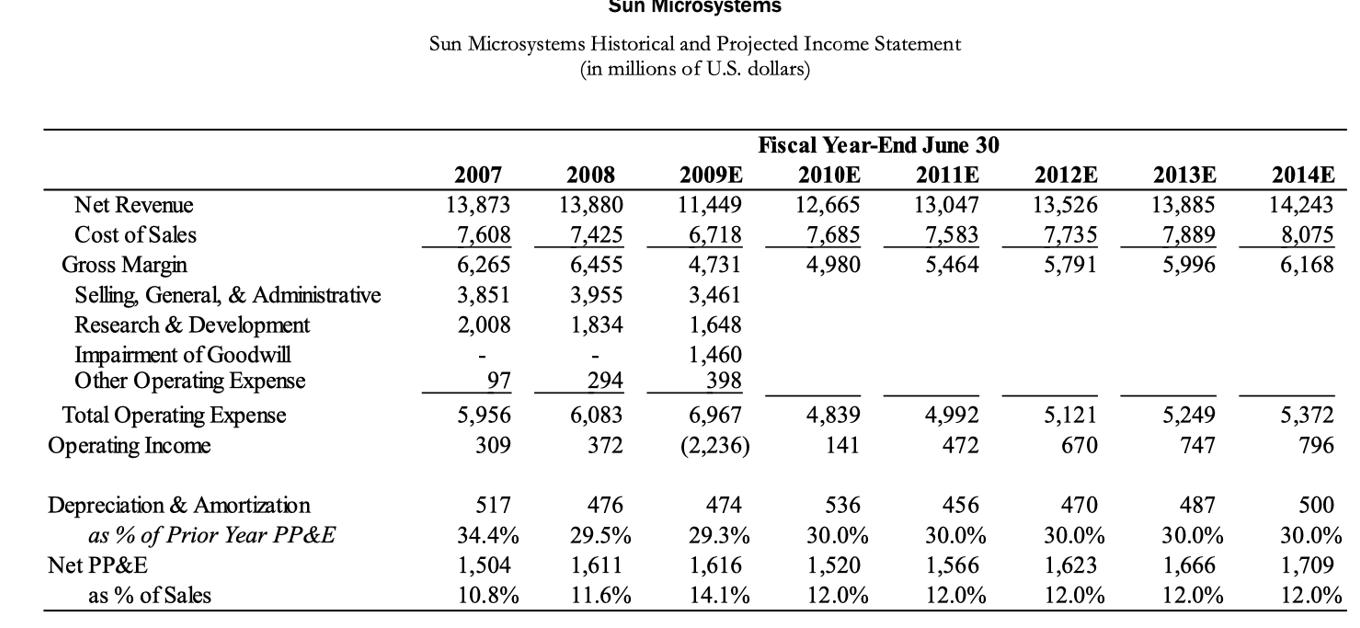

Assuming a discounted cashflow (DCF) valuation: What rate of return should Oracle require on the acquisition? What base-case cashflows do you forecast? What is your

- Assuming a discounted cashflow (DCF) valuation:

- What rate of return should Oracle require on the acquisition?

- What base-case cashflows do you forecast?

- What is your estimate of terminal value?

- What is the enterprise value of Sun Microsystems?

- What is Sun's equity value?

- You should assume a 35% corporate tax rate and a 7% market risk premium for your valuation.

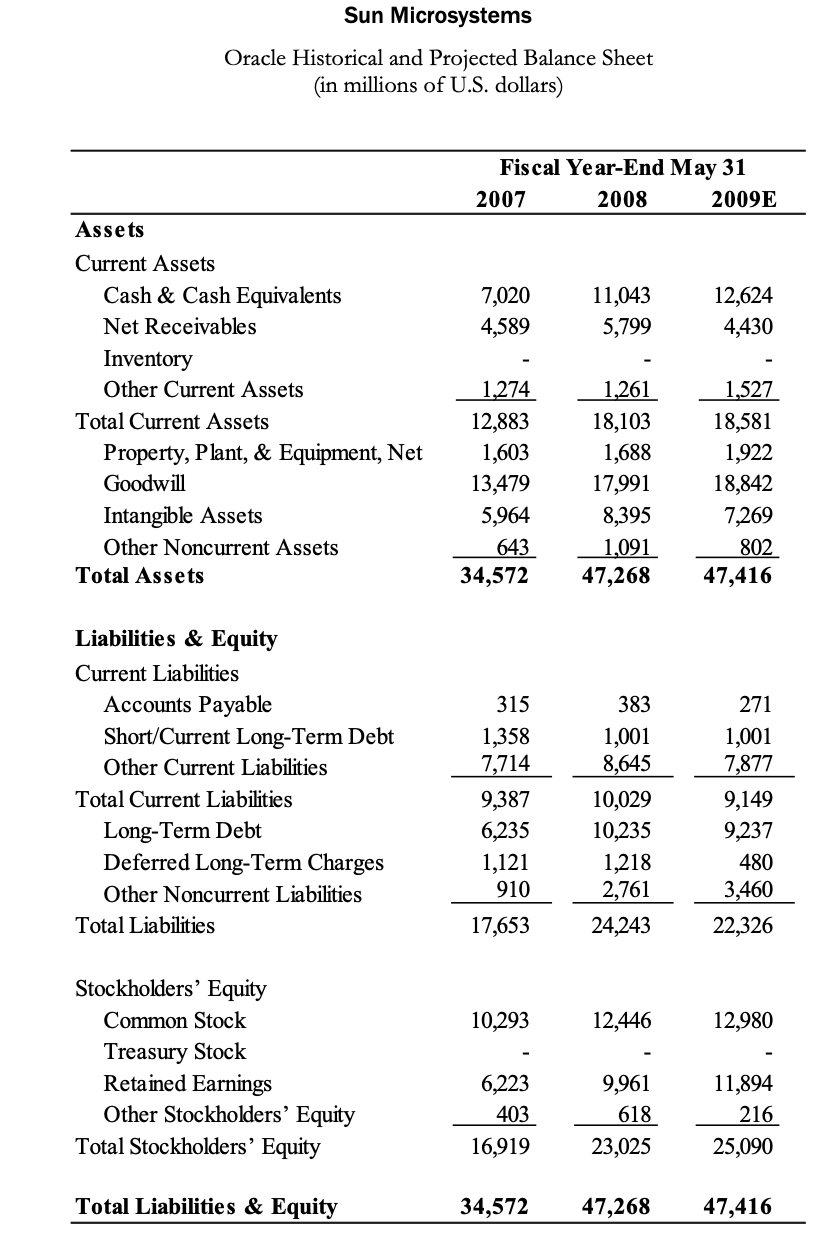

Assets Current Assets Sun Microsystems Oracle Historical and Projected Balance Sheet (in millions of U.S. dollars) Cash & Cash Equivalents Net Receivables Inventory Other Current Assets Total Current Assets Property, Plant, & Equipment, Net Goodwill Intangible Assets Other Noncurrent Assets Total Assets Liabilities & Equity Current Liabilities Accounts Payable Short/Current Long-Term Debt Other Current Liabilities Total Current Liabilities Long-Term Debt Deferred Long-Term Charges Other Noncurrent Liabilities Total Liabilities Stockholders' Equity Common Stock Treasury Stock Retained Earnings Other Stockholders' Equity Total Stockholders' Equity Total Liabilities & Equity Fiscal Year-End May 31 2008 2007 7,020 4,589 1,274 12,883 1,603 13,479 5,964 643 34,572 315 1,358 7,714 9,387 6,235 1,121 910 17,653 10,293 6,223 403 16,919 34,572 11,043 5,799 1,261 18,103 1,688 17,991 8,395 1,091 47,268 383 1,001 8,645 10,029 10,235 1,218 2,761 24,243 12,446 9,961 618 23,025 2009E 12,624 4,430 1,527 18,581 1,922 18,842 7,269 802 47,416 271 1,001 7,877 9,149 9,237 480 3,460 22,326 12,980 11,894 216 25,090 47,268 47,416

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started